National Grid 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

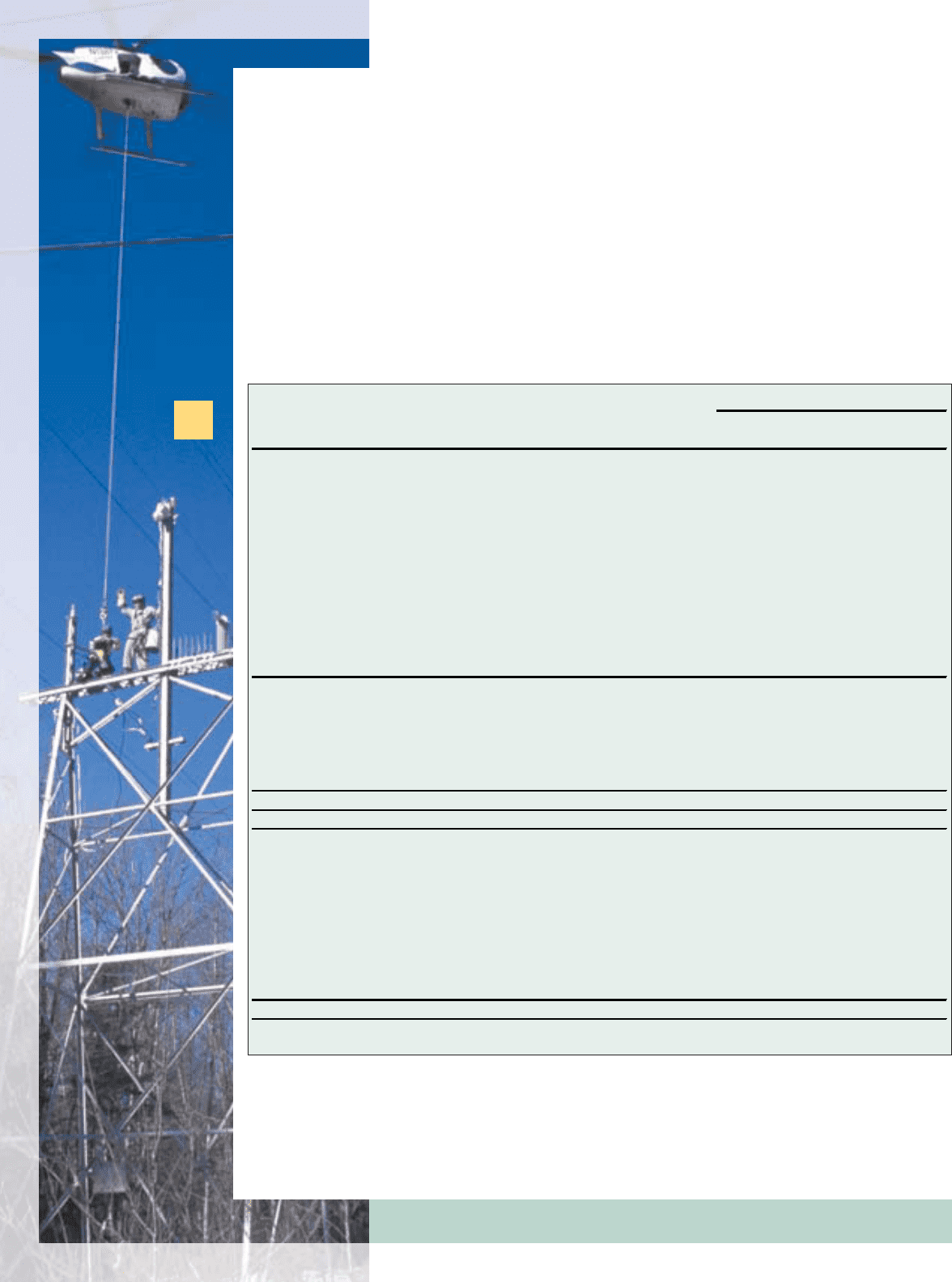

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

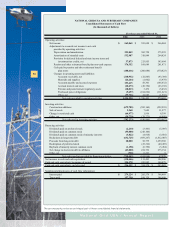

NOTE B – RATE AND REGULATORY ISSUES

The Company’s regulated subsidiaries generally use the same accounting policies and practices

for financial reporting purposes as non-regulated companies under US GAAP. However, actions by

the FERC and the state utility commissions can result in accounting treatment that is different from

that used by non-regulated companies. The Company applies the provisions of the SFAS No. 71,

“Accounting for Certain Types of Regulation.” In accordance with SFAS No. 71, the Company’s

regulated subsidiaries record regulatory assets (expenses deferred for future recovery from cus-

tomers) and regulatory liabilities (amounts provided in current rates to cover costs to be incurred

in the future) on their balance sheets. This permits the regulated subsidiaries to defer certain costs

(because they are expected to be recovered through customer billings) and revenues (because

they are expected to be refunded to customers), which would otherwise be charged to expense

or revenue, when authorized to do so by the regulator.

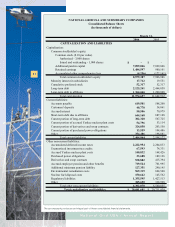

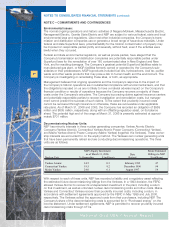

The following table details the various categories of regulatory assets and liabilities:

41

National Grid USA / Annual Report

2006 2005

Regulatory assets:

Stranded costs 2,478,018$ 2,997,281$

Purchased power 114,829 382,955

Derivative instruments 506,328 415,394

Regulatory tax asset 148,678 120,521

Deferred environmental restoration costs 563,871 594,283

Pension and post-retirement benefit plans costs 550,179 531,366

Additional minimum pension liability (see Note F) 79,923 252,218

Yankee nuclear decommissioning costs 140,832 168,426

Loss on reacquired debt 78,966 87,645

Long-term portion of standard offer under-recovery of fuel costs 46,803 42,420

Other 556,362 388,663

Total non-current regulatory assets 5,264,789 5,981,172

Current potion of regulatory assets:

Derivatives and swap contracts 324,858 203,558

Purchase power buyout costs 13,559 104,486

Yankee nuclear decommissioning costs 54,796 53,114

Total current portion of regulatory assets 393,213 361,158

Total regulatory assets 5,658,002$ 6,342,330$

Regulatory liabilities:

Cost of removal reserve (see Note K) (537,526)$ (504,819)$

Stranded costs and CTC related (123,105) (209,291)

Pension and post-retirement plans fair value deferred gain (234,754)

(228,138)

Interest savings deferral (92,534) (92,534)

Environmental response fund and insurance recoveries (81,673) (82,012)

Storm costs reserve (39,391) (33,681)

Other (246,612) (277,038)

Total regulatory liabilities (1,355,595)$ (1,427,513)$

($'s in 000's)

At March 31,