National Grid 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

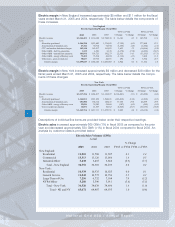

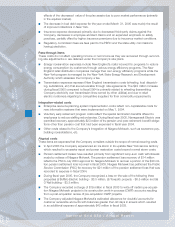

In addition to the market returns, various other assumptions also affect the pension and other

post-retirement benefit expense and measurement of their respective obligations. The more signifi-

cant assumptions include the assumed return on assets, discount rate, and in the case of retiree

healthcare benefits, medical trend assumptions. All ongoing costs of qualified pension and post-

retirement healthcare benefits plans are recoverable from customers through reconciling provisions

of the Merger Rate Plans.

■Assumed return on assets. The estimated rate of return for various passive asset classes is

based both on analysis of historical rates of return and forward looking analysis of risk premi-

ums and yields. Current market conditions, such as inflation and interest rates, are evaluated

in connection with the setting of our long-term assumption. A small premium is added for

active management of both equity and fixed income. The rates of return for each asset class

are then weighted in accordance with our target asset allocation, and the resulting long-term

return on asset rate is then applied to the market-related value of assets. For fiscal 2005, the

Company used an 8.50% assumed return on assets for its pension plan and an 8.26%

assumed return on assets for its other post-retirement benefits plans, respectively.

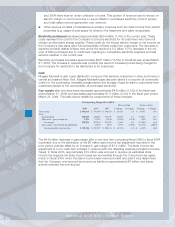

■Discount rate. In determining the discount rate, the Company considers Moody’s Aa rates for

corporate bonds and public utility bonds. In addition, the Company considers other measures

of interest rates for high quality fixed income investments which match the duration of the lia-

bilities. A rate is chosen within the range set by these measures.

■Medical trend assumptions. The health care cost trend rate is the assumed rate of increase

in per-capita health care charges. For 2005, the health trend was set at 10% with the ultimate

trend of 5% reached in 2010.

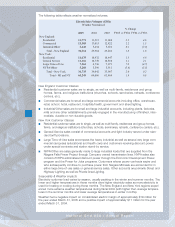

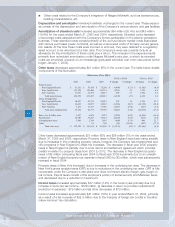

RESULTS OF OPERATIONS

EARNINGS

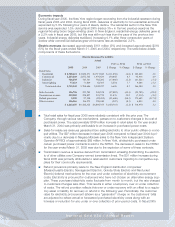

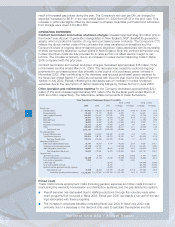

Net income for the fiscal year ended March 31, 2005 increased approximately $288 million (108%)

as compared to the prior year. The increase was primarily due to reductions in the following (i)

operating expenses - $345 million, (ii) other deductions - $27 million, and (iii) interest expense -

$38 million. The reductions in expenses were partially off set by a reduction in revenue of approxi-

mately $122 million. See the following discussions of revenues, operating expenses and other

income (deductions) for more detailed explanations.

Net income for the twelve months ended March 31, 2004 decreased approximately $44 million

(14%) as compared to the prior year. This decrease was primarily a result of non-recurring costs

related to the merger with Niagara Mohawk, partially offset by reduced interest costs resulting

from the redemption or refinancing of long-term debt.

ELECTRIC

The Company’s electricity business encompasses the transmission, distribution, and delivery of

electricity in New England and New York including stranded cost recoveries. The Company’s New

England distribution subsidiaries (Massachusetts Electric, Narragansett Electric, Granite State

Electric and Nantucket Electric) are responsible for the distribution and sale of electricity to cus-

tomers while NEP is responsible for the transmission of electricity. For New York, Niagara Mohawk

is responsible for the transmission, distribution, and sale of electricity. Electric results are dis-

cussed by geography.

The Company is no longer in the business of electricity generation and has divested the vast

majority of its formerly owned generation assets (the Company still retains a nine percent joint

ownership interest in the Wyman #4 generating unit in Maine, which the Company is attempting to

sell). Since deregulation, electricity customers have the ability to choose an alternative supplier of

their electricity other than the retail distribution company serving that customer’s region. For cus-

tomers who have not chosen an alternative supplier, the Company procures power on their behalf.

These energy procurement costs (i.e. purchased electricity expenses) are recoverable from cus-

tomers and do not impact the company’s electric margin or net income.

9

National Grid USA / Annual Report