National Grid 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

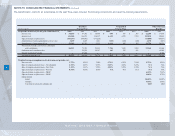

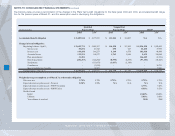

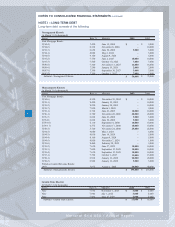

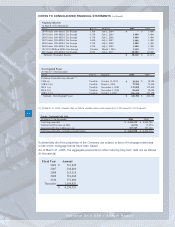

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(1) Refinanced to auction rate mode on December 11, 2003. Effective interest rate at March 31, 2005 and March 31, 2004

was 2.70 percent and 1.18 percent, respectively.

(2) Refinanced to auction rate mode on May 27, 2004. Effective interest rate at March 31, 2005 was 2.10 percent.

(3) Refinanced to auction rate mode on May 1, 2003. Effective interest rate at March 31, 2005 and March 31, 2004 was

2.35 percent and 1.19 percent, respectively.

58

National Grid USA / Annual Report

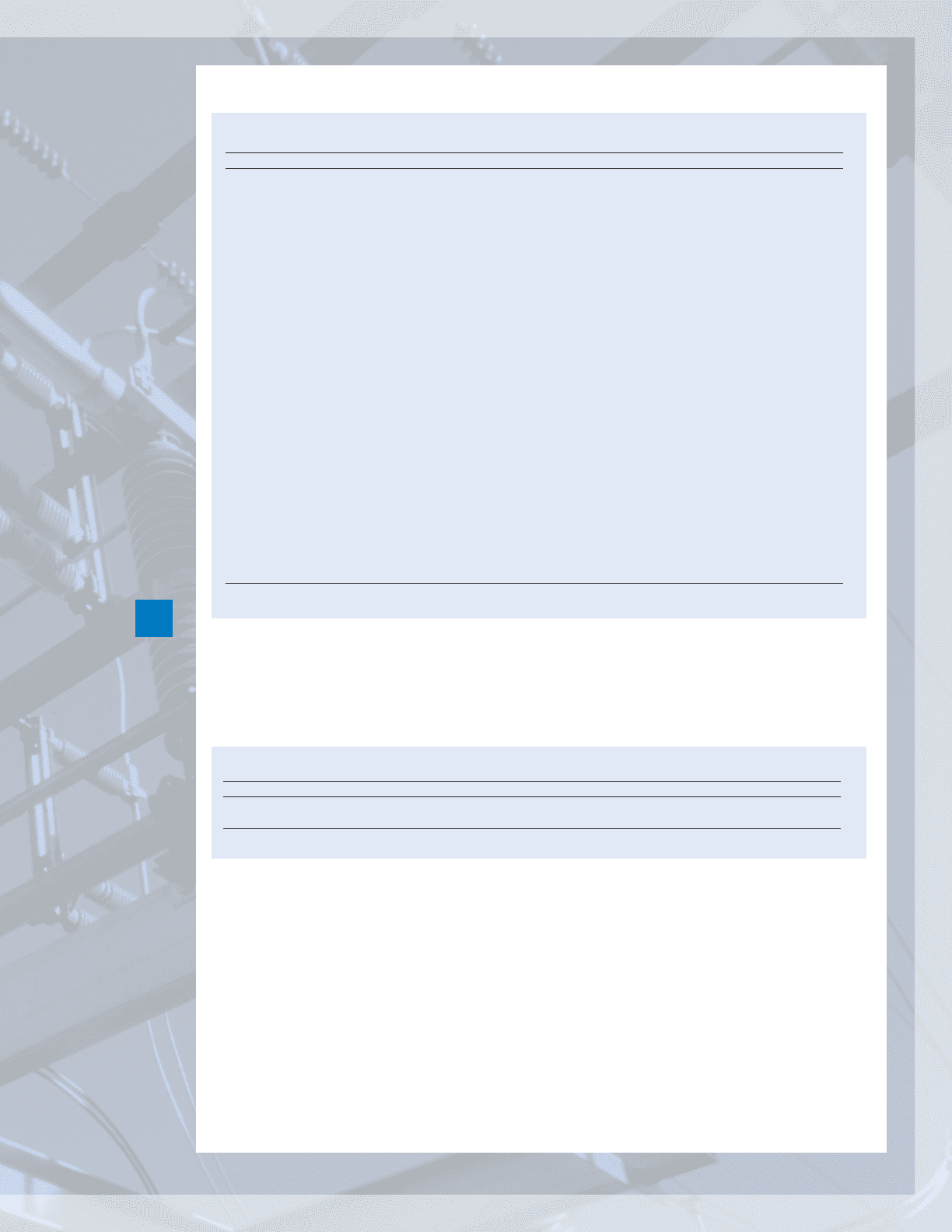

Niagara Mohawk

At March 31 (In thousands)

Series Rate % Maturity 2005 2004

First Mortgage Bonds:

8% 8.000 June 1, 2004 -$ 232,425$

6 5/8% 6.625 July 1, 2005 110,000 110,000

9 3/4% 9.750 November 1, 2005 137,981 137,981

7 3/4% 7.750 May 15, 2006 275,000 275,000

6 5/8% (1) 6.625 October 1, 2013 45,600 45,600

5.15% 5.150 November 1, 2025 75,000 75,000

7.2% (2) 7.200 July 1, 2029 115,705 115,705

Senior Notes:

5 3/8% 5.375 October 1, 2004 - 300,000

7 5/8% 7.625 October 1, 2005 302,439 302,439

8 7/8% 8.875 May 15, 2007 200,000 200,000

7 3/4% 7.750 October 1, 2008 600,000 600,000

Promissory Notes: (3)

2015 Variable July 1, 2015 100,000 100,000

2023 Variable December 1, 2023 69,800 69,800

2025 Variable December 1, 2025 75,000 75,000

2026 Variable December 1, 2026 50,000 50,000

2027 Variable March 1, 2027 25,760 25,760

2027 Variable July 1, 2027 93,200 93,200

Notes Payable:

NM Holdings Note 3.720 July 31, 2009 350,000 350,000

NM Holdings Note 3.830 June 30, 2010 350,000 350,000

NM Holdings Note 5.800 November 1, 2012 500,000 500,000

Other - 195

Subtotal - Niagara Mohawk 3,475,485$ 4,008,105$

Hydros

At March 31 (In thousands)

Series Rate % Maturity 2005 2004

Series B 9.260 April 17, 2007 12,110$ 21,380$

Series C 9.410 October 17, 2015 46,270 46,270

Subtotal - Hydros 58,380$ 67,650$