National Grid 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Divested Nuclear Units:

Nine Mile Point: On November 7, 2001, Niagara Mohawk sold its nuclear assets to Constellation

Energy Group (Constellation). As of March 31, 2005, Niagara Mohawk has a liability of $146 mil-

lion for the disposal of nuclear fuel irradiated prior to 1983. In January 1983, the Nuclear Waste

Policy Act of 1982 (the Nuclear Waste Act) established a cost of $.001 per KWh of net generation

for current disposal of nuclear fuel and provides for a determination of Niagara Mohawk’s liability

to the DOE for the disposal of nuclear fuel irradiated prior to 1983. The Nuclear Waste Act also

provides three payment options for liquidating such liability and Niagara Mohawk has elected to

delay payment, with interest, until the year in which Constellation initially plans to ship irradiated

fuel to an approved DOE disposal facility. Progress in developing the DOE facility has been slow

and it is anticipated that the DOE facility will not be ready to accept deliveries until at least 2010.

Millstone 3 Prudence Challenge: In November 1999, NEP agreed with Northeast Utilities (NU) to

settle certain claims. As part of the agreement, NU agreed to include NEP’s 16.2 percent owner-

ship interest in Millstone Unit 3 in an auction of NU’s share of the unit. Upon the closing of the

sale, NEP was to receive a fixed amount, regardless of the actual sale price. In March 2001, the

Millstone units were sold, including NEP’s interest, for $1.3 billion. In accordance with the settle-

ment, NEP was paid approximately $25 million for its interest in the unit (plus reimbursement of

pre-paid amounts), from which NEP paid approximately $6.2 million to increase the decommis-

sioning trust fund.

In the past, regulatory authorities from Rhode Island, New Hampshire and Massachusetts

expressed intent to challenge the reasonableness of the settlement agreement on various

grounds, taking the position that NEP would have received approximately $140 million of sale pro-

ceeds if there had been no agreement with NU. The matter has been resolved in New Hampshire

and Massachusetts. In the event that Rhode Island proceeds with a challenge, the dispute will be

resolved by the FERC. Management believes that the Company acted prudently because, among

other reasons, the amount it received under the settlement agreement was the highest sale price

for a nuclear unit at the time the agreement was reached.

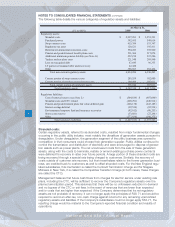

Long-Term Contracts for the Purchase of Electric Power:

The Company’s subsidiaries have several types of long-term contracts for the purchase of electric

power. The Company’s commitments under these long-term contracts, as of March 31, 2005, are

as follows:

If the Company’s subsidiaries need any additional energy to meet load requirements, they can pur-

chase the electricity from other IPPs, other utilities, other energy merchants or the open market

through the New York Independent System Operator (NYISO) or the New England Independent

System Operator (ISO –NE) at market prices.

Gas Supply, Storage and Pipeline Commitments:

In connection with its regulated gas business, Niagara Mohawk has long-term commitments with

a variety of suppliers and pipelines to purchase gas commodity, provide gas storage capability

and transport gas commodity on interstate gas pipelines.

40

National Grid USA / Annual Report

Fiscal Year

Ended

March 31, Amount

2006 1,745$

2007 1,064

2008 1,050

2009 1,065

2010 869

Thereafter 3,057

Total 8,850$

(In millions of dollars)