National Grid 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

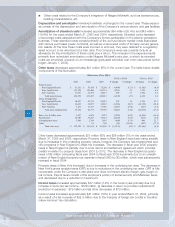

LONG TERM

The Company’s total capital requirements consist of amounts for its construction programs, work-

ing capital needs and maturing debt issues. Construction expenditure levels for the energy delivery

business are generally consistent from year to year.

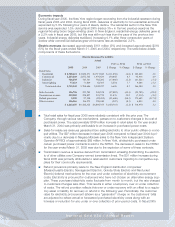

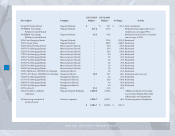

The following table summarizes estimated long-term contractual cash obligations of the Company:

OTHER REGULATORY MATTERS

Regional Transmission Organizations

Midwest. GridAmerica manages a range of electricity transmission operations on behalf of its three

participant utilities. It is the first multi-system independent transmission company and was formed

under agreements with Ameren, First Energy, Northern Indiana Public Service Company and the

Midwest Independent System Operator (MISO), which was approved by FERC to operate as an

RTO.

During April 2005, Ameren notified the Company’s electricity transmission business and its fellow

GridAmerica participants that it will withdraw from GridAmerica effective November 1, 2005.

Together with FirstEnergy and Northern Indiana Public Service Company, the Company evaluated

GridAmerica’s viability given the current industry environment, their respective long-term corporate

strategies and Ameren’s departure, and ultimately agreed to cease GridAmerica operations also

effective November 1, 2005.

NEW YORK PSC MATTERS

The New York PSC has issued orders that will or may have an impact on Niagara Mohawk.

Pension settlement loss

In July 2004, Niagara Mohawk obtained PSC approval that would provide rate recovery for

approximately $14 million of the $30 million pension settlement loss incurred in fiscal 2003. In

addition, the agreement covers the funding of the entire settlement loss to benefit plan trust funds.

Niagara Mohawk has filed a petition with the PSC seeking recovery of a $21 million pension settle-

ment loss incurred in fiscal year 2004. For further discussion of the settlement losses see

Footnote G – “Employee Benefits” of the Consolidated Financial Statements.

Pension and post-retirement benefits costs

In August 2003, the New York State PSC approved a settlement with Niagara Mohawk

following an audit that identified reconciliation issues between the rate allowance and actual

costs of Niagara Mohawk’s pension and other post-retirement benefits. The settlement resolved all

issues associated with those obligations for the period prior to its acquisition by National Grid and,

among other things, covered the funding of Niagara Mohawk’s pension and post-retirement bene-

fit plans. As part of the settlement, Niagara Mohawk provided $100 million of tax-deductible fund-

22

National Grid USA / Annual Report

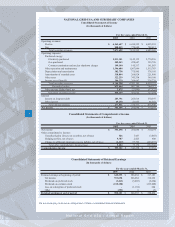

Payment due in:

($'s in millions) 2006 2007 2008 2009 2010 Thereafter Total

Long-term debt 568$ 302$ 207$ 687$ 357$ 2,113$ 4,234$

Electric purchase power commitments 1,745 1,064 1,050 1,065 869 3,057 8,850

Gas supply commitments 255 114 52 5 5 10 441

Derivative swap commitments* 204 196 183 36 - - 619

Expected pension and post-retirement

trust funding** 234 N/A N/A N/A N/A N/A 234

Interest on long-term debt*** 157 119 101 75 54 N/A 506

Construction expenditures**** 608 N/A N/A N/A N/A N/A 608

Total contractual cash obligations 3,771$ 1,795$ 1,593$ 1,868$ 1,285$ 5,180$ 15,492$

* Forecasted, actual amounts could differ based on changes in market conditions.

** These are expected contributions to Company's pension and post-retirement benefit

plans' trusts, not the minimum funding requirement.

*** Forecasted, actual amounts could differ based on changes in market conditions.

Amounts beyond five years are not forecasted.

**** Budgeted amount in which substantial commitments have been made. Amounts

beyond 1 year are budgetary in nature and not contractual obligations and are therefore

not included.