National Grid 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

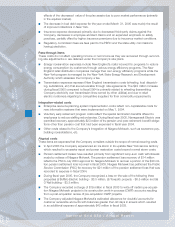

LIQUIDITY AND CAPITAL RESOURCES

SHORT TERM

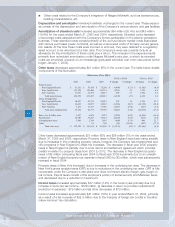

At March 31, 2005, the Company’s principal sources of liquidity included cash and cash equiva-

lents of approximately $355 million and accounts receivable of approximately $1.1 billion. The

Company has a negative working capital balance of $184 million primarily due to long-term debt

due within one year of $568 million and short-term debt due to affiliates of $687 million. Cash is

being generated from sales (via electric rates) to offset stranded cost amortization (non-cash

expense). This excess cash is used for debt payments and other operating needs. As discussed

below, the Company believes it has sufficient cash flow and borrowing capacity to fund such

deficits as necessary in the near term. In addition, construction expenditures planned within one

year are estimated to be $608 million.

Operating Activities

Net cash provided by operating activities increased approximately $782 million in the current year.

The increase is primarily due to:

■Increase in net income (see earnings discussion above) of approximately $288 million.

■Increased stranded cost recovery of $54 million.

■Increased provision for deferred income taxes of approximately $70 million primarily related to

net operating loss carryforwards.

■Decreased pension and other retirement benefit plan expense of approximately $113 million.

■Decreased cash paid to pension and postretirement benefit plan trusts of approximately $171

million primarily due to a one time payment made in fiscal year 2004 related to a settlement

agreement between Niagara Mohawk and the New York PSC that allows Niagara Mohawk to

earn a return on its additional funding.

■Decrease in the change in accounts receivable and accrued interest and taxes of $60 million

and $34 million respectively (increases in cash).

■Increase in accounts payable and accrued expenses of approximately $164 million.

■Increases from other changes of approximately $54 million (i.e. changes in materials and sup-

plies, purchased power obligations, etc.).

Investing Activities

Net cash used in investing activities increased approximately $71 million in the current year. This

increase was primarily due to an increase in construction additions and an increase in other prop-

erty and investments. Capital expenditures increased approximately $40 million during fiscal year

2005 primarily due to increased transmission utility plant expenditures at NEP. The funds neces-

sary for utility plant expenditures during the period were primarily provided by internal funds.

Financing Activities

Net cash used in financing activities increased approximately $702 million in the current year. This

increase is primarily the result of early redemption of third-party debt with internally generated

funds. Also contributing to the increase was a common dividend paid to the Company’s parent of

$218 million for which there was no similar cash outflow in the prior year.

The Company has been refinancing and redeeming early various issues of debt and preferred

stock and replacing them with lower-cost affiliated-company debt.

20

National Grid USA / Annual Report