National Grid 2005 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2005 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

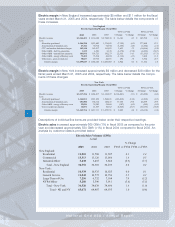

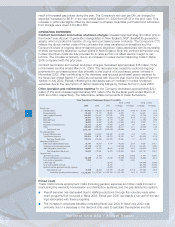

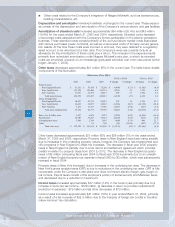

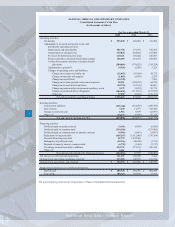

OTHER INCOME (DEDUCTIONS), INTEREST AND PREFERRED DIVIDENDS

Other income (deductions), net increased $27 million (127%) in the current year. This is primarily

attributable to a $9 million settlement of an estimated liability and an $8 million favorable adjust-

ment to non-utility related income taxes at Niagara Mohawk.

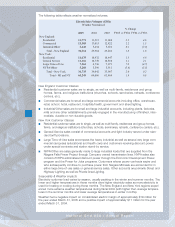

Other deductions, net decreased $16 million (44%) in the fiscal year ended March 31, 2004. This

was primarily attributable to telecom operations which recorded a $17 million charge for the aban-

donment of long-term lease obligations as well as the write-off of obsolete inventory in fiscal 2003

as compared to a charge of $10 million for a telecom-related asset impairment in fiscal 2004.

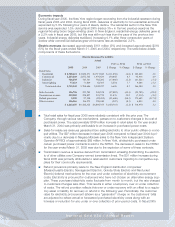

Interest expense decreased $39 million (12%) and $101 million (24%) for the years ended March

31, 2005 and 2004, respectively. The decreases are primarily due to long-term debt maturing and

the early redemption of third-party debt using affiliated-company debt at lower interest rates. See

“Liquidity and Capital Resources: Financing Activities” below for a detailed description of the vari-

ous refinancings and redemptions.

19

National Grid USA / Annual Report