Motorola 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

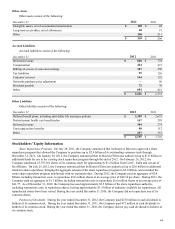

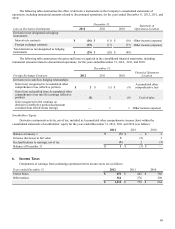

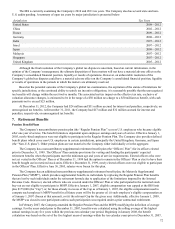

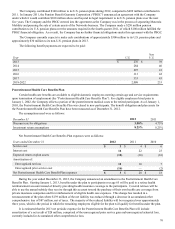

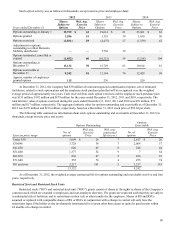

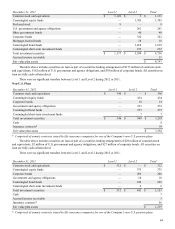

The status of the Company’s plans are as follows:

2012 2011

U.S

Non

U.S. U.S.

Non

U.S.

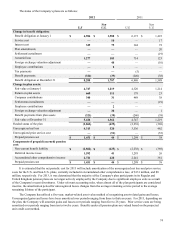

Change in benefit obligation:

Benefit obligation at January 1 $ 6,986 $ 1,588 $ 6,173 $ 1,423

Service cost —10—17

Interest cost 349 75 344 72

Plan amendments ———20

Settlement/curtailment ———(19)

Actuarial loss 1,277 103 714 123

Foreign exchange valuation adjustment —48—(10)

Employee contributions —2

——

Tax payments —— (5)—

Benefit payments (324)(39)(240)(38)

Benefit obligation at December 31 8,288 1,787 6,986 1,588

Change in plan assets:

Fair value at January 1 4,747 1,219 4,320 1,214

Return on plan assets 660 111 178 23

Company contributions 340 31 489 38

Settlements/curtailments ———(19)

Employee contributions —2

——

Foreign exchange valuation adjustment —38—1

Benefit payments from plan assets (321)(39)(240)(38)

Fair value at December 31 5,426 1,362 4,747 1,219

Funded status of the plan (2,862)(425)(2,238)(369)

Unrecognized net loss 4,313 520 3,536 462

Unrecognized prior service cost —(51)—(55)

Prepaid pension cost $ 1,451 $ 44 $ 1,298 $ 38

Components of prepaid (accrued) pension

cost:

Non-current benefit liability $(2,862)$ (425)$(2,238)$ (369)

Deferred income taxes 1,592 41 1,295 26

Accumulated other comprehensive income 2,721 428 2,241 381

Prepaid pension cost $ 1,451 $ 44 $ 1,298 $ 38

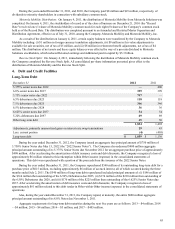

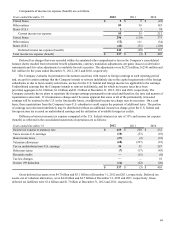

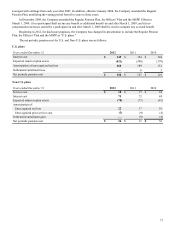

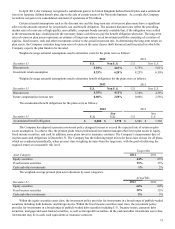

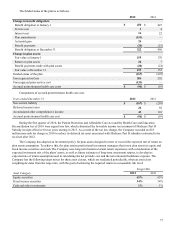

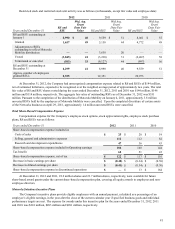

It is estimated that the net periodic cost for 2013 will include amortization of the unrecognized net loss and prior service

costs for the U.S. and Non-U.S. plans, currently included in Accumulated other comprehensive loss, of $131 million, and $8

million, respectively. For 2013, it was determined that the majority of the Company's plan participants in its Regular and

United Kingdom pension plans are no longer actively employed by the Company due to significant employee exits as a result

of the Company's recent divestitures. Under relevant accounting rules, when almost all of the plan participants are considered

inactive, the amortization period for unrecognized losses changes from the average remaining service period to the average

remaining lifetime of the participant.

The Company has utilized a five-year, market-related asset value method of recognizing asset-related gains and losses.

Unrecognized gains and losses have been amortized over periods ranging from three to thirteen years. For 2013, depending on

the plan, the Company will amortize gains and losses over periods ranging from five to 28 years. Prior service costs are being

amortized over periods ranging from ten to twelve years. Benefits under all pension plans are valued based on the projected

unit credit cost method.