Motorola 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

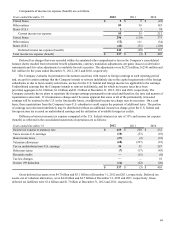

compensation cost for these share-based awards is generally measured based on the fair value of the awards, as of the date that

the share-based awards are issued and adjusted to the estimated number of awards that are expected to vest. The fair values of

stock options and stock appreciation rights are generally determined using a Black-Scholes option pricing model which

incorporates assumptions about expected volatility, risk free rate, dividend yield, and expected life. Compensation cost for

share-based awards is recognized on a straight-line basis over the vesting period.

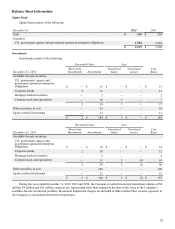

Retirement Benefits: The Company records annual expenses relating to its pension benefit and postretirement plans

based on calculations which include various actuarial assumptions, including discount rates, assumed asset rates of return,

compensation increases, turnover rates and health care cost trend rates. The Company reviews its actuarial assumptions on an

annual basis and makes modifications to the assumptions based on current rates and trends. The effects of the gains, losses, and

prior service costs and credits are amortized either over the average service life or over the average remaining lifetime of the

participant, depending on the number of active employees in the plan. The funding status, or projected benefit obligation less

plan assets, for each plan, is reflected in the Company’s consolidated balance sheets using a December 31 measurement date.

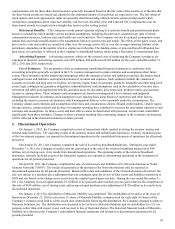

Advertising Expense: Advertising expenses, which are the external costs of marketing the Company’s products, are

expensed as incurred. Advertising expenses were $95 million, $98 million and $109 million for the years ended December 31,

2012, 2011 and 2010, respectively.

Use of Estimates: The preparation of the accompanying consolidated financial statements in conformity with

accounting principles generally accepted in the U.S. requires management to make estimates and assumptions about future

events. These estimates and the underlying assumptions affect the amounts of assets and liabilities reported, disclosures about

contingent assets and liabilities, and reported amounts of revenues and expenses. Such estimates include the valuation of

accounts receivable and long term receivables, inventories, Sigma Fund, investments, goodwill, intangible and other long-lived

assets, legal contingencies, guarantee obligations, indemnifications, and assumptions used in the calculation of income taxes,

retirement and other post-employment benefits and allowances for discounts, price protection, product returns, and customer

incentives, among others. These estimates and assumptions are based on management’s best estimates and judgment.

Management evaluates its estimates and assumptions on an ongoing basis using historical experience and other factors,

including the current economic environment, which management believes to be reasonable under the circumstances. The

Company adjusts such estimates and assumptions when facts and circumstances dictate. Illiquid credit markets, volatile equity,

foreign currency, energy markets and declines in consumer spending have combined to increase the uncertainty inherent in such

estimates and assumptions. As future events and their effects cannot be determined with precision, actual results could differ

significantly from these estimates. Changes in those estimates resulting from continuing changes in the economic environment

will be reflected in the financial statements in future periods.

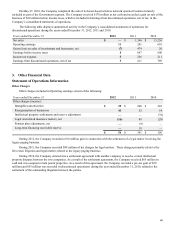

2. Discontinued Operations

On January 1, 2012, the Company completed a series of transactions which resulted in exiting the amateur, marine and

airband radio businesses. The operating results of the amateur, marine and airband radio businesses, formerly included as part

of the Government segment, are reported as discontinued operations in the consolidated statements of operations for all periods

presented.

On October 28, 2011, the Company completed the sale of its wireless broadband businesses. During the year ended

December 31, 2011, the Company recorded a pre-tax gain related to the sale of the wireless broadband businesses of $40

million, net of closing costs, in its results from discontinued operations. The operating results of the wireless broadband

businesses, formerly included as part of the Enterprise segment, are reported as discontinued operations in the statements of

operations for all periods presented.

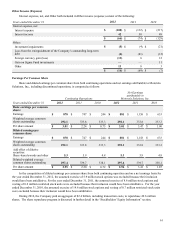

On April 29, 2011, the Company completed the sale of certain assets and liabilities of its Networks business to Nokia

Siemens Networks ("NSN"). The results of operations of the portions of the Networks business sold are reported as

discontinued operations for all periods presented. Based on the terms and conditions of the Networks business divestiture, the

sale was subject to a purchase price adjustment that was contingent upon the review of final assets and liabilities transferred to

NSN and was based on the change in net assets from the original agreed upon sale date. During the year ended December 31,

2011, the Company received approximately $1.0 billion of net proceeds and recorded a pre-tax gain related to the completion of

this sale of $434 million, net of closing costs, and an agreed upon purchase price adjustment of $120 million in its results from

discontinued operations.

On January 4, 2011, the distribution of Motorola Mobility was completed. The stockholders of record as of the close of

business on December 21, 2010 received one (1) share of Motorola Mobility common stock for each eight (8) shares of the

Company’s common stock held as of the record date. Immediately following the distribution, the Company changed its name to

Motorola Solutions, Inc. The distribution was structured to be tax-free to Motorola Solutions and its stockholders for U.S. tax

purposes (other than with respect to any cash received in lieu of fractional shares). The historical financial results of Motorola

Mobility are reflected in the Company’s consolidated financial statements and footnotes as discontinued operations for all

periods presented.