Motorola 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

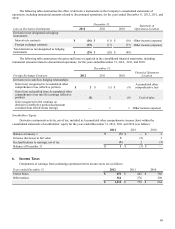

Income Taxes: Deferred tax assets and liabilities are recognized for the future tax consequences attributable to

differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and

operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to

apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on

deferred tax assets and liabilities from a change in tax rates is recognized in the period that includes the enactment date.

Deferred tax assets are reduced by valuation allowances if, based on the consideration of all available evidence, it is

more-likely-than-not that some portion of the deferred tax asset will not be realized. Significant weight is given to evidence that

can be objectively verified. The Company evaluates deferred tax assets on a quarterly basis to determine if valuation

allowances are required by considering available evidence. Deferred tax assets are realized by having sufficient future taxable

income to allow the related tax benefits to reduce taxes otherwise payable. The sources of taxable income that may be available

to realize the benefit of deferred tax assets are future reversals of existing taxable temporary differences, future taxable income,

exclusive of reversing temporary differences and carryforwards, taxable income in carry-back years and tax planning strategies

that are both prudent and feasible.

The Company recognizes the effect of income tax positions only if sustaining those positions is more-likely-than-not.

Changes in recognition or measurement are reflected in the period in which a change in judgment occurs. The Company

records interest related to unrecognized tax benefits in Interest expense and penalties in Selling, general and administrative

expenses in the Company’s consolidated statements of operations.

Sales and Use Taxes: The Company records taxes imposed on revenue-producing transactions, including sales, use,

value added and excise taxes, on a net basis with such taxes excluded from revenue.

Long-term Receivables: Long-term receivables include trade receivables where contractual terms of the note

agreement are greater than one year. Long-term receivables are considered impaired when management determines collection

of all amounts due according to the contractual terms of the note agreement, including principal and interest, is no longer

probable. Impaired long-term receivables are valued based on the present value of expected future cash flows discounted at the

receivable’s effective interest rate, or the fair value of the collateral if the receivable is collateral dependent. Interest income and

late fees on impaired long-term receivables are recognized only when payments are received. Previously impaired long-term

receivables are no longer considered impaired and are reclassified to performing when they have performed under a workout or

restructuring for four consecutive quarters.

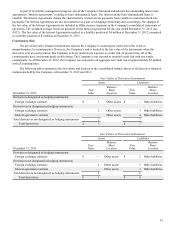

Foreign Currency: Certain of the Company’s non-U.S. operations use their respective local currency as their

functional currency. Those operations that do not have the U.S. dollar as their functional currency translate assets and liabilities

at current rates of exchange in effect at the balance sheet date and revenues and expenses using rates that approximate those in

effect during the period. The resulting translation adjustments are included as a component of Accumulated other

comprehensive income (loss) in the Company’s consolidated balance sheets. For those operations that have the U.S. dollar as

their functional currency, transactions denominated in the local currency are measured in U.S. dollars using the current rates of

exchange for monetary assets and liabilities and historical rates of exchange for nonmonetary assets. Gains and losses from

remeasurement of monetary assets and liabilities are included in Other within Other income (expense) within the Company’s

consolidated statements of operations.

Derivative Instruments: Gains and losses on hedges of existing assets or liabilities are marked-to-market and the

result is included in Other within Other income (expense) within the Company’s consolidated statements of operations. Certain

financial instruments are used to hedge firm future commitments or forecasted transactions. Gains and losses pertaining to

those instruments that qualify for hedge accounting are deferred until such time as the underlying transactions are recognized

and subsequently recognized in the same line within the consolidated statements of operations of the hedged item. Gains and

losses pertaining to those instruments that do not qualify for hedge accounting are recorded immediately in Other income

(expense) within the consolidated statements of operations.

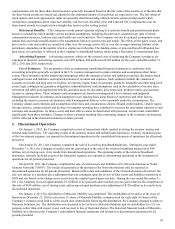

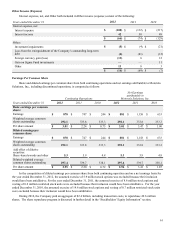

Earnings Per Share: The Company calculates its basic earnings per share based on the weighted-average effect of all

common shares issued and outstanding. Net earnings attributable to Motorola Solutions, Inc. is divided by the weighted

average common shares outstanding during the period to arrive at the basic earnings per share. Diluted earnings per share is

calculated by dividing net earnings attributable to Motorola Solutions, Inc. by the sum of the weighted average number of

common shares used in the basic earnings per share calculation and the weighted average number of common shares that would

be issued assuming exercise or conversion of all potentially dilutive securities, excluding those securities that would be anti-

dilutive to the earnings per share calculation. Both basic and diluted earnings per share amounts are calculated for earnings

from continuing operations and net earnings attributable to Motorola Solutions, Inc. for all periods presented. All earnings per

share information presented gives effect to the distribution of Motorola Mobility and Reverse Stock Split, which occurred on

January 4, 2011.

Share-Based Compensation Costs: The Company has incentive plans that reward employees with stock options, stock

appreciation rights, restricted stock and restricted stock units, as well as an employee stock purchase plan. The amount of