LG 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

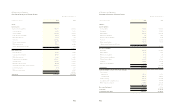

86 87

(in millions of Korean won, except per share amounts) 2012 2011

Net sales 50,959,978 54,256,585

Cost of sales 38,652,915 42,057,595

Gross profit 12,307,063 12,198,990

Selling and marketing expenses 6,785,477 7,158,784

Administrative expenses 1,229,288 1,366,823

Research and development expenses 1,831,211 1,698,917

Service costs 1,325,106 1,595,453

Operating income 1,135,981 379,013

Financial income 441,380 571,693

Financial expenses 735,719 909,804

Gain (loss) from equity method 46,189 (329,472)

Other non-operating income 1,256,378 1,582,432

Other non-operating expenses 1,620,142 1,693,175

Profit (loss) before income tax 524,067 (399,313)

Income tax expense 433,246 33,492

Profit (loss) for the year 90,821 (432,805)

Profit (loss) for the year attributable to:

Equity holders of the Parent Company 66,774 (469,624)

Non-controlling interest 24,047 36,819

Earnings (loss) per share attributable

to the equity holders of the Parent

Company during the year (in won):

Earnings (loss) per share for profit attributable to

the ordinary equity holders of the Parent Company 366 (2,880)

Earnings (loss) per share for profit attributable to

the preferred equity holders of the Parent Company 416 (2,563)

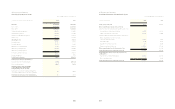

(in millions of Korean won) 2012 2011

Profit (loss) for the year 90,821 (432,805)

Other comprehensive income (loss), net of tax

Items that will not be reclassified subsequently to profit or loss:

Actuarial loss on defined benefit liability (90,797) (94,056)

Share of actuarial loss of associates (31,018) (11,887)

Items that will be reclassified subsequently to profit or loss:

Other comprehensive income (loss) from

associates and joint ventures (50,790) 22,259

Cash flow hedges 4,184 (4,717)

Available-for-sale financial assets (601) (3,474)

Currency translation differences (315,746) (117,633)

Other comprehensive loss for the year, net of tax (484,768) (209,508)

Total comprehensive loss for the year, net of tax (393,947) (642,313)

Comprehensive income (loss) for the year, net of tax,

attributable to:

Equity holders of the Parent Company (402,622) (692,307)

Non-controlling interest 8,675 49,994

Total comprehensive loss for the year, net of tax (393,947) (642,313)

Years ended December 31, 2012 and 2011 Years ended December 31, 2012 and 2011

LG Electronics and Subsidiaries

Consolidated Statements of Income

LG Electronics and Subsidiaries

Consolidated Statements of Comprehensive Income