Kroger 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Kroger Co. Page 48

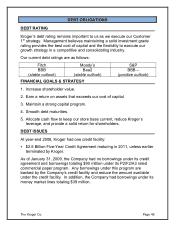

FREE CASH FLOW

Kroger’s strong earnings results in 2008 would not be possible without our

prudent and balanced long-term financial strategy. We believe it is

important to allocate free cash flow to maximize its benefit for our equity

and fixed income investors. In 2008, to preserve liquidity and financial

flexibility, we reduced the amount of stock repurchased during the year,

decreasing the cash used for stock purchases in 2008 compared to 2007.

We have focused on improving our leverage metrics. On a rolling four-

quarters basis, Kroger’s net total debt to EBITDA ratio was 1.89 for fiscal

2008 compared to 2.03 during the corresponding period for fiscal 2007.

We ended fiscal 2008 with $7.7 billion in net total debt, a decrease of $24.1

million from a year earlier.

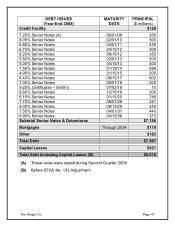

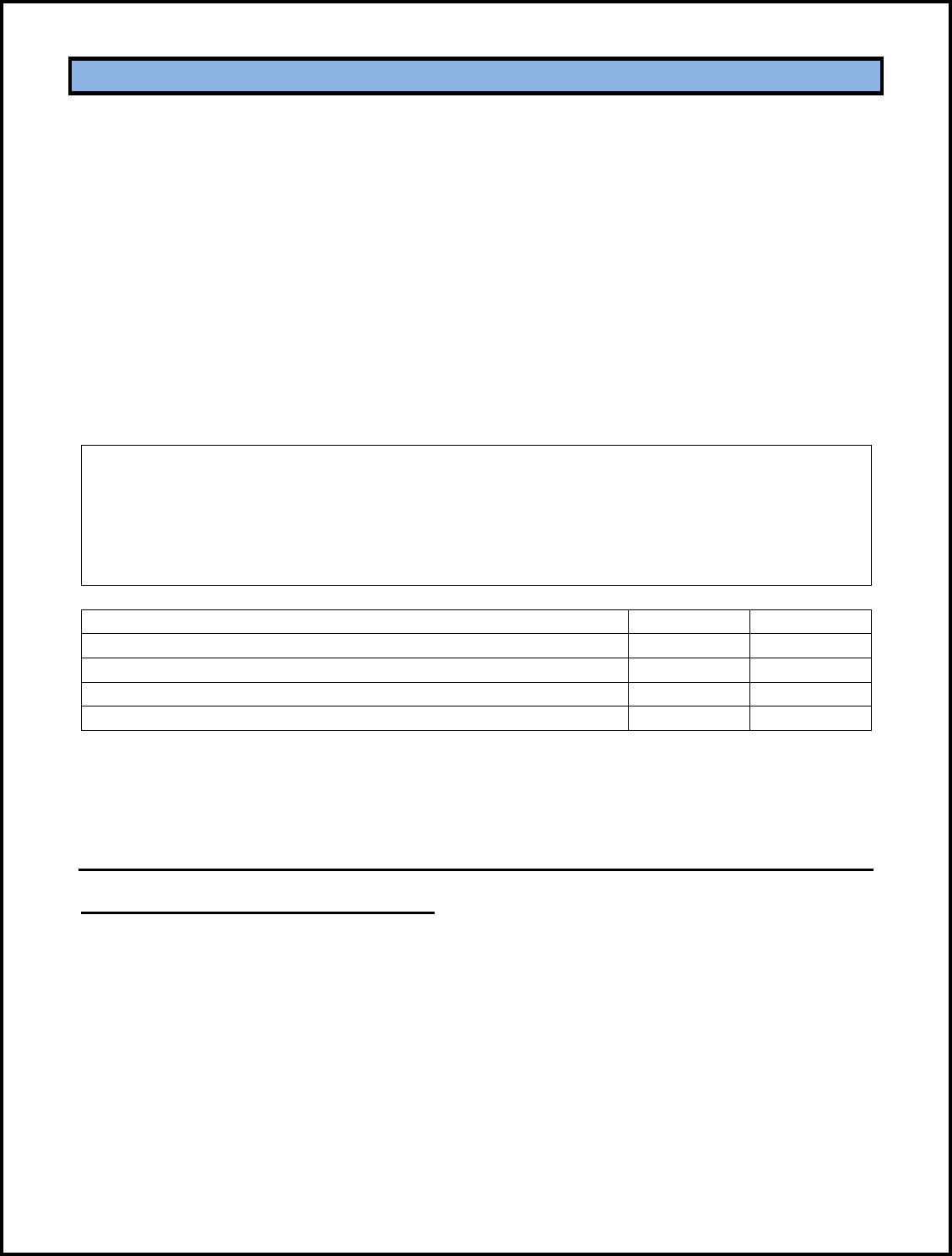

Note: Management believes net total debt is an important measure of liquidity, and a

primary component of measuring compliance with the financial covenants under the

Company’s credit facility. Net total debt should not be considered an alternative to

any GAAP measure of performance or liquidity and should be reviewed in conjunction

with Kroger’s financial results reported in accordance with GAAP. The following table

provides a reconciliation of total debt to net total debt for year-end 2008 and 2007.

$ millions

YE 2008

YE 2007

Total debt

$8,062.5

$8,121.6

Temporary cash investments

<46.6>

<81.7>

Prepaid employee benefits

<300.0>

<300.0>

Net total debt

$7,715.9

$7,739.9

Our bias towards strengthening our leverage metrics remains. We believe

this approach supports an appropriate level of liquidity and leverages

Kroger’s financial strength to continue delivering on our Customer 1st plan.

SHARE REPURCHASE

Board Repurchase Authorizations

We maintain stock repurchase programs that comply with Securities

Exchange Act Rule 10b5-1 to allow for the orderly repurchase of our

common stock, from time to time, even though we may be aware of

material non-public information, as long as purchases are made in

accordance with the plan. We made open market purchases totaling $448

million, $1.2 billion, and $374 million under Board-authorized repurchase

programs during fiscal 2008, 2007, and 2006, respectively. At the end of

fiscal 2008, approximately $493 million remained under the $1 billion share

repurchase program authorized by our Board in January 2008.