Kroger 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Kroger Co. Page 44

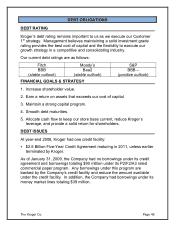

We believe that long-term shareholder value is determined, in part, by the

return on invested capital and therefore we use a disciplined approach to

evaluate every capital investment:

Capital investments are assessed versus our after-tax hurdle rate with

consideration given to the risk of the specific investment.

The projected incremental sales and EBITDA from each capital

expenditure are added to divisional and corporate bonus bases in order

to motivate the entire organization to achieve returns above our hurdle

rate.

A quarterly re-analysis of each major project is conducted to ensure we

understand the return from major capital projects.

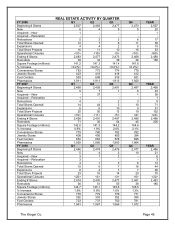

Kroger continues to aggressively close underperforming stores. In fiscal

2008, we closed 46 stores – 32 of these were operational closures. The

term “operational closure” describes a store location that has been

closed without opening another store in the same vicinity to replace it.

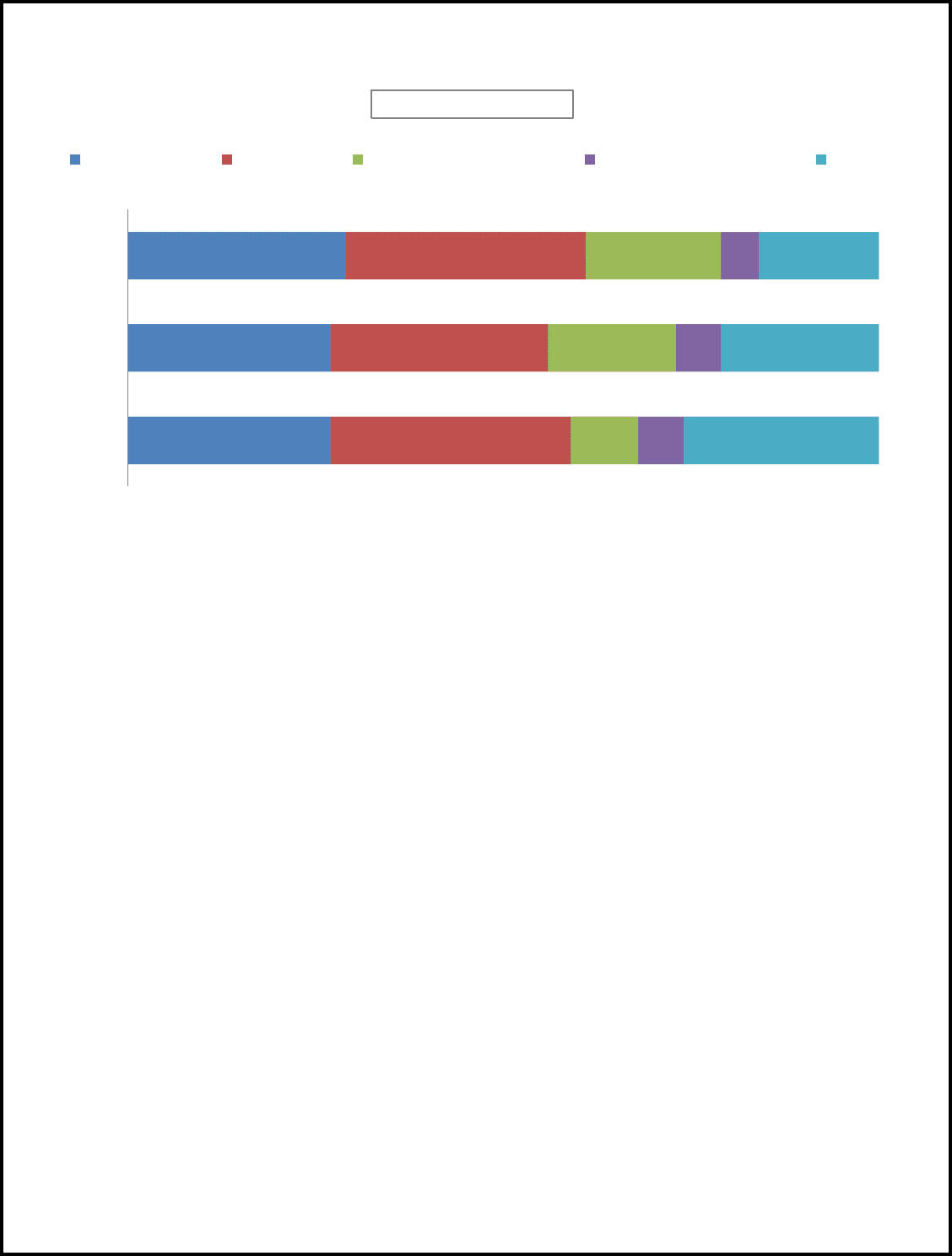

The chart on the following page provides Kroger’s real estate activity by

quarter for fiscal 2006, 2007, and 2008.

27%

27%

29%

32%

29%

32%

9%

17%

18%

6%

6%

5%

26%

21%

16%

2006

2007

2008

Capital Investments

Supermarkets

Real Estate

Technology & Logistics

Mfg, C-Stores, Jewelry

Other