Kroger 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Kroger Co. Page 32

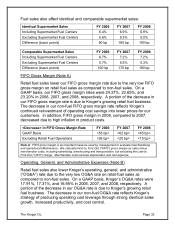

Fuel sales also affect identical and comparable supermarket sales:

Identical Supermarket Sales

FY 2006

FY 2007

FY 2008

Including Supermarket Fuel Centers

6.4%

6.9%

6.9%

Excluding Supermarket Fuel Centers

5.6%

5.3%

5.0%

Difference (basis points)

80 bp

160 bp

190 bp

Comparable Supermarket Sales

FY 2006

FY 2007

FY 2008

Including Supermarket Fuel Centers

6.7%

7.2%

7.2%

Excluding Supermarket Fuel Centers

5.7%

5.5%

5.3%

Difference (basis points)

100 bp

170 bp

190 bp

FIFO Gross Margin (Note A)

Retail fuel sales lower our FIFO gross margin rate due to the very low FIFO

gross margin on retail fuel sales as compared to non-fuel sales. On a

GAAP basis, our FIFO gross margin rates were 24.27%, 23.65%, and

23.20% in 2006, 2007, and 2008, respectively. A portion of the decrease in

our FIFO gross margin rate is due to Kroger’s growing retail fuel business.

The decrease in our non-fuel FIFO gross margin rate reflects Kroger’s

continued reinvestment of operating cost savings into lower prices for our

customers. In addition, FIFO gross margin in 2008, compared to 2007,

decreased due to high inflation in product costs.

<Decrease> in FIFO Gross Margin Rate

FY 2006

FY 2007

FY 2008

GAAP Basis

<53 bp>

<62 bp>

<45 bp>

Excluding Retail Fuel Operations

<26 bp>

<20 bp>

<15 bp>

Note A: FIFO gross margin is an important measure used by management to evaluate merchandising

and operational effectiveness. We calculate First-In, First-Out (“FIFO”) gross margin as sales minus

merchandise costs, including advertising, warehousing and transportation, but excluding the Last-In,

First-Out (“LIFO”) charge. Merchandise costs exclude depreciation and rent expense.

Operating, General, and Administrative Expenses (Note B)

Retail fuel sales also lower Kroger’s operating, general, and administrative

(“OG&A”) rate due to the very low OG&A rate on retail fuel sales as

compared to non-fuel sales. On a GAAP basis, Kroger’s OG&A rates were

17.91%, 17.31%, and 16.95% in 2006, 2007, and 2008, respectively. A

portion of the decrease in our OG&A rate is due to Kroger’s growing retail

fuel business. The decrease in our non-fuel OG&A rate reflects Kroger’s

strategy of producing operating cost leverage through strong identical sales

growth, increased productivity, and cost control.