JetBlue Airlines 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2014Annual Report56

PART II

ITEM 8Financial Statements and Supplementary Data

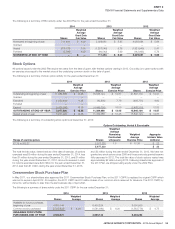

The 2011 CSPP has a series of six month offering periods, with a new

offering period beginning on the first business day of May and November

each year. Crewmembers can only join an offering period on the start

date. Crewmembers may contribute up to 10% of their pay towards the

purchase of common stock via payroll deductions. Purchase dates occur

on the last business day of April and October each year.

Until April 2013, our 2011 CSPP was considered non-compensatory as the

purchase price discount was 5% based upon the stock price on the date

of purchase. The plan was amended and restated in May 2013 with the

CSPP purchase price discount increasing to 15% based upon the stock

price on the date of purchase. In accordance with the Compensation-

Stock Compensation topic of the Codification, the 2011 CSPP no longer

meets the non-compensatory definition as the terms of the plan are more

favorable than those to all holders of the common stock. For all offering

periods starting after May 1, 2013, the compensation cost relating to

the discount is recognized over the offering period. The total expense

recognized relating to the 2011 CSPP was approximately $3 million and

$2 million for the years ended December 31, 2014 and 2013 respectively.

Should we be acquired by merger or sale of substantially all of our assets or

sale of more than 50% of our outstanding voting securities, all outstanding

purchase rights will automatically be exercised immediately prior to the

effective date of the acquisition at a price equal to 85% of the fair market

value per share immediately prior to the acquisition.

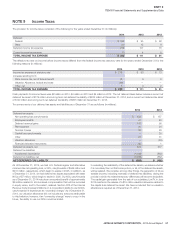

Taxation

The Compensation-Stock Compensation topic of the Codification requires

deferred taxes be recognized on temporary differences that arise with

respect to stock-based compensation attributable to nonqualified stock

options and awards. However, no tax benefit is recognized for stock-

based compensation attributable to incentive stock options, or ISO, or

CSPP shares until there is a disqualifying disposition, if any, for income

tax purposes. A portion of our stock-based compensation is attributable

to ISO and CSPP shares; therefore, our effective tax rate is subject to

fluctuation.

LiveTV sale

In June 2014, we sold our subsidiary LiveTV and accelerated the vesting for

all RSUs outstanding for LiveTV employees. The total expense recognized

relating to this acceleration was less than $1 million.

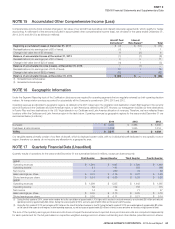

NOTE 8 LiveTV

LiveTV, LLC, formerly a wholly owned subsidiary of JetBlue, provides in-flight

entertainment and connectivity solutions for various commercial airlines

including JetBlue. On June 10, 2014, JetBlue entered into an amended

and restated purchase agreement with Thales Holding Corporation, or

Thales, replacing the original purchase agreement between the parties

dated as of March 13, 2014. Under the terms of the amended and restated

purchase agreement, JetBlue sold LiveTV to Thales for $399million, subject

to purchase adjustments based upon the amount of cash, indebtedness,

and working capital of LiveTV at the closing date of the transaction

relative to a target amount. Excluded from this sale was LiveTV Satellite

Communications, LLC, which was retained by JetBlue pending receipt of

the necessary regulatory approvals for the sale. On September 25, 2014,

JetBlue received all necessary regulatory approvals and sold LiveTV Satellite

Communications, LLC, to Thales for approximately $1 million in cash.

The total cash proceeds of $393 million reflect the agreed upon purchase

price, net of purchase agreement adjustments including post-closing

purchase price adjustments, which were finalized during the third quarter

of 2014. The sale resulted in a pre-tax gain of approximately $241 million

and is net of approximately $19 million in transactions costs. The gain

on the sale has been reported as a separate line item in the consolidated

statement of operations for the year ended December 31, 2014.

The tax expense recorded in connection with this transaction totaled

$72million, net of a $19 million tax benefit related to the utilization of

a capital loss carryforward. The capital gain generated from the sale of

LiveTV resulted in the release of a valuation allowance related to the capital

loss deferred tax asset. This resulted in an after tax gain on the sale of

approximately $169 million.

Following the close of the sales on June 10, 2014, and on September 25,

2014, the applicable LiveTV operations are no longer being consolidated

as a subsidiary in JetBlue’s consolidated financial statements. The effect of

this reporting structure change is not material to the consolidated financial

statements presented. LiveTV third party revenues in 2014 up to the date

of sale were $30 million, compared to $72 million in 2013 and $81 million

in 2012. In December 2011, LiveTV terminated its contract with one of its

airline customers and upon fulfilling its obligation to deactivate service on

the customer’s aircraft, recorded a gain of $8 million in other operating

expenses in 2012.

Deferred profit on hardware sales and advance deposits for future hardware

sales were included in other accrued liabilities and other long term liabilities

on our consolidated balance sheets depending on whether we expected

to recognize it in the next 12 months or beyond. No deferred profit is

recognized in our consolidated balance sheets as of December 31,

2014, compared to $42 million as of December 31, 2013. There is no net

book value of equipment installed for other airlines in our consolidated

balance sheets as of December 31, 2014, compared to $102 million as

of December 31, 2013.

JetBlue expects to continue to be a significant customer of LiveTV.

Concurrent with the LiveTV sale, the parties have entered into two

agreements, each with seven year terms pursuant to which LiveTV

continues to provide JetBlue with in-flight entertainment and onboard

connectivity products and services.