JetBlue Airlines 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2014Annual Report32

PART II

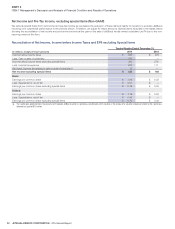

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

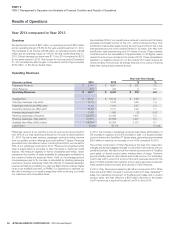

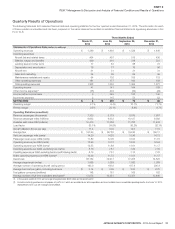

Although we experienced revenue growth in 2014, this trend may not

continue. We expect our expenses to continue to increase significantly

as we acquire additional aircraft, as our fleet ages and as we expand the

frequency of flights in existing markets as well as enter into new markets.

Accordingly, the comparison of the financial data for the quarterly periods

presented may not be meaningful. In addition, we expect our operating

results to fluctuate significantly from quarter-to-quarter in the future as a result

of various factors, many of which are outside our control. Consequently,

we believe quarter-to-quarter comparisons of our operating results may

not necessarily be meaningful and you should not rely on our results for

any one quarter as an indication of our future performance.

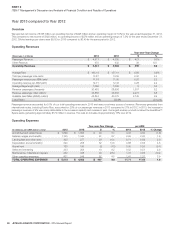

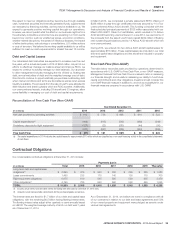

Liquidity and Capital Resources

The airline business is capital intensive. Our ability to successfully execute

our profitable growth plans is largely dependent on the continued availability

of capital on attractive terms. In addition, our ability to successfully

operate our business depends on maintaining sufficient liquidity. We

believe we have adequate resources from a combination of cash and

cash equivalents, investment securities on-hand and two available lines of

credit. Additionally, as of December 31, 2014, we had 39 unencumbered

aircraft and 33unencumbered spare engines which we believe could be

an additional source of liquidity, if necessary.

We believe a healthy cash balance is crucial to our ability to weather any

part of the economic cycle while continuing to execute on our plans for

profitable growth and increased returns. Our goal is to continue to be

diligent with our liquidity, maintaining financial flexibility and allowing for

prudent capital spending. We expect these goals will lead to improved

returns for our shareholders. As of December 31, 2014, our cash and

cash equivalents balance increased by 52% to $341 million. We believe

our current level of unrestricted cash, cash equivalents and short-term

investments of approximately 12% of trailing twelve months revenue,

combined with our $600 million in available lines of credit and portfolio of

unencumbered assets, provides us with a strong liquidity position and the

potential for higher returns on cash deployment. We believe we have taken

several important actions during 2014 in solidifying our strong balance

sheet and overall liquidity position. Our highlights for 2014 included:

•Reduced our overall debt balance by $352 million.

•Prepaid approximately $308 million in debt resulting in 14 Airbus A320

aircraft and five spare engines becoming unencumbered. The majority

of this prepayment was from the proceeds of the sale of LiveTV in June

2014. This will result in 2015 interest expense savings of $7 million and

total interest expense savings of $28 million.

•

Increased the number of unencumbered aircraft from 23 as of

December31, 2013, to 39 as of December 31, 2014.

•

In March 2014, we completed a $226 million Enhanced Equipment

Trust Certificate offering, or EETC, in pass-through certificates which

was secured by 14 previously unencumbered Airbus A320 aircraft. This

coincided with the final payment on the Series 2004-1 EETC of $188

million which resulted in 13 Airbus A320 aircraft becoming unencumbered.

•

We took delivery of nine Airbus A321 aircraft, two of which were financed

with capital leases.