JetBlue Airlines 2014 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2014 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JETBLUE AIRWAYS CORPORATION-2014Annual Report26

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

Results of Operations

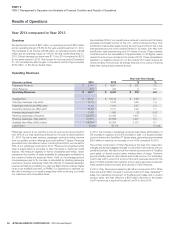

Year 2014 compared to Year 2013

Overview

We reported net income of $401 million, an operating income of $515million

and an operating margin of 8.9% for the year ended December 31, 2014.

This compares to net income of $168 million, an operating income of $428

million and an operating margin of 7.9% for the year ended December 31,

2013. Diluted earnings per share were $1.19 for 2014 compared to $0.52

for the same period in 2013. Net income for the year ended December

31, 2014 includes the after tax gain on the sale of LiveTV of approximately

$169 million, or $0.49 per diluted share.

Approximately 80% of our operations are centered in and around the heavily

populated northeast corridor of the U.S., which includes the New York

and Boston metropolitan areas. During the first three months of 2014, this

area experienced one of the coldest winters in 20 years, with New York

and Boston each experiencing over 57 inches of snow. These weather

conditions led to the cancellation of approximately 4,100 flights, nearly

double the amount we canceled in the whole of 2013. These cancellations

resulted in a negative impact on our first quarter 2014 seat revenue as

well as ancillary revenue such as change fees due to our policy of waiving

these fees during severe weather events.

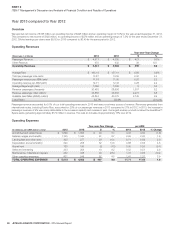

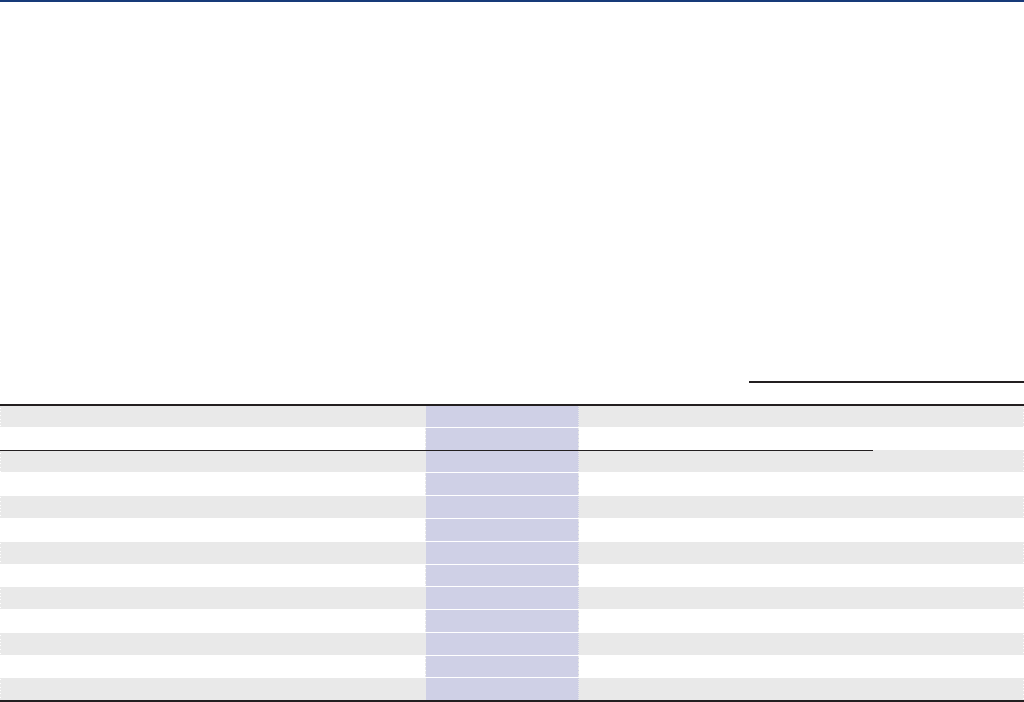

Operating Revenues

(Revenue in millions)

2014 2013

Year-over-Year Change

$%

Passenger Revenue $ 5,343 $ 4,971 $ 372 7.5

Other Revenue 474 470 4 0.7

Operating Revenues $ 5,817 $ 5,441 $ 376 6.9

Average Fare $ 166.57 $ 163.19 $ 3.38 2.1

Yield per passenger mile

(cents)

14.13 13.87 0.26 1.9

Passenger revenue per ASM

(cents)

11.88 11.61 0.27 2.3

Operating revenue per ASM

(cents)

12.93 12.71 0.22 1.7

Average stage length

(miles)

1,088 1,090 (2) (0.2)

Revenue passengers

(thousands)

32,078 30,463 1,615 5.3

Revenue passenger miles

(millions)

37,813 35,836 1,977 5.5

Available Seat Miles

(ASMs) (millions)

44,994 42,824 2,170 5.1

Load Factor 84.0% 83.7% 0.3 pts

Passenger revenue is our primary source of revenue and accounted for

over 92% of our total operating revenues for the year ended December

31, 2014. As well as seat revenue, passenger revenue includes revenue

from our ancillary product offerings such as EvenMore™ Space. Revenues

generated from international routes, including Puerto Rico, accounted for

30% of our passenger revenues in 2014. Revenue is recognized either

when transportation is provided or after the ticket or customer credit

expires. We measure capacity in terms of available seat miles, which

represents the number of seats available for passengers multiplied by

the number of miles the seats are flown. Yield, or the average amount

one passenger pays to fly one mile, is calculated by dividing passenger

revenue by revenue passenger miles. We attempt to increase passenger

revenue primarily by increasing our yield per flight which produces higher

revenue per available seat mile, or RASM. Our objective is to optimize our

fare mix to increase our overall average fare while continuing to provide

our customers with competitive fares.

In 2014, the increase in passenger revenues was mainly attributable to a

5% increase in capacity and a 2% increase in yield. Our largest ancillary

product remains the EvenMore™ Space seats, generating approximately

$200 million in revenue, an increase of over 16% compared to 2013.

The primary component of Other Revenue is the fees from reservation

changes and excess baggage charged to customers in accordance with our

published policies. We also include the marketing component of TrueBlue

point sales, on-board product sales, transportation of cargo, Charters,

ground handling fees of other airlines and rental income. Our subsidiary,

LiveTV was sold in June 2014 and any third party revenues earned for the

sale of in-flight entertainment systems and on-going services provided for

these systems before this date are included in Other Revenue.

In 2014, Other Revenue increased by $4 million compared to 2013. While

there was a $42 million increase in revenues mainly from fees, Getaways™

sales, the marketing component of TrueBlue point sales and on-board

product sales, this was offset by a $38 million reduction in third party

LiveTV revenue as a result of the sale of LiveTV in June 2014.