Huntington National Bank 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

-

183

-

184

-

185

-

186

-

187

-

188

-

189

-

190

-

191

-

192

-

193

-

194

-

195

-

196

-

197

-

198

-

199

-

200

-

201

-

202

-

203

-

204

-

205

-

206

-

207

-

208

-

209

-

210

-

211

-

212

-

213

-

214

-

215

-

216

-

217

-

218

-

219

-

220

-

221

-

222

-

223

-

224

-

225

-

226

-

227

-

228

-

229

-

230

-

231

-

232

-

233

-

234

-

235

-

236

Table of contents

-

Page 1

-

Page 2

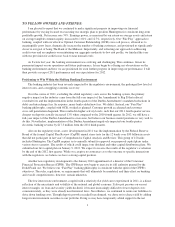

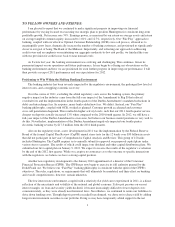

...bank holding company headquartered in Columbus, Ohio. The Huntington National Bank, founded in 1866, provides full-service commercial, small business, and consumer banking services; mortgage banking services; treasury management and foreign exchange services; equipment leasing; wealth and investment...

-

Page 3

... in debit card interchange fees. In response, many banks added new fees. We didn't. Instead, our "Fair Play" banking philosophy, coupled with OCR, worked as planned. Customer growth accelerated and customer cross-sell penetration deepened. This resulted in higher activity levels, such that our 2011...

-

Page 4

...to commercial and business customers in Michigan. We are already more than halfway towards our goal. In addition to lending commitments, Huntington continues to invest in its communities. Every year, our employees educate many thousands of families in financial literacy, help hundreds of high school...

-

Page 5

... paces, such that service charges on deposit accounts in 2011 fourth quarter were 13% higher than in the year earlier quarter. Other areas of fee income benefited from our customer growth and cross-sell strategy. This included brokerage, trust services, and capital markets whose combined revenue...

-

Page 6

... deposit accounts. Noninterest income is expected to show a modest increase throughout 2012 from 2011 fourth quarter levels. This is primarily due to anticipated growth in new customers and increased contribution from key fee income activities including capital markets, treasury management services...

-

Page 7

In 2011, we further improved our credit quality performance as we have returned to near normal provision levels sooner than most. Through our differentiated strategy, we accelerated customer growth. In each quarter of last year, we roughly added the same number of new consumer checking account ...

-

Page 8

... to Item 1A "Risk Factors" and the "Additional Disclosure" sections in Huntington's Form 10-K for the year ending December 31, 2011, for additional information. All forward-looking statements speak only as of the date they are made and are based on information available at that time. We assume no...

-

Page 9

... File Number 1-34073

Huntington Bancshares Incorporated

(Exact name of registrant as specified in its charter)

Maryland

(State or other jurisdiction of incorporation or organization)

31-0724920

(I.R.S. Employer Identification No.)

41 S. High Street, Columbus, Ohio

(Address of principal executive...

-

Page 10

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

Page 11

... 6. Item 7.

Business ...Risk Factors ...Unresolved Staff Comments ...Properties ...Legal Proceedings ...Mine Safety Disclosures ...Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities ...Selected Financial Data ...Management's Discussion and...

-

Page 12

...Board's Capital Plan Review Certificate of Deposit Account Registry Service Collateralized Debt Obligations Bureau of Consumer Financial Protection Collateralized Mortgage Obligations Capital Purchase Program Commercial Real Estate Demand Deposit Account Deposit Insurance Fund Dodd-Frank Wall Street...

-

Page 13

... Interbank Offered Rate Loss-Given-Default Loan to Value Management's Discussion and Analysis of Financial Condition and Results of Operations Market Risk Committee Mortgage Servicing Rights Nonaccrual Loans Net Asset Value Net Charge-off Nonperforming Assets Nonsufficient Funds and Overdraft Office...

-

Page 14

... Debt Restructured loan Temporary Liquidity Guarantee Program U.S. Department of the Treasury Uniform Classification System Unpaid Principal Balance U.S. Department of Agriculture U.S. Department of Veteran Affairs Variable Interest Entity Wealth Advisors, Government Finance, and Home Lending...

-

Page 15

... small business customers located within our primary banking markets consisting of five areas covering the six states of Ohio, Michigan, Pennsylvania, Indiana, West Virginia, and Kentucky. Its products include individual and small business checking accounts, savings accounts, money market accounts...

-

Page 16

... deposit, consumer loans, and small business loans and leases. Other financial services available to consumers and small business customers include investments, insurance services, interest rate risk protection products, foreign exchange hedging, and treasury management services. Retail and Business...

-

Page 17

... a banking network of over 600 branches and over 1,300 ATMs within our markets and our award-winning website at www.huntington.com. We have also instituted new and more customer friendly practices, such as our 24-Hour Grace® account feature, which gives customers an additional business day to...

-

Page 18

...file reports and other information regarding our business operations and the business operations of our subsidiaries with the Federal Reserve. The Federal Reserve maintains a bank holding company rating system that emphasizes risk management, introduces a framework for analyzing and rating financial...

-

Page 19

... asset size or foreign financial exposure. Over a three year phase-out period beginning on January 1, 2013, trust preferred securities will no longer qualify as Tier 1 risk-based capital for certain bank holding companies, including us. We have plans in place, including the fourth quarter 2011...

-

Page 20

... Board amended Regulation E under the Electronic Fund Transfer Act to prohibit banks from charging overdraft fees for ATM or point-of-sale debit card transactions that overdrew the account unless customers opt-in to the discretionary overdraft service and to require banks to explain the terms of...

-

Page 21

... bank holding companies. Under the guidelines and related policies, bank holding companies must maintain capital sufficient to meet both a risk-based asset ratio test and a leverage ratio test on a consolidated basis. The risk-based ratio is determined by allocating assets and specified off-balance...

-

Page 22

... and limited-life preferred stock, mandatory convertible securities, qualifying subordinated debt, and the ACL, up to 1.25% of risk-weighted assets. • Total risk-based capital is the sum of Tier 1 and Tier 2 risk-based capital. The Federal Reserve and the other federal banking regulators require...

-

Page 23

... a regulatory order, agreement, or directive to meet and maintain a specific capital level for any capital measure.

At December 31, 2011 Excess Actual Capital(1)

Wellcapitalized minimums (dollar amounts in billions)

Ratios: Tier 1 leverage ratio ...Consolidated Bank Tier 1 risk-based capital ratio...

-

Page 24

..., or safeguarding money or securities, • underwriting insurance or annuities, • providing financial or investment advice, • underwriting, dealing in, or making markets in securities, • merchant banking, subject to significant limitations, • insurance company portfolio investing, subject to...

-

Page 25

... consumers, including the Home Mortgage Disclosure Act, the Real Estate Settlement Procedures Act, the Equal Credit Opportunity Act, the Truth in Lending Act, the Fair Credit Reporting Act, the Truth in Savings Act, the Electronic Funds Transfer Act, and the Expedited Funds Availability Act. The...

-

Page 26

...this Annual Report on Form 10-K, information on those web sites is not part of this report. You also should be able to inspect reports, proxy statements, and other information about us at the offices of the NASDAQ National Market at 33 Whitehall Street, New York, New York. Item 1A: Risk Factors Risk...

-

Page 27

...-testing, and oversee the quarterly self-assessment process. Segment risk officers report directly to the related segment manager with a dotted line to the Chief Risk Officer. Corporate Risk Management establishes policies, sets operating limits, reviews new or modified products/ processes, ensures...

-

Page 28

... by credit risk exposures which could materially adversely affect our net income and capital.

Our business depends on the creditworthiness of our customers. Our ACL of $1.0 billion at December 31, 2011, represented Management's estimate of probable losses inherent in our loan and lease portfolio as...

-

Page 29

... real estate in future periods. Market Risks: 1. Changes in interest rates could reduce our net interest income, reduce transactional income, and negatively impact the value of our loans, securities, and other assets. This could have a material adverse impact on our cash flows, financial condition...

-

Page 30

...to meet customers' needs, which could adversely impact our financial condition, results of operations, cash flows, and level of regulatory-qualifying capital. We may, from time to time, consider opportunistically retiring our outstanding securities in privately negotiated or open market transactions...

-

Page 31

...These operational risks could lead to expensive litigation and loss of confidence by our customers, regulators, and the capital markets. Moreover, negative public opinion can result from our actual or alleged conduct in any number of activities, including lending practices, corporate governance, and...

-

Page 32

... Kentucky, Indiana, Michigan, Pennsylvania, West Virginia and Illinois. (For further discussion, see Note 17 of the Notes to Consolidated Financial Statements.) 4. Failure to maintain effective internal controls over financial reporting in the future could impair our ability to accurately and timely...

-

Page 33

... Common risk-based capital ratio under both expected and stressed conditions. 2. If our regulators deem it appropriate, they can take regulatory actions that could result in a material adverse impact on our ability to compete for new business, constrain our ability to fund our liquidity needs or pay...

-

Page 34

... Staff Comments None. Item 2: Properties Our headquarters, as well as the Bank's, are located in the Huntington Center, a thirty-seven-story office building located in Columbus, Ohio. Of the building's total office space available, we lease approximately 33%. The lease term expires in 2030, with six...

-

Page 35

... to Consolidated Financial Statements and incorporated into this Item by reference. Huntington did not repurchase any common shares for the year ended December 31, 2011. The line graph below compares the yearly percentage change in cumulative total shareholder return on Huntington common stock and...

-

Page 36

... total assets ...Return on average common shareholders' equity ...Return on average tangible common shareholders' equity(4) ...Efficiency ratio(5) ...Dividend payout ratio ...Average shareholders' equity to average assets ...Effective tax rate (benefit) ...Tier 1 common risk-based capital ratio...

-

Page 37

... other long-term debt. (3) On an FTE basis assuming a 35% tax rate. (4) Net income (loss) less expense excluding amortization of intangibles for the period divided by average tangible shareholders' equity. Average tangible shareholders' equity equals average total shareholders' equity less average...

-

Page 38

..., automobile financing, equipment leasing, investment management, trust services, brokerage services, customized insurance service programs, and other financial products and services. Our over 600 banking offices are located in Indiana, Kentucky, Michigan, Ohio, Pennsylvania, and West Virginia...

-

Page 39

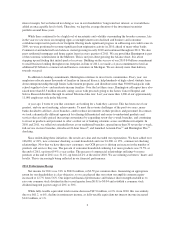

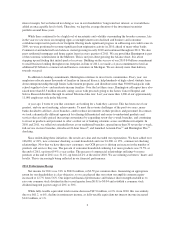

... of government-mandated reductions in fee income during 2011, and a slower mortgage market, we were able to produce a return on average total assets of 1.01%, up from 0.59% in 2010. We also saw continuing results from our strategic business investments and Optimal Customer Relationship (OCR) sales...

-

Page 40

... be a high level of uncertainty and volatility surrounding the economy, though late in the year we saw more encouraging signs. Unemployment rates as of December 2011 for Ohio, Pennsylvania, and West Virginia were below the national unemployment average. Indiana, Michigan, and Kentucky were slightly...

-

Page 41

...-term interest rates, in turn, will contribute to a broad easing in financial market conditions that will provide additional stimulus to support the economic recovery. We do not anticipate that this program will have a material impact on our current securities portfolio or future investment strategy...

-

Page 42

... deposit accounts. Noninterest income is expected to show a modest increase throughout 2012 from 2011 fourth quarter levels. This is primarily due to anticipated growth in new customers and increased contribution from key fee income activities including capital markets, treasury management services...

-

Page 43

... for credit losses ...Service charges on deposit accounts ...Trust services ...Electronic banking ...Mortgage banking income ...Brokerage income ...Insurance income ...Bank owned life insurance income ...Capital markets fees ...Gain (loss) on sale of loans ...Automobile operating lease income...

-

Page 44

..., the impact of the convertible preferred stock issued in 2008 and the warrants issued to the U.S. Department of the Treasury in 2008 related to Huntington's participation in the voluntary Capital Purchase Program was excluded from the diluted share calculation because the result was more than basic...

-

Page 45

... the Company; e.g., regulatory actions / assessments, windfall gains, changes in accounting principles, one-time tax assessments / refunds, litigation actions, etc. In other cases they may result from our decisions associated with significant corporate actions out of the ordinary course of business...

-

Page 46

... restructuring. • During the 2010 second quarter, the portfolio of Franklin-related loans ($333.0 million of residential mortgages and $64.7 million of home equity loans) was transferred to loans held for sale. At the time of the transfer, the loans were marked to the lower of cost or fair value...

-

Page 47

...tax benefit recognized(4) ...Franklin-related loans transferred to held for sale ...Franklin relationship restructuring(4) ...Gain related to sale of Visa® stock ...Deferred tax valuation allowance benefit(4) . . Goodwill impairment ...FDIC special assessment ...Gain on early extinguishment of debt...

-

Page 48

...is the difference between interest income from earning assets (primarily loans, securities, and direct financing leases), and interest expense of funding sources (primarily interest-bearing deposits and borrowings). Earning asset balances and related funding sources, as well as changes in the levels...

-

Page 49

...(2) (dollar amounts in millions)

Loans and direct financing leases ...Investment securities ...Other earning assets ...Total interest income from earning assets ...Deposits ...Short-term borrowings ...Federal Home Loan Bank advances ...Subordinated notes and other long-term debt, including capital...

-

Page 50

... available-for-sale and other securities ...Held-to-maturity securities - taxable ...Loans and leases: (3) Commercial: Commercial and industrial ...Commercial real estate: Construction ...Commercial ...Commercial real estate ...Total commercial ...Consumer: Automobile loans and leases ...Home equity...

-

Page 51

... available-for-sale and other securities ...Held-to-maturity securities - taxable ...Loans and leases: (3) Commercial: Commercial and industrial ...Commercial real estate: Construction ...Commercial ...Commercial real estate ...Total commercial ...Consumer: Automobile loans and leases ...Home equity...

-

Page 52

... initiatives focusing on large corporate, asset based lending, and equipment finance. In addition, we continued to see growth in more traditional middle-market, business banking, and automobile floorplan loans. This growth was evident despite utilization rates that remained well below historical...

-

Page 53

... to 2009. The expansion into Eastern Pennsylvania and the five New England states also had a positive impact on our volume. Total average investment securities increased $2.9 billion, or 45%, reflecting the deployment of the cash from core deposit growth and loan runoff over this period, as well...

-

Page 54

...) (9) 76,413 3,087 Bank owned life insurance income ...62,336 1,270 2 61,066 6,194 Capital markets fees ...36,540 12,654 53 23,886 13,035 Gain (loss) on sale of loans ...31,944 25,669 409 6,275 13,851 Automobile operating lease income ...26,771 (19,193) (42) 45,964 (5,846) Securities gains (losses...

-

Page 55

... banking, reflecting increased debit card transaction volume. • $10.0 million benefit from lower securities losses. • $8.9 million, or 9%, increase in trust services income, with 50% of the increase due to increases in asset market values, and the remainder reflecting growth in new business...

-

Page 56

... 2010 Amount Percent

2011 (dollar amounts in thousands)

2009

Personnel costs ...$ 892,534 $ 93,561 Outside data processing and other services ...187,195 27,947 Net occupancy ...109,129 1,267 Equipment ...92,544 6,624 Deposit and other insurance expense ...77,692 (19,856) Marketing ...75,627 9,703...

-

Page 57

... Consolidated Financial Statements.) 2011 versus 2010 The provision for income taxes was $164.6 million for 2011 compared with a provision of $40.0 million in 2010. Both years included the benefits from tax-exempt income, tax-advantaged investments, and general business credits. At December 31, 2011...

-

Page 58

...'s balance sheet, amount of on-hand cash and unencumbered securities and the availability of contingent sources of funding, can have an impact on Huntington's ability to satisfy current or future funding commitments. We manage liquidity risk at both the Bank and the parent company. Operational risk...

-

Page 59

...-to-maturity securities portfolio (see Notes 4 and 5 of the Notes to Consolidated Financial Statements). We engage with other financial counterparties for a variety of purposes including investing, asset and liability management, mortgage banking, and for trading activities. Given the current level...

-

Page 60

... and real estate developers. We mitigate our risk on these loans by requiring collateral values that exceed the loan amount and underwriting the loan with projected cash flow in excess of the debt service requirement. These loans are made to finance properties such as apartment buildings, office and...

-

Page 61

... within the new markets that have existing dealer relationships. We have a loan securitization strategy to maintain any growth within our established portfolio concentration limits. Home equity - Home equity lending includes both home equity loans and lines-of-credit. This type of lending, which is...

-

Page 62

... - Loan and Lease Portfolio Composition

2011 (dollar amounts in millions) 2010 At December 31, 2009 2008 2007

Commercial:(1) Commercial and industrial ...Commercial real estate: Construction ...Commercial ...Total commercial real estate ...Total commercial ...Consumer: Automobile(2) ...Home equity...

-

Page 63

... Loan and Lease Portfolio by Collateral Type

2011 (dollar amounts in millions) 2010 At December 31, 2009 2008 2007

Secured loans: Real estate - commercial ...$ 9,557 Real estate - consumer ...13,444 Vehicles ...6,021 Receivables/Inventory ...4,450 Machinery/Equipment ...1,994 Securities/Deposits...

-

Page 64

... Financial Statements) are managed by our SAD. The SAD is a specialized group of credit professionals that handle the day-to-day management of workouts, commercial recoveries, and problem loan sales. Its responsibilities include developing and implementing action plans, assessing risk ratings...

-

Page 65

... metrics of all CRE loan types, with a focus on higher risk classes. Both macro-level and loan-level stress-test scenarios based on existing and forecast market conditions are part of the on-going portfolio management process for the CRE portfolio. Dedicated real estate professionals originated the...

-

Page 66

..., segregated by core CRE loans and noncore CRE loans, is presented in the following table: Table 12 - Commercial Real Estate - Core vs. Noncore portfolios

December 31, 2011 Ending Balance (dollar amounts in millions) Prior NCOs ACL $ ACL % Credit Mark(1) Nonaccrual Loans

Total core ...Noncore - SAD...

-

Page 67

... of automobile loans were transferred to loans held for sale, reflecting an automobile loan securitization planned for the first half of 2012. RESIDENTIAL REAL ESTATE-SECURED PORTFOLIOS The properties securing our residential mortgage and home equity portfolios are primarily located throughout our...

-

Page 68

...credit risk profile is substantially reduced when we hold a first-lien position. During 2011, 70% of our home equity portfolio originations were secured by a first-mortgage lien. We focus on high quality borrowers primarily located within our footprint. The majority of our home equity line-of-credit...

-

Page 69

...-rate loans through this process. Several government programs continued to impact the residential mortgage portfolio, including various refinance programs such as HAMP and HARP, which positively affected the availability of credit for the industry. During the year ended December 31, 2011, we closed...

-

Page 70

... purposes resulting from ordinary banking activities such as payment processing, transactions entered into for risk management purposes (see Note 20 of the Notes to Consolidated Financial Statements), and for investment diversification. As a result, we are exposed to credit risk, or risk of loss, if...

-

Page 71

...five years. Table 14 - Nonaccrual Loans and Nonperforming Assets

2011 (dollar amounts in thousands) 2010 At December 31, 2009 2008 2007

Nonaccrual loans and leases: Commercial and industrial(1) ...Commercial real estate ...Residential mortgages(1) ...Home equity ...Total nonaccrual loans and leases...

-

Page 72

... weak economic conditions and decline of residential real estate property values. The home equity portfolio will continue to be impacted by borrowers that are seeking to refinance but are in a negative equity position because of a second-lien loan. Right-sizing and debt forgiveness associated...

-

Page 73

... Leases

2011 (dollar amounts in thousands) 2010 At December 31, 2009 2008 2007

Accruing loans and leases past due 90 days or more Commercial and industrial ...Commercial real estate ...Residential mortgage (excluding loans guaranteed by the U.S. government) ...Home equity ...Other loans and leases...

-

Page 74

... past three years: Table 16 - Accruing and Nonaccruing Troubled Debt Restructured Loans

2011 (dollar amounts in thousands) December 31, 2010 2009

Troubled debt restructured loans - accruing: Residential mortgage ...Other consumer(1) ...Commercial ...Total troubled debt restructured loans - accruing...

-

Page 75

... of the loan exposures adjusted by an applicable funding expectation. A provision for credit losses is recorded to adjust the ACL to the level we have determined to be appropriate to absorb credit losses inherent in our loan and lease portfolio. The provision for credit losses in 2011 was $174...

-

Page 76

... charge-offs ...Recoveries of loan and lease charge-offs Commercial: Commercial and industrial ...Commercial real estate: Construction ...Commercial ...Total commercial real estate ...Total commercial ...Consumer: Automobile ...Home equity ...Residential mortgage ...Other consumer ...Total consumer...

-

Page 77

... for Credit Losses (1)

2011 (dollar amounts in thousands) Commercial: Commercial and industrial ...Commercial real estate ...Total commercial ...Consumer: Automobile ...Home equity ...Residential mortgage ...Other loans ...Total consumer ...Total allowance for loan and lease losses ...Allowance...

-

Page 78

... high quality new loans will contribute to continued improvement in our key credit quality metrics. However, the continued weakness in the residential real estate market and the overall economic conditions remained stressed, and additional risks emerged throughout 2011. These additional risks...

-

Page 79

...-offs

2011 (dollar amounts in thousands) Year Ended December 31, 2010 2009 2008 2007

Net charge-offs by loan and lease type Commercial: Commercial and industrial ...Commercial real estate: Construction ...Commercial ...Total commercial real estate ...Total commercial ...Consumer: Automobile ...Home...

-

Page 80

... to charge-off and, also during 2011, we executed two NPL sales in the residential mortgage portfolio with resulting charge-offs. We anticipate a return to the historical pattern of residential mortgage portfolio NCOs being lower than the home equity portfolio NCOs as exhibited in the second half...

-

Page 81

... interest rate risk are employed: income simulation and economic value analysis. An income simulation analysis is used to measure the sensitivity of forecasted ISE to changes in market rates over a one-year time period. Although bank owned life insurance, automobile operating lease assets, and...

-

Page 82

... of interest rate swaps executed in the 2011 second and third quarters, the impact of lower interest rates on mortgage asset prepayments, and low-cost deposit growth. The following table shows the income sensitivity of select portfolios to changes in market interest rates. A portfolio with 100...

-

Page 83

... in market interest rates beyond the interest rate change implied by the current yield curve. The table below outlines the December 31, 2011 results compared with December 31, 2010. All of the positions were within the board of directors' policy limits. Table 24 - Economic Value of Equity at Risk...

-

Page 84

...should be read in conjunction with Note 6 of the Notes to the Consolidated Financial Statements.) At December 31, 2011, we had $137.4 million of capitalized MSRs representing the right to service $15.9 billion in mortgage loans. Of this $137.4 million, $65.0 million was recorded using the fair value...

-

Page 85

... of Huntington's balance sheet, amount of on-hand cash and unencumbered securities and the availability of contingent sources of funding, can have an impact on Huntington's ability to satisfy current or future funding commitments. We manage liquidity risk at both the Bank and the parent company. The...

-

Page 86

... asset/liability management objectives. Changing market conditions could affect the profitability of the portfolio, as well as the level of interest rate risk exposure. Our available-for-sale and other securities portfolio is comprised of various financial instruments. At December 31, 2011...

-

Page 87

... bonds ...Corporate debt: Under 1 year ...1-5 years ...6-10 years ...Over 10 years ...Total corporate debt ...Other: Under 1 year ...1-5 years ...6-10 years ...Over 10 years ...Nonmarketable equity securities (2) ...Marketable equity securities (3) ...Total other ...Total available-for-sale and...

-

Page 88

... as checking and savings account balances, are withdrawn. Noninterest-bearing demand deposits increased $3.9 billion from the prior year, but include certain large commercial deposits that may be more short-term in nature. Demand deposit overdrafts that have been reclassified as loan balances were...

-

Page 89

... five years. Table 29 - Deposit Composition

2011 (dollar amounts in millions)

2010

At December 31, 2009

2008

2007

By Type Demand deposits - noninterest-bearing ...$11,158 Demand deposits - interest-bearing ...5,722 Money market deposits ...13,117 Savings and other domestic deposits ...4,698...

-

Page 90

...December 31, 2010. The $6.6 billion portfolio at December 31, 2011, had a weighted average maturity of 3.9 years. The Bank has access to the Federal Reserve Bank's discount window. These borrowings are secured by commercial loans and home equity lines-of-credit. The Bank is also a member of the FHLB...

-

Page 91

...our stock, and acquisitions. The parent company obtains funding to meet obligations from dividends received from direct subsidiaries, net taxes collected from subsidiaries included in the federal consolidated tax return, fees for services provided to subsidiaries, and the issuance of debt securities...

-

Page 92

... to build Bank regulatory capital above its already well-capitalized level. To help meet any additional liquidity needs, we have an open-ended, automatic shelf registration statement filed and effective with the SEC, which permits us to issue an unspecified amount of debt or equity securities. With...

-

Page 93

... support securities that were issued by our customers and remarketed by the Huntington Investment Company, our brokerdealer subsidiary. We enter into forward contracts relating to the mortgage banking business to hedge the exposures we have from commitments to extend new residential mortgage loans...

-

Page 94

... and external influences such as market conditions, fraudulent activities, disasters, and security risks. We continuously strive to strengthen our system of internal controls to ensure compliance with laws, rules, and regulations, and to improve the oversight of our operational risk. For example, we...

-

Page 95

... to Consolidated Financial Statements.) Capital is managed both at the Bank and on a consolidated basis. Capital levels are maintained based on regulatory capital requirements and the economic capital required to support credit, market, liquidity, and operational risks inherent in our business, and...

-

Page 96

... Consolidated Financial Statements.) As a result of bank capital standards arising from the Dodd-Frank Act, beginning in 2013, trust preferred securities will eventually no longer be considered Tier 1 risk-based capital. The Exchange Offer described below is intended to improve our Tier 1 risk-based...

-

Page 97

... and the impacts related to the payments of dividends and the repurchase of the TARP warrants. Although not a regulatory capital ratio, the Tier 1 common risk-based ratio has gained prominence with our regulators and investors. The Dodd-Frank Act requires that any bank with assets over $50.0 billion...

-

Page 98

... and Bank levels for the past five years: Table 37 - Selected Regulatory Capital Data

2011 (dollar amounts in millions) 2010 At December 31, 2009 2008 2007

Total risk-weighted assets ...Tier 1 risk-based capital ...Tier 2 risk-based capital ...Total risk-based capital ...Tier 1 leverage ratio...

-

Page 99

... and Commercial Banking; Automobile Finance and Commercial Real Estate; and Wealth Advisors, Government Finance, and Home Lending. A Treasury / Other function also includes our insurance business and other unallocated assets, liabilities, revenue, and expenses. While this section reviews financial...

-

Page 100

... improved retention of existing commercial accounts. The overall objective is to grow the number of relationships, along with an increase in product service distribution. The commercial relationship is defined as a business banking or commercial banking customer with a checking account relationship...

-

Page 101

... rate and liquidity risk in the Treasury / Other function where it can be centrally monitored and managed. The Treasury / Other function charges (credits) an internal cost of funds for assets held in (or pays for funding provided by) each business segment. The FTP rate is based on prevailing market...

-

Page 102

...Other function includes revenue and expense related to our insurance business, and assets, liabilities, and equity not directly assigned or allocated to one of the four business segments. Assets include investment securities and bank owned life insurance. The financial impact associated with our FTP...

-

Page 103

... ...Commercial real estate ...Total commercial ...Automobile loans and leases ...Home equity ...Residential mortgage ...Other consumer ...Total consumer ...Total loans ...Average Deposits Demand deposits - noninterest-bearing ...Demand deposits - interest-bearing ...Money market deposits ...Savings...

-

Page 104

... in CD balances and increased money market and savings balances. This strategy has improved deposit spreads by 23 basis points compared to 2010. Provision for credit losses in 2011 was lower than the prior year as loan credit quality benefitted from aggressive account management and disciplined...

-

Page 105

... due to increased sales of investment products. Partially offset by: • $21.1 million, or 10%, decrease in deposit service charge income due to the full year impact of Reg E changes relating to certain overdraft fees and Huntington's 24-Hour Grace® feature on all consumer checking accounts...

-

Page 106

... (benefit) for income taxes ...Net income (loss) ...Number of employees (full-time equivalent) ...Total average assets (in millions) ...Total average loans/leases (in millions) ...Total average deposits (in millions) ...Net interest margin ...NCOs ...NCOs as a % of average loans and leases ...Return...

-

Page 107

...managed by SAD reflecting improved credit quality in the portfolio. The increase in total average deposits from the year-ago period reflected: • $0.8 billion, or 26%, increase in average core deposits reflected a $0.4 billion increase in both average DDA and money market deposits. In 2011, a money...

-

Page 108

..., of which $9.8 million represents increased sales of customer interest rate protection products and $4.1 million represents an increase in capital markets income resulting from strategic investments made over the last year in these types of products and services. • $6.4 million, or 262%, increase...

-

Page 109

... the year-ago period reflected: • 20 basis point increase in the net interest margin. This increase primarily reflected the continuation of a risk-based pricing strategy in the CRE portfolio that began in early 2009 and has resulted in improved spreads on CRE loan renewals as well as new business...

-

Page 110

... as well as new commercial automobile dealer relationships developed in 2010 and 2011. The decrease in the provision for credit losses from the year-ago period reflected: • $183.7 million, or 57%, decrease in commercial NCOs. Expressed as a percentage of related average balances, commercial NCO...

-

Page 111

... ...Number of employees (full-time equivalent) ...Total average assets (in millions) ...Total average loans/leases (in millions) ...Total average deposits (in millions) ...Net interest margin ...NCOs ...NCOs as a % of average loans and leases ...Return on average common equity ...Mortgage banking...

-

Page 112

... of related average balance, NCOs decreased to 1.06% in 2011 from 1.65% in 2010. The overall decline in NCOs was the result of improved credit quality of the portfolio. The decrease in noninterest income from the year-ago period reflected: • $91.5 million, or 61%, decrease in mortgage banking...

-

Page 113

...tax EPS(2) (dollar amounts in millions, except per share amounts)

Three Months Ended: December 31, 2011 - GAAP income ...$126.9 • Gain on early extinguishment of debt ...9.7 • Visa®-related derivative loss ...(6.4) December 31, 2010 - GAAP income ...$122.9 • Preferred stock conversion deemed...

-

Page 114

... corporate , asset based lending, business banking, automobile floor plan lending, and equipment finance. Traditional middle-market loans continued to grow despite line utilization rates that remained well below historical norms. • $0.6 billion, or 14%, increase in average residential mortgages...

-

Page 115

... Quarter 2011 2010 (dollar amounts in thousands) Change Amount Percent

Service charges on deposit accounts ...Trust services ...Electronic banking ...Mortgage banking income ...Brokerage income ...Insurance income ...Bank owned life insurance income ...Capital markets fees ...Gain on sale of loans...

-

Page 116

... securities. • $5.5 million, or 52%, decrease in OREO and foreclosure expense. • $4.8 million, or 21%, decrease in deposit and other insurance expense. • $4.8 million, or 59%, decline in automobile operating lease expense as the portfolio continued its planned runoff as we exited that business...

-

Page 117

...of risks through our on-going portfolio management processes. The decline in commercial NALs was partially offset by an increase in consumer NALs. These increases reflected the current weak economic conditions and the continued decline of residential real estate property values. Both home equity and...

-

Page 118

...a commercial letter-of-credit associated with one relationship. On a combined basis, the ACL as a percent of total loans and leases at December 31, 2011, was 2.60%, down from 3.39% at December 31, 2010. This decline was primarily a result of the improvement in the underlying quality of the portfolio...

-

Page 119

... declared ...Common stock price, per share High(4) ...Low(4) ...Close ...Average closing price ...Return on average total assets ...Return on average common shareholders' equity ...Return on average tangible common shareholders' equity(5) ...Efficiency ratio(6) ...Effective tax rate ...Margin...

-

Page 120

...Income Statement, Capital, and Other Data-Continued(1)

Capital adequacy December 31, 2011 September 30, June 30, March 31,

Total risk-weighted assets (in millions) ...Tier 1 leverage ratio ...Tier 1 risk-based capital ratio ...Total risk-based capital ratio ...Tier 1 common risk-based capital ratio...

-

Page 121

... ...Common stock price, per share High(4) ...Low(4) ...Close ...Average closing price ...Return on average total assets ...Return on average common shareholders' equity ...Return on average tangible common shareholders' equity(5) ...Efficiency ratio(6) ...Effective tax rate (benefit) ...Margin...

-

Page 122

... would have been higher than basic earnings per common share (anti-dilutive) for the periods. (3) Deferred tax liability related to other intangible assets is calculated assuming a 35% tax rate. (4) High and low stock prices are intra-day quotes obtained from NASDAQ. (5) Net income excluding expense...

-

Page 123

...the level of capital available to withstand unexpected market conditions. Additionally, presentation of these ratios allows readers to compare the Company's capitalization to other financial services companies. These ratios differ from capital ratios defined by banking regulators principally in that...

-

Page 124

.... The most significant accounting policies and estimates and their related application are discussed below. Total Allowance for Credit Losses Our ACL of $1.0 billion at December 31, 2011, represents our estimate of probable credit losses inherent in our loan and lease portfolio and our unfunded...

-

Page 125

...-preferred securities and subordinated debt securities issued by banks, bank holding companies, and insurance companies. A full cash flow analysis is used to estimate fair values and assess impairment for each security within this portfolio. We engaged a third party specialist with direct industry...

-

Page 126

.... For our annual impairment testing conducted during 2011, we identified four reporting units with goodwill: Retail and Business Banking, Regional and Commercial Banking, Wealth Advisors, Government Finance, and Home Lending (WGH), and Insurance. Auto Finance and Commercial Real Estate was not...

-

Page 127

... sales price. The discount rate and expected return on plan assets used to determine the benefit obligation and pension expense are both assumptions. Actual results may be materially different. (See Note 18 of the Notes to the Consolidated Financial Statements). OTHER REAL ESTATE OWNED OREO property...

-

Page 128

... the applicable section of this MD&A and the Notes to Consolidated Financial Statements. Acquisitions Sky Financial The merger with Sky Financial was completed on July 1, 2007. At the time of acquisition, Sky Financial had assets of $16.8 billion, including $13.3 billion of loans, and total deposits...

-

Page 129

...Net Loan and Lease Charge-offs - Franklin-Related Impact (dollar amounts in millions)

Year Ended December 31, 2011 2010

Total home equity net charge-offs (recoveries) Franklin ...Non-Franklin ...Total ...Total home equity net charge-offs ratio Total ...Non-Franklin ...Total residential mortgage net...

-

Page 130

...of the Consolidated Financial Statements in conformity with accounting principles generally accepted in the United States. Huntington's Management assessed the effectiveness of the Company's internal control over financial reporting as of December 31, 2011. In making this assessment, Management used...

-

Page 131

... of the Public Company Accounting Oversight Board (United States), the consolidated financial statements as of and for the year ended December 31, 2011 of the Company and our report dated February 17, 2012 expressed an unqualified opinion on those financial statements.

Columbus, Ohio February 17...

-

Page 132

...PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Huntington Bancshares Incorporated Columbus, Ohio We have audited the accompanying consolidated balance sheets of Huntington Bancshares Incorporated and subsidiaries (the "Company") as of December 31, 2011 and 2010, and the related...

-

Page 133

... and industrial loans and leases ...Commercial real estate loans ...Automobile loans and leases ...Home equity loans ...Residential mortgage loans ...Other consumer loans ...Loans and leases ...Allowance for loan and lease losses ...Net loans and leases ...Bank owned life insurance ...Premises and...

-

Page 134

... credit losses ...Service charges on deposit accounts ...Trust services income ...Electronic banking income ...Mortgage banking income ...Brokerage income ...Insurance income ...Bank owned life insurance income ...Capital markets income ...Gain (loss) on sales of loans ...Automobile operating lease...

-

Page 135

Huntington Bancshares Incorporated Consolidated Statements of Changes in Shareholders' Equity

Preferred Stock Series B Accumulated Other Retained Series A Floating Rate Common Stock Capital Treasury Stock Comprehensive Earnings Shares Amount Shares Amount Shares Amount Surplus Shares Amount Loss (...

-

Page 136

Huntington Bancshares Incorporated Consolidated Statements of Changes in Shareholders' Equity

Preferred Stock Series B Accumulated Other Retained Fixed Rate Series A Common Stock Capital Treasury Stock Comprehensive Earnings Shares Amount Shares Amount Shares Amount Surplus Shares Amount Loss (...

-

Page 137

Huntington Bancshares Incorporated Consolidated Statements of Changes in Shareholders' Equity

Preferred Stock Series B Accumulated Other Retained Fixed Rate Series A Common Stock Capital Treasury Stock Comprehensive Earnings Shares Amount Shares Amount Shares Amount Surplus Shares Amount Loss (...

-

Page 138

... sales ...Proceeds from sale of operating lease assets ...Purchases of premises and equipment ...Proceeds from sales of other real estate ...Other, net ...Net cash provided by (used for) investing activities ...Financing activities Increase (decrease) in deposits ...Increase (decrease) in short-term...

-

Page 139

..., mortgage banking services, automobile financing, equipment leasing, investment management, trust services, brokerage services, customized insurance programs, and other financial products and services. Huntington's banking offices are located in Ohio, Michigan, Pennsylvania, Indiana, West Virginia...

-

Page 140

...Federal Home Loan Bank stock and Federal Reserve Bank stock. These securities are accounted for at cost, evaluated for impairment, and included in available-for-sale and other securities. Loans and Leases - Loans and direct financing leases for which Huntington has the intent and ability to hold for...

-

Page 141

... for U.S. dollar interest rate swaps and are consistent with pricing of capital markets instruments. The current and projected mortgage interest rate influences the prepayment rate and, therefore, the timing and magnitude of the cash flows associated with the MSR. Expected mortgage loan prepayment...

-

Page 142

...'s bank owned life insurance policies are carried at their cash surrender value. Huntington recognizes tax-exempt income from the periodic increases in the cash surrender value of these policies and from death benefits. A portion of cash surrender value is supported by holdings in separate accounts...

-

Page 143

...its mortgage loans held for sale. Mortgage loan sale commitments and the related interest rate lock commitments are carried at fair value on the Consolidated Balance Sheets with changes in fair value reflected in mortgage banking revenue. Huntington also uses certain derivative financial instruments...

-

Page 144

... - Huntington uses the fair value recognition concept relating to its share-based compensation plans. Compensation expense is recognized based on the fair value of unvested stock options and awards over the requisite service period. Segment Results - Accounting policies for the business segments...

-

Page 145

... periods within those years, beginning after December 15, 2011. The amendments should be applied retrospectively. Early adoption is permitted. Management does not believe the amendment will have a material impact on Huntington's Consolidated Financial Statements. ASU 2011-08 - Intangibles - Goodwill...

-

Page 146

... is able to redeliberate the matter. Management does not believe the deferral will have a material impact on Huntington's Consolidated Financial Statements. 3. LOANS AND LEASES AND ALLOWANCE FOR CREDIT LOSSES

Loans and direct financing leases for which Huntington has the intent and ability to hold...

-

Page 147

...31, 2011, and 2010.

Commercial Commercial and Industrial Real Estate Automobile (dollar amounts in thousands) Home Residential Other Equity Mortgage Consumer Total

Portfolio loans purchased during the: Year ended December 31, 2011 59,578(1) $ -$ - Year ended December 31, 2010 Portfolio loans sold...

-

Page 148

... current financial statements, industry, management capabilities, and other qualitative measures. For all classes within the consumer loan portfolio, the determination of a borrower's ability to make the required principal and interest payments is based on multiple factors, including number of days...

-

Page 149

... real estate: Retail properties ...Multi family ...Office ...Industrial and warehouse ...Other commercial real estate ...Total commercial real estate ...Automobile ...Home equity: Secured by first-lien ...Secured by second-lien ...Residential mortgage ...Other consumer ...Total nonaccrual loans...

-

Page 150

...ACL is based on Management's current judgments about the credit quality of the loan portfolio. These judgments consider on-going evaluations of the loan and lease portfolio, including such factors as the differing economic risks associated with each loan category, the financial condition of specific...

-

Page 151

... analysis of the type of collateral and the relative LTV ratio. These reserve factors are developed based on credit migration models that track historical movements of loans between loan ratings over time and a combination of long-term average loss experience of our own portfolio and external...

-

Page 152

... 2009:

2011 (dollar amounts in thousands) Year Ended December 31, 2010 2009

ALLL, beginning of year ...Loan charge-offs ...Recoveries of loans previously charged-off ...Provision for loan and lease losses ...Allowance for loans sold or transferred to loans held for sale ...ALLL, end of year ...AULC...

-

Page 153

... to loans held for sale ...ALLL balance, end of period ...AULC balance, beginning of period ...Provision for unfunded loan commitments and letters-ofcredit ...AULC balance, end of period . . ACL balance, end of period ...Commercial Real Estate Home Equity Residential Mortgage Other Consumer...

-

Page 154

...update quarterly. A FICO credit bureau score is a credit score developed by Fair Isaac Corporation based on data provided by the credit bureaus. The FICO credit bureau score is widely accepted as the standard measure of consumer credit risk used by lenders, regulators, rating agencies, and consumers...

-

Page 155

... 2011 Credit Risk Profile by UCS classification OLEM Substandard Doubtful

Pass (dollar amounts in thousands)

Total

Commercial and industrial: Owner occupied ...Other commercial and industrial ...Total commercial and industrial ...Commercial real estate: Retail properties ...Multi family ...Office...

-

Page 156

... deferred fees and costs, loans in process, loans to legal entities, etc. (3) Includes $1,250,000 thousand of loans reflected as loans held for sale related to a planned automobile securitization. Impaired Loans For all classes within the C&I and CRE portfolios, all loans with an outstanding balance...

-

Page 157

... ALLL attributable to loans by portfolio segment individually and collectively evaluated for impairment and the related loan and lease balance for the years ended December 31, 2011 and 2010(1):

Commercial Commercial and Real Estate Automobile Industrial ALLL at December 31, 2011: (dollar amounts in...

-

Page 158

... Balance(5) Allowance (dollar amounts in thousands) Year Ended December 31, 2011 Interest Average Income Balance Recognized

With no related allowance recorded: Commercial and industrial: Owner occupied ...Other commercial and industrial ...Total commercial and industrial ...Commercial real estate...

-

Page 159

... Commercial real estate: Retail properties ...$ 31,972 Multi family ...5,058 Office ...2,270 Industrial and warehouse ...3,305 Other commercial real estate ...26,807 Total commercial real estate ...Automobile loans and leases ...Home equity loans and lines-of-credit: Secured by first-lien ...Secured...

-

Page 160

...the different loan types: Commercial loan TDRs - Commercial accruing TDRs often result from loans receiving a concession with terms that are not considered a market transaction to Huntington. The TDR remains in accruing status as long as the customer is less than 90 days past due on payments per the...

-

Page 161

... with home equity borrowings and automobile loans. The Company may make similar interest rate, term, and principal concessions as with residential mortgage loan TDRs. TDR Impact on Credit Quality Huntington's ALLL is largely driven by updated risk ratings assigned to commercial loans, updated...

-

Page 162

...off. Residential mortgage loans not guaranteed by a U.S. government agency such as the FHA, VA, and the USDA, including TDR loans, are reported as accrual or nonaccrual based upon delinquency status. Nonaccrual TDRs are those that are greater than 150-days contractually past due. Loans guaranteed by...

-

Page 163

... for the year ended December 31, 2011:

New Troubled Debt Restructurings During The Year Ended December 31, 2011 Post-modification Net change in Number of Outstanding ALLL resulting Contracts Balance(1) from modification (dollar amounts in thousands)

C&I - Owner occupied: Interest rate reduction...

-

Page 164

... 31, 2011 Post-modification Net change in Number of Outstanding ALLL resulting Contracts Balance(1) from modification (dollar amounts in thousands)

Residential mortgage: Interest rate reduction ...Amortization or maturity date change ...Other ...Total Residential mortgage ...First-lien home equity...

-

Page 165

... commercial real estate ...Automobile: Interest rate reduction ...Amortization or maturity date change ...Other ...Total Automobile ...Residential mortgage: Interest rate reduction ...Amortization or maturity date change ...Other ...Total Residential mortgage ...First-lien home equity: Interest rate...

-

Page 166

... in return for a reduction of a portion of defaulted commercial loans as a result of a default under the Legacy Credit Agreement. As of December 31, 2011, Franklin does not own any equity interests in REIT. 4. AVAILABLE-FOR-SALE AND OTHER SECURITIES Contractual maturities of available-for-sale and...

-

Page 167

....7 million, of Federal Reserve Bank stock, respectively. Other securities also include corporate debt and marketable equity securities. Nonmarketable equity securities are valued at amortized cost. At December 31, 2011 and 2010, Huntington did not have any material equity positions in FNMA or FHLMC...

-

Page 168

...public and trust deposits, trading account liabilities, U.S. Treasury demand notes, and security repurchase agreements totaled $3.6 billion. There were no securities of a single issuer, which are not governmental or government-sponsored, that exceeded 10% of shareholders' equity at December 31, 2011...

-

Page 169

... of our risk-weighted assets, and a reduction to our regulatory capital ratios. The following table summarizes the relevant characteristics of our pooled-trust-preferred securities portfolio at December 31, 2011. Each security is part of a pool of issuers and supports a more senior tranche of...

-

Page 170

...OTTI. Huntington assesses whether OTTI has occurred when the fair value of a debt security is less than the amortized cost basis at period-end. Management reviews the amount of unrealized loss, the length of time the security has been in an unrealized loss position, the credit rating history, market...

-

Page 171

...-preferred securities and subordinated debt securities issued by banks, bank holding companies, and insurance companies. A full cash flow analysis is used to estimate fair values and assess impairment for each security within this portfolio. A third party specialist with direct industry experience...

-

Page 172

...Alt-A Mortgage-backed (dollar amounts in thousands)

Year Ended ...debt securities held by Huntington for the years ended December 31, 2011 and 2010 as follows:

Year Ended December 31, 2011 2010 (dollar amounts in thousands)

Balance, beginning of year ...Reductions from sales of securities with credit...

-

Page 173

... OTTI recognized in earnings on debt securities held by Huntington for the years ended December 31, 2011 and 2010 as follows.

Year Ended December 31, 2011 2010 (dollar amounts in thousands)

Balance, beginning of year ...Reductions from sales ...Credit losses not previously recognized ...Additional...

-

Page 174

...2011, Management has evaluated all held-to-maturity securities and concluded no impairment existed in the portfolio. 6. LOAN SALES AND SECURITIZATIONS

Residential Mortgage Loans The following table summarizes activity relating to residential mortgage loans sold with servicing retained for the years...

-

Page 175

... with loans that paid off during the period. (3) Represents change in value resulting primarily from market-driven changes in interest rates and prepayment spreads.

Amortization Method (dollar amounts in thousands) 2011 2010

Carrying value, beginning of year ...New servicing assets created...

-

Page 176

... loan portfolio to loans held for sale during the 2011 fourth quarter. At December 31, 2011, and through the date of this filing, the Company has not yet identified the specific loans that would be securitized or finalized terms of the securitization. Automobile loan servicing rights are accounted...

-

Page 177

... Advisors, Government Finance, and Home Lending, (WGH), (4) certain capital market businesses moved from the former PFG operating segment to the Commercial Banking operating segment, and (5) the insurance business area moved from WGH to Treasury / Other. Goodwill was assigned to the new reporting...

-

Page 178

At December 31, 2011 and 2010, Huntington's other intangible assets consisted of the following:

Gross Carrying Amount (dollar amounts in thousands) Accumulated Amortization Net Carrying Value

December 31, 2011 Core deposit intangible ...Customer relationship ...Other ...Total other intangible ...

-

Page 179

...0.21% 1.47

Huntington's long-term advances from the Federal Home Loan Bank had weighted average interest rates of 0.19% and 0.56% at December 31, 2011 and 2010, respectively. These advances, which predominantly had variable interest rates, were collateralized by qualifying real estate loans. As of...

-

Page 180

... any consolidated affiliates. The transfer did not meet the sale requirement of ASC 860 and therefore has been reflected as a secured financing on the Consolidated Balance Sheet of Huntington. Other long-term debt maturities for the next five years and thereafter are as follows:

Other long-term debt...

-

Page 181

... assets to hedge the interest rate values of certain fixed-rate debt by converting the debt to a variable rate. See Note 20 for more information regarding such financial instruments. All principal is due upon maturity of the note as described in the table above. During 2011, Huntington retired...

-

Page 182

...-for-sale debt securities ...Net change in unrealized holding gains (losses) on available-for-sale equity securities ...Net unrealized gains and losses on derivatives used in cash flow hedging relationships arising during the period ...Change in pension and post-retirement benefit plan assets and...

-

Page 183

...-for-sale debt securities ...Net change in unrealized holding (losses) gains on available-for-sale equity securities ...Net unrealized gains and losses on derivatives used in cash flow hedging relationships arising during the period ...Change in pension and post-retirement benefit plan assets and...

-

Page 184

...of debt, a reduction of noninterest expense in the Consolidated Financial Statements. Repurchase of Outstanding TARP Capital and Warrant to Repurchase Common Stock In 2008, Huntington received $1.4 billion of equity capital by issuing to the Treasury 1.4 million shares of TARP Capital and a ten-year...

-

Page 185

... incentive share based compensation plans. These plans provide for the granting of stock options and other awards to officers, directors, and other employees. Compensation costs are included in personnel costs on the Consolidated Statements of Income. Stock options are granted at the closing market...

-

Page 186

... adjusted share-based compensation expense to account for the higher forfeiture rate. Huntington's stock option activity and related information for the year ended December 31, 2011, was as follows:

WeightedWeightedAverage Average Remaining Aggregate Exercise Contractual Intrinsic Price Life (Years...

-

Page 187

... and Restated 2007 Stock and Long-Term Incentive Plan to certain executives as a portion of their annual base salary. These awards are 100% vested as of the grant date and are not subject to any requirement of future service. However, the shares are subject to restrictions regarding sale, transfer...

-

Page 188

...impact on our consolidated financial position. In the 2011 third quarter, the IRS began its examination of our 2008 and 2009 consolidated federal income tax returns. Various state and other jurisdictions remain open to examination for tax years 2005 and forward. Huntington accounts for uncertainties...

-

Page 189

... income ...Tax-exempt bank owned life insurance income ...Dividends ...Asset securitization activities ...Federal tax loss carryforward /carryback ...General business credits ...Reversals of valuation allowance ...Capital loss ...Loan acquisitions ...Goodwill impairment ...State income taxes, net...

-

Page 190

...Total deferred tax assets ...Deferred tax liabilities: Lease financing ...Purchase accounting adjustments ...Loan origination costs ...Mortgage servicing rights ...Securities adjustments ...Operating assets ...Pension and other employee benefits ...Partnership investments ...Other ...Total deferred...

-

Page 191

... and life insurance benefits to retired employees who have attained the age of 55 and have at least 10 years of vesting service under this plan. For any employee retiring on or after January 1, 1993, post-retirement healthcare benefits are based upon the employee's number of months of service and...

-

Page 192

... consolidated balance sheets at December 31:

Pension Benefits 2011 2010 (dollar amounts in thousands) Post-Retirement Benefits 2011 2010

Projected benefit obligation at beginning of measurement year ...Changes due to: Service cost ...Interest cost ...Benefits paid ...Settlements ...Effect of plan...

-

Page 193

...2010, The Huntington National Bank, as trustee, held all Plan assets. The Plan assets consisted of investments in a variety of Huntington mutual funds and Huntington common stock as follows:

Fair Value 2011 (dollar amounts in thousands) 2010

Cash ...Cash equivalents: Huntington funds - money market...

-

Page 194

...with market conditions, Management has targeted a long-term allocation of Plan assets of 70% in equity investments and 30% in bond investments. The following table shows the number of shares and dividends received on shares of Huntington stock held by the Plan:

December 31, 2011 2010 (dollar amounts...

-

Page 195

...the Supplemental Retirement Income Plan. These plans are nonqualified plans that provide certain current and former officers and directors of Huntington and its subsidiaries with defined pension benefits in excess of limits imposed by federal tax law. At December 31, 2011 and 2010, Huntington has an...

-

Page 196

... the number of shares, market value, and dividends received on shares of Huntington stock held by the defined contribution plan as of December 31:

December 31, 2011 2010 (dollar amounts in millions, except share amounts)

Shares in Huntington common stock ...Market value of Huntington common stock...

-

Page 197

... in markets that are not active, and inputs that are observable for the asset, either directly or indirectly, for substantially the full term of the financial instrument. 95% of the positions in these portfolios are Level 2, and consist of U.S. Government and agency debt securities, agency mortgage...

-

Page 198

... underlying loans in the portfolio and a market assumption of interest rate spreads. Certain interest rates are available from similarly traded securities while other interest rates are developed internally based on similar asset-backed security transactions in the market. MSRs MSRs do not trade in...

-

Page 199

....

Fair Value Measurements at Reporting Date Using Level 1 Level 2 Level 3 (dollar amounts in thousands) Netting Adjustments (1) Balance at December 31, 2011

Assets Mortgage loans held for sale ...Trading account securities: U.S. Treasury securities ...Federal agencies: Mortgagebacked ...Federal...

-

Page 200

... that allow the Company to settle positive and negative positions and cash collateral held or placed with the same counterparties. (2) During 2011, Huntington transferred $469.1 million of federal agencies: mortgage-backed securities from the available-for-sale securities portfolio to the held...

-

Page 201

... 3 Fair Value Measurements Year ended December 31, 2011 Available-for-sale securities AssetMunicipal Privatebacked securities label CMO securities

MSRs (dollar amounts in thousands)

Derivative instruments

Automobile loans

Equity investments

Balance, beginning of year ...Total gains / losses...

-

Page 202

...thousands)

Derivative instruments

Level 3 Fair Value Measurements Year ended December 31, 2010 Available-for-sale securities AssetMunicipal Private backed securities label CMO securities

Automobile loans

Equity investments

Balance, beginning of year ...Total gains / losses: Included in earnings...

-

Page 203

... Measurements Year ended December 31, 2011 Available-for-sale securities AssetMunicipal Private backed securities label CMO securities

MSRs (dollar amounts in thousands)

Derivative instruments

Automobile loans

Equity investments

Classification of gains and losses in earnings: Mortgage banking...

-

Page 204

...Measurements Year ended December 31, 2010 Available-for-sale securities AssetMunicipal Private backed securities label CMO securities

Automobile loans

Equity investments

Classification of gains and losses in earnings: Mortgage banking income (loss) ...Securities gains (losses) ...Interest and fee...

-

Page 205

...were recorded within the provision for credit losses. Other real estate owned properties are valued based on appraisals and third party price opinions, less estimated selling costs. During the year ended December 31, 2011, Huntington recorded $38.4 million of OREO assets at fair value and recognized...

-

Page 206

...Trading account securities ...Loans held for sale ...Available-for-sale and other securities ...Held-to-maturity securities ...Net loans and direct financing leases ...Derivatives ...Financial Liabilities: Deposits ...Short-term borrowings ...Federal Home Loan Bank advances ...Other long term debt...

-

Page 207

...fair values of fixed-rate time deposits are estimated by discounting cash flows using interest rates currently being offered on certificates with similar maturities. Debt Fixed-rate, long-term debt is based upon quoted market prices, which are inclusive of Huntington's credit risk. In the absence of...

-

Page 208

...table presents additional information about the interest rate swaps and caps used in Huntington's asset and liability management activities at December 31, 2011:

Notional Value (dollar amounts in thousands) Average Maturity (years) Fair Value Weighted-Average Rate Receive Pay

Asset conversion swaps...

-

Page 209

...other-long-term debt in the Consolidated Statements of Income. Any resulting ineffective portion of the hedging relationship is recognized in noninterest income in the Consolidated Statements of Income. For cash flow hedges, interest rate swap contracts were entered into that pay fixed-rate interest...

-

Page 210

... relationships Interest rate contracts Loans ...FHLB Deposits ...Derivatives used in trading activities

$98 -

$947 -

$16,638 (792)

Various derivative financial instruments are offered to enable customers to meet their financing and investing objectives and for their risk management purposes...

-

Page 211

... notional values of derivative financial instruments used by Huntington on behalf of customers, including offsetting derivatives, were $10.6 billion and $9.8 billion at December 31, 2011 and 2010, respectively. Huntington's credit risks from interest rate swaps used for trading purposes were $309...

-

Page 212

... to repay the securitized notes. Huntington services the loans and leases and uses the proceeds from principal and interest payments to pay the securitized notes during the amortization period. Huntington has not provided financial or other support that was not previously contractually required...

-

Page 213

... any additional financial support to the trust. Investors and creditors only have recourse to the assets held by the trust. The interest Huntington holds in the VIE relates to servicing rights which are included within accrued income and other assets of Huntington's Consolidated Balance Sheets. The...

-

Page 214

... within Huntington's Consolidated Financial Statements. A list of trust-preferred securities outstanding at December 31, 2011 follows:

Principal amount of subordinated note/ debenture issued to trust(1) Investment in unconsolidated subsidiary

(dollar amounts in thousands)

Rate

Huntington Capital...

-

Page 215

... the identification, development, and operation of multi family housing that is leased to qualifying residential tenants. Generally, these types of investments are funded through a combination of debt and equity. Huntington is a limited partner in each Low Income Housing Tax Credit Partnership...

-

Page 216

...of-credit issued by the Bank that support securities that were issued by customers and remarketed by The Huntington Investment Company, the Company's broker-dealer subsidiary. Huntington uses an internal loan grading system to assess an estimate of loss on its loan and lease portfolio. The same loan...

-

Page 217

... currently available, advice of counsel, and available insurance coverage, Management believes that the amount it has already accrued is adequate and any incremental liability arising from the Company's legal proceedings will not have a material effect on the Company's consolidated financial...

-

Page 218

... consolidation of the two bankruptcy estates. The Bank has appealed this ruling and the appeal is pending. On January 17, 2012, the Company was named a defendant in a putative class action filed on behalf of all 88 counties in Ohio against MERSCORP, Inc. and numerous other financial institutions...

-

Page 219

... to meet minimum capital requirements can initiate certain actions by regulators that, if undertaken, could have a material adverse effect on Huntington's and the Bank's financial statements. Applicable capital adequacy guidelines require minimum ratios of 4.00% for Tier 1 risk-based Capital, 8.00...

-

Page 220

... offices or on deposit at the Federal Reserve Bank. During 2011 and 2010, the average balances of these deposits were $0.8 billion and $0.8 billion, respectively. Under current Federal Reserve regulations, the Bank is limited as to the amount and type of loans it may make to the parent company...

-

Page 221

Statements of Income (dollar amounts in thousands)

2011

Year Ended December 31, 2010 2009

Income Dividends from Non-bank subsidiaries ...Interest from ...The Huntington National Bank ...Non-bank subsidiaries ...Other ...Total income ...Expense Personnel costs ...Interest on borrowings ...Other ...

-

Page 222

... the execution of strategic plans. We have four major business segments: Retail and Business Banking, Regional and Commercial Banking, Automobile Finance and Commercial Real Estate, and Wealth Advisors, Government Finance, and Home Lending. A Treasury / Other function includes our insurance business...

-

Page 223

... of deposit, consumer loans, and small business loans and leases. Other financial services available to consumer and small business customers include investments, insurance services, interest rate risk protection products, foreign exchange hedging, and treasury management services. Huntington serves...

-

Page 224

... real estate industry. Most of our customers are located within our footprint. Wealth Advisors, Government Finance, and Home Lending: This segment consists of our wealth management, government banking, and home lending businesses. In wealth management, Huntington provides financial services to high...

-

Page 225

... services. Our retirement plan services business offers fully bundled and third party distribution of a variety of qualified and non-qualified plan solutions. Listed below is certain operating basis financial information reconciled to Huntington's 2011, 2010, and 2009 reported results by business...

-

Page 226

... (UNAUDITED) The following is a summary of the unaudited quarterly results of operations, for the years ended December 31, 2011 and 2010:

2011 Fourth (dollar amounts in thousands, except per share data) Third Second First