Honeywell 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

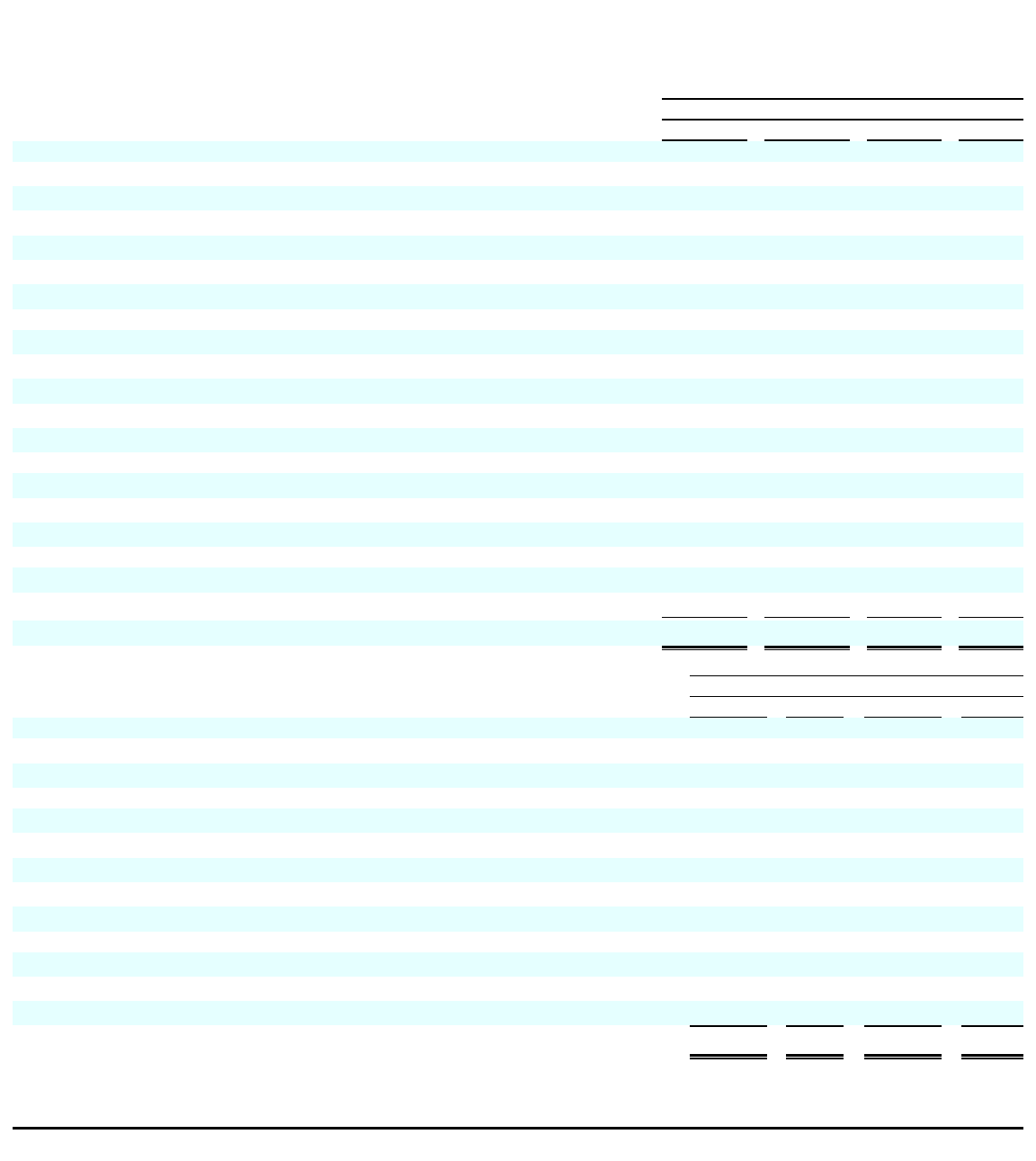

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS

—(Continued)

(Dollars in millions, except per share amounts)

73

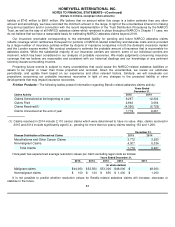

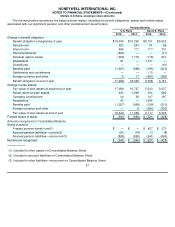

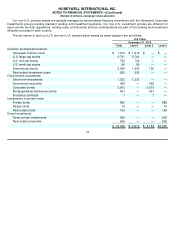

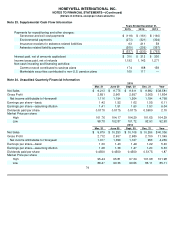

U.S. Plans

December 31, 2014

Total

Level 1

Level 2

Level 3

Common stock/preferred stock:

Honeywell common stock

$

1,851

$

1,851

$

—

$

—

U.S. large cap stocks

3,913

3,867

46

—

U.S. mid cap stocks

1,028

1,018

10

—

U.S. small cap stocks

219

219

—

—

International stocks

2,576

2,400

176

—

Real estate investment trusts

204

204

—

—

Fixed income investments:

Short term investments

1,078

1,078

—

—

Government securities

438

—

438

—

Corporate bonds

2,988

—

2,988

—

Mortgage/Asset-backed securities

635

—

635

—

Insurance contracts

7

—

7

—

Investments in private funds:

Private funds

999

—

—

999

Hedge funds

3

—

—

3

Real estate funds

226

—

—

226

Direct investments:

Direct private investments

301

—

—

301

Real estate properties

600

—

—

600

$

17,066

$

10,637

$

4,300

$

2,129

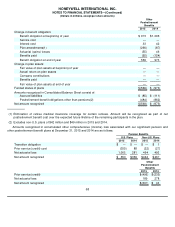

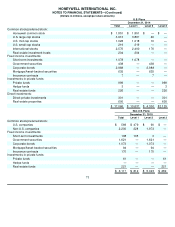

Non

-

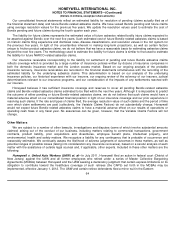

U.S. Plans

December 31, 2015

Total

Level 1

Level 2

Level 3

Common stock/preferred stock:

U.S. companies

$

569

$

479

$

90

$

—

Non

-U.S. companies

2,200

228

1,972

—

Fixed income investments:

Short-term investments

108

105

3

—

Government securities

1,621

—

1,621

—

Corporate bonds

1,073

—

1,073

—

Mortgage/Asset-backed securities

94

—

94

—

Insurance contracts

170

—

170

—

Investments in private funds:

Private funds

61

—

—

61

Hedge funds

—

—

—

—

Real estate funds

221

—

—

221

$

6,117

$

812

$

5,023

$

282