Honeywell 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS

—(Continued)

(Dollars in millions, except per share amounts)

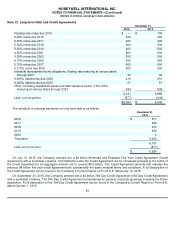

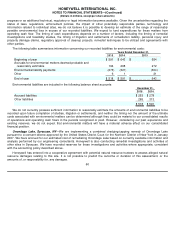

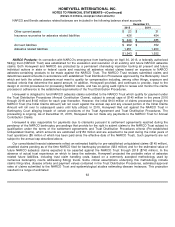

and related current maturities utilizing transactions in the listed markets for identical or similar liabilities. As such, the fair

value of the long-term debt and related current maturities is considered level 2 as well.

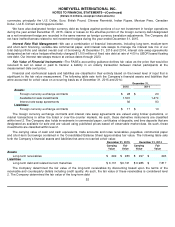

Interest rate swap agreements are designated as hedge relationships with gains or losses on the derivative recognized

in Interest and other financial charges offsetting the gains and losses on the underlying debt being hedged. Losses on

interest rate swap agreements recognized in earnings were $2 million in the year ended December 31, 2015. Gains on

interest rate swap agreements recognized in earnings were $38 million in the year ended 2014. Gains and losses are fully

offset by losses and gains on the underlying debt being hedged.

We also economically hedge our exposure to changes in foreign exchange rates principally with forward contracts.

These contracts are marked-to-market with the resulting gains and losses recognized in earnings offsetting the gains and

losses on the non-functional currency denominated monetary assets and liabilities being hedged. We recognized $86 million

and $181 million of expense, in other (income) expense for the years ended December 31, 2015 and 2014. See Note 4

Other (Income) Expense for further details of the net impact of these economic foreign currency hedges.

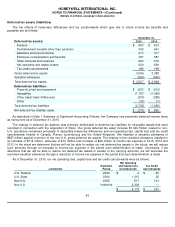

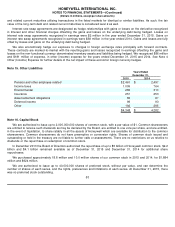

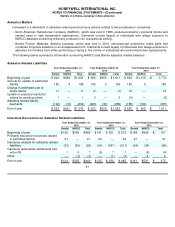

Note 15. Other Liabilities

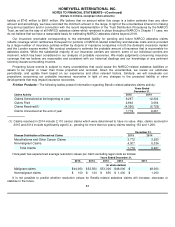

Note 16. Capital Stock

We are authorized to issue up to 2,000,000,000 shares of common stock, with a par value of $1. Common shareowners

are entitled to receive such dividends as may be declared by the Board, are entitled to one vote per share, and are entitled,

in the event of liquidation, to share ratably in all the assets of Honeywell which are available for distribution to the common

shareowners. Common shareowners do not have preemptive or conversion rights. Shares of common stock issued and

outstanding or held in the treasury are not liable to further calls or assessments. There are no restrictions on us relative to

dividends or the repurchase or redemption of common stock.

In December 2013 the Board of Directors authorized the repurchase of up to $5 billion of Honeywell common stock, $2.2

billion and $4.1 billion remained available as of December 31, 2015 and December 31, 2014 for additional share

repurchases.

We purchased approximately 18.8 million and 10.0 million shares of our common stock in 2015 and 2014, for $1,884

million and $924 million.

We are authorized to issue up to 40,000,000 shares of preferred stock, without par value, and can determine the

number of shares of each series, and the rights, preferences and limitations of each series. At December 31, 2015, there

was no preferred stock outstanding.

53

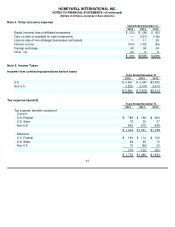

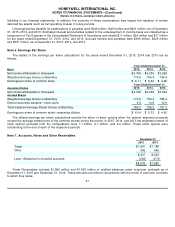

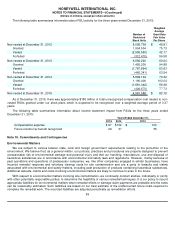

Years Ended

December 31,

2015

2014

Pension and other employee related

$

2,461

$

2,497

Income taxes

1,009

764

Environmental

265

313

Insurance

257

253

Asset retirement obligations

65

67

Deferred income

99

93

Other

192

295

$

4,348

$

4,282