Honeywell 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS

—(Continued)

(Dollars in millions, except per share amounts)

currencies, principally the U.S. Dollar, Euro, British Pound, Chinese Renminbi, Indian Rupee, Mexican Peso, Canadian

Dollar, U.A.E. Dirham and Singapore Dollar.

We have also designated foreign currency debt as hedges against portions of our net investment in foreign operations

during the year ended December 31, 2015. Gains or losses on the effective portion of the foreign currency debt designated

as a net investment hedge are recorded in the same manner as foreign currency translation adjustments. The Company did

not have ineffectiveness related to net investment hedges during the year ended December 31, 2015.

Interest Rate Risk Management—We use a combination of financial instruments, including long-term, medium-term

and short-term financing, variable-rate commercial paper, and interest rate swaps to manage the interest rate mix of our

total debt portfolio and related overall cost of borrowing. At December 31, 2015 and 2014, interest rate swap agreements

designated as fair value hedges effectively changed $1,100 million of fixed rate debt at rate of 4.00 to LIBOR based floating

rate debt. Our interest rate swaps mature at various dates through 2023.

Fair Value of Financial Instruments—The FASB

’

s accounting guidance defines fair value as the price that would be

received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the

measurement date (exit price).

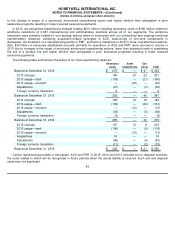

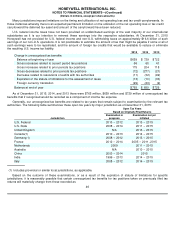

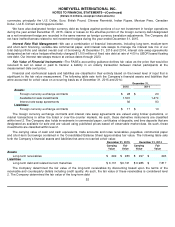

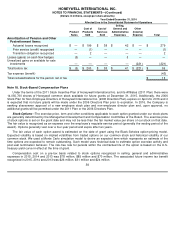

Financial and nonfinancial assets and liabilities are classified in their entirety based on the lowest level of input that is

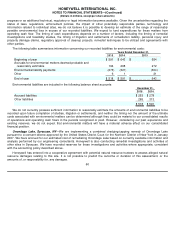

significant to the fair value measurement. The following table sets forth the Company

’

s financial assets and liabilities that

were accounted for at fair value on a recurring basis as of December 31, 2015 and 2014:

The foreign currency exchange contracts and interest rate swap agreements are valued using broker quotations, or

market transactions in either the listed or over-the-counter markets. As such, these derivative instruments are classified

within level 2. The Company also holds investments in commercial paper, certificates of deposits, and time deposits that are

designated as available for sale and are valued using published prices based off observable market data. As such, these

investments are classified within level 2.

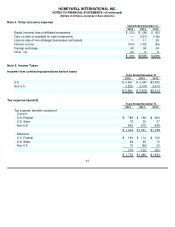

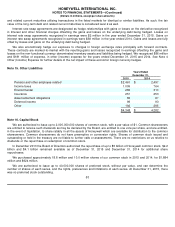

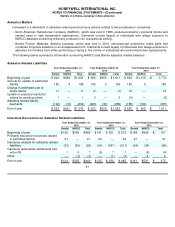

The carrying value of cash and cash equivalents, trade accounts and notes receivables, payables, commercial paper

and short-term borrowings contained in the Consolidated Balance Sheet approximates fair value. The following table sets

forth the Company

’

s financial assets and liabilities that were not carried at fair value:

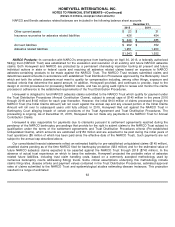

The Company determined the fair value of the long-term receivables by discounting based upon the terms of the

receivable and counterparty details including credit quality. As such, the fair value of these receivables is considered level

2. The Company determined the fair value of the long-term debt

52

December 31,

2015

2014

Assets:

Foreign currency exchange contracts

$

28

$

20

Available for sale investments

1,501

1,479

Interest rate swap agreements

92

93

Liabilities:

Foreign currency exchange contracts

$

17

$

10

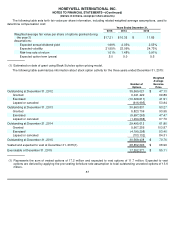

December 31, 2015

December 31, 2014

Carrying

Value

Fair

Value

Carrying

Value

Fair

Value

Assets

Long-term receivables

$

292

$

283

$

297

$

293

Liabilities

Long-term debt and related current maturities

$

6,131

$

6,721

$

6,985

$

7,817