Honeywell 2015 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2015 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7.

Management

’

s Discussion and Analysis of Financial Condition and Results of Operations

(Dollars in millions, except per share amounts)

The following Management

’

s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is

intended to help the reader understand the results of operations and financial condition of Honeywell International Inc. and

its consolidated subsidiaries (Honeywell or the Company) for the three years ended December 31, 2015. All references to

Notes relate to Notes to Financial Statements in Item 8. Financial Statements and Supplementary Data.

EXECUTIVE SUMMARY

In 2015, Honeywell successfully navigated a challenging macro-economic climate by combining strategic growth in our

diverse portfolio and our well-known cost discipline with a marked acceleration of our capital deployment strategy. Earnings

per share of common stock–assuming dilution, grew 13% to $6.04 per share in 2015 and net income attributable to

Honeywell grew 12% to $4,768 million. Our balanced long-term focus on enhancing shareowner value resulted in segment

margin expansion of 220 basis points versus 2014 without sacrificing seed planting intended to ensure future growth,

including maintaining R&D spending at 5% of sales, new product introductions aligned with global macroeconomic trends in

energy, safety and security and productivity, $216 million of repositioning investments to improve our operations and

increased investment in High Growth Regions. Honeywell Operating System (HOS) Gold and Honeywell User Experience

(HUE) initiatives intensified throughout the company, driving productivity through sustainable improvements to our factories,

footprints and supply chain.

In 2015 we deployed capital of over $10 billion, including the following:

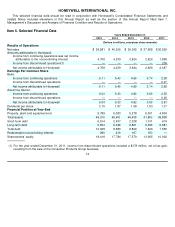

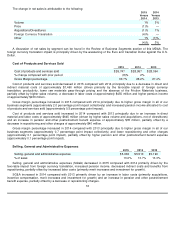

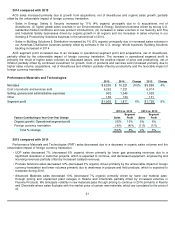

CONSOLIDATED RESULTS OF OPERATIONS

Net Sales

15

•

Mergers and Acquisitions—we deployed over $5 billion during 2015, acquiring businesses that will be integrated into

each of our three operating segments. These acquisitions all share a technology focus and increase our existing

deep alignment with enduring macro trends such as energy efficiency, clean energy generation, safety and security,

urbanization and customer productivity.

•

Dividend—after a 15% dividend rate increase in 2014, we again increased our annual dividend rate by 15% in 2015,

as we seek to grow the dividend faster than earnings.

•

Share Repurchases—we continue to opportunistically repurchase our shares with the goal of generally keeping

share count flat and seeking to offset the dilutive impact of employee stock based compensation plans. In 2015, we

repurchased 18.8 million shares for $1.9 billion.

•

Capital Investment in Facilities—we invested over $1 billion in high return capital expenditures, focused on revenue

growth projects such as our Solstice low global-warming potential refrigerant products for the automotive industry and

catalyst products in UOP.

2015

2014

2013

Net sales

$

38,581

$

40,306

$

39,055

% change compared with prior period

(4

)%

3

%