Honeywell 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

based on a 10% weakening of the U.S. Dollar versus local currency exchange rates across all maturities at December 31,

2015 and 2014.

See Note 14 Financial Instruments and Fair Value Measures of Notes to Financial Statements for further discussion on

the agreements.

CRITICAL ACCOUNTING POLICIES

The preparation of our consolidated financial statements in accordance with generally accepted accounting principles is

based on the selection and application of accounting policies that require us to make significant estimates and assumptions

about the effects of matters that are inherently uncertain. We consider the accounting policies discussed below to be critical

to the understanding of our financial statements. Actual results could differ from our estimates and assumptions, and any

such differences could be material to our consolidated financial statements.

Contingent Liabilities—We are subject to a number of lawsuits, investigations and claims (some of which involve

substantial dollar amounts) that arise out of the conduct of our global business operations or those of previously owned

entities, including matters relating to commercial transactions, government contracts, product liability (including asbestos),

prior acquisitions and divestitures, employee benefit plans, intellectual property, and environmental, health and safety

matters. We continually assess the likelihood of any adverse judgments or outcomes to our contingencies, as well as

potential amounts or ranges of probable losses, and recognize a liability, if any, for these contingencies based on a careful

analysis of each matter with the assistance of outside legal counsel and, if applicable, other experts. Such analysis includes

making judgments concerning matters such as the costs associated with environmental matters, the outcome of

negotiations, the number and cost of pending and future asbestos claims, and the impact of evidentiary requirements.

Because most contingencies are resolved over long periods of time, liabilities may change in the future due to new

developments (including new discovery of facts, changes in legislation and outcomes of similar cases through the judicial

system), changes in assumptions or changes in our settlement strategy. See Note 19 Commitments and Contingencies of

Notes to Financial Statements for a discussion of

27

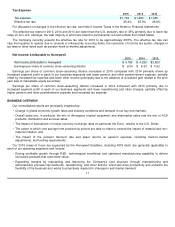

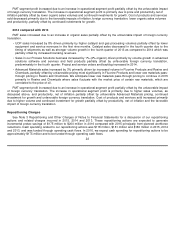

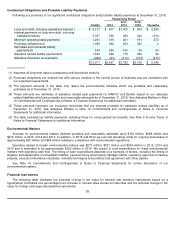

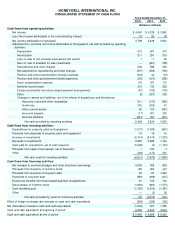

Face or

Notional

Amount

Carrying

Value(1)

Fair

Value(1)

Estimated

Increase

(Decrease)

in Fair

Value(2)

December 31, 2015

Interest Rate Sensitive Instruments

Long-term debt (including current maturities)

$

6,131

$

(6,131

)

$

(6,721

)

$

(407

)

Interest rate swap agreements

1,100

92

92

(59

)

Foreign Exchange Rate Sensitive Instruments

Foreign currency exchange contracts(3)

10,538

11

11

(153

)

December 31, 2014

Interest Rate Sensitive Instruments

Long-term debt (including current maturities)

$

6,985

$

(6,985

)

$

(7,817

)

$

(478

)

Interest rate swap agreements

1,100

93

93

(69

)

Foreign Exchange Rate Sensitive Instruments

Foreign currency exchange contracts(3)

7,291

10

10

86

(1)

Asset or (liability).

(2)

A hypothetical immediate one percentage point decrease in interest rates across all maturities and a potential change

in fair value of foreign exchange rate sensitive instruments based on a 10% strengthening of the U.S. dollar versus

local currency exchange rates across all maturities will result in a change in fair value equal to the inverse of the

amount disclosed in the table.

(3)

Changes in the fair value of foreign currency exchange contracts are offset by changes in the fair value or cash flows

of underlying hedged foreign currency transactions.