Honeywell 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS

—(Continued)

(Dollars in millions, except per share amounts)

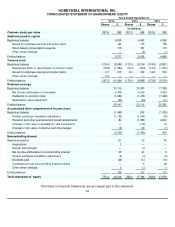

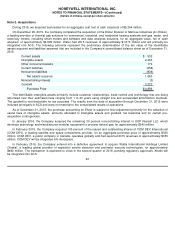

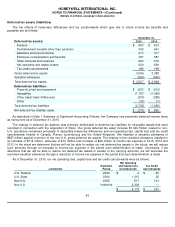

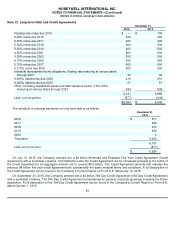

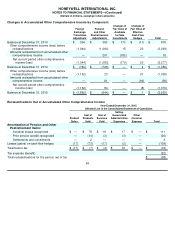

Deferred tax assets (liabilities)

The tax effects of temporary differences and tax carryforwards which give rise to future income tax benefits and

payables are as follows:

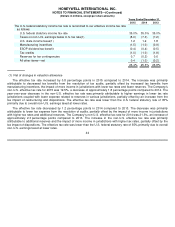

As described in Note 1 Summary of Significant Accounting Policies, the Company has presented deferred income taxes

as noncurrent as of December 31, 2015.

The change in deferred tax balance was primarily attributable to deferred tax liabilities for intangible assets that were

recorded in connection with the acquisition of Elster. Our gross deferred tax asset includes $1,049 million related to non-

U.S. operations comprised principally of deductible temporary differences and net operating loss, capital loss and tax credit

carryforwards (mainly in Canada, France, Luxembourg and the United Kingdom). We maintain a valuation allowance of

$587 million against a portion of the non-U.S. gross deferred tax assets. The change in the valuation allowance resulted in

an increase of $114 million, decrease of $10 million and increase of $49 million to income tax expense in 2015, 2014 and

2013. In the event we determine that we will not be able to realize our net deferred tax assets in the future, we will reduce

such amounts through an increase to income tax expense in the period such determination is made. Conversely, if we

determine that we will be able to realize net deferred tax assets in excess of the carrying amounts, we will decrease the

recorded valuation allowance through a reduction to income tax expense in the period that such determination is made.

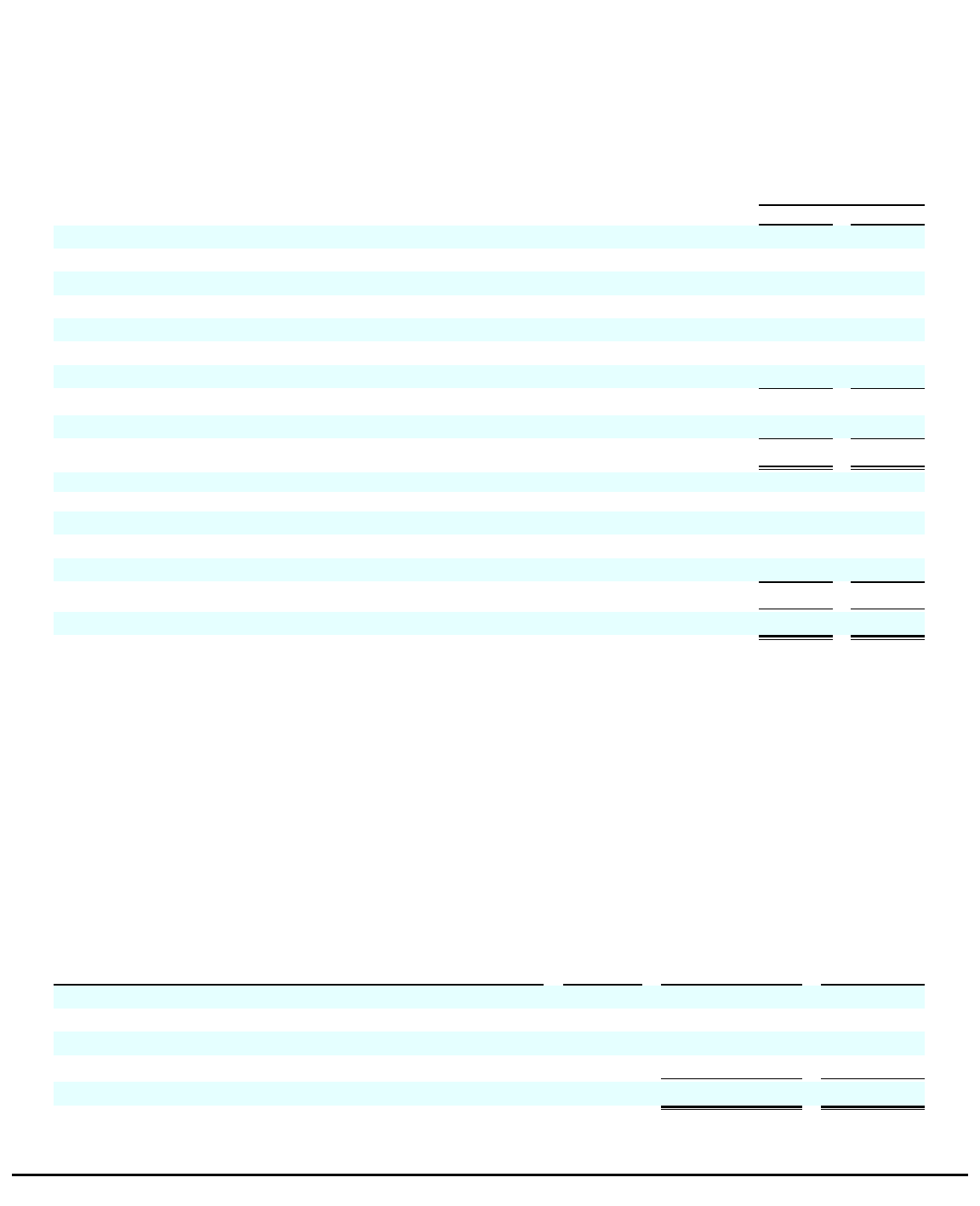

As of December 31, 2015, our net operating loss, capital loss and tax credit carryforwards were as follows:

45

Deferred tax assets:

December 31,

2015

2014

Pension

$

500

$

573

Postretirement benefits other than pensions

292

441

Asbestos and environmental

473

477

Employee compensation and benefits

387

387

Other accruals and reserves

626

672

Net operating and capital losses

620

639

Tax credit carryforwards

198

199

Gross deferred tax assets

3,096

3,388

Valuation allowance

(589

)

(560

)

Total deferred tax assets

$

2,507

$

2,828

Deferred tax liabilities:

Property, plant and equipment

$

(661

)

$

(612

)

Intangibles

(1,797

)

(1,060

)

Other asset basis differences

(293

)

(286

)

Other

(31

)

(7

)

Total deferred tax liabilities

(2,782

)

(1,965

)

Net deferred tax (liability) asset

$

(275

)

$

863

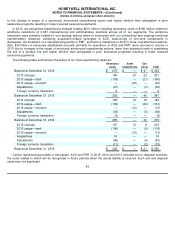

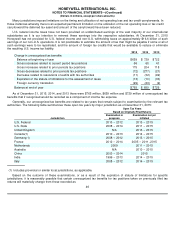

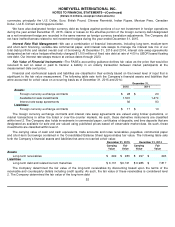

Jurisdiction

Expiration

Period

Net Operating

and Capital Loss

Carryforwards

Tax Credit

Carryforwards

U.S. Federal

2032

$

2

$

45

U.S. State

2034

1,315

25

Non

-

U.S.

2035

517

131

Non

-

U.S.

Indefinite

2,339

—

$

4,173

$

201