Honeywell 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS

—(Continued)

(Dollars in millions, except per share amounts)

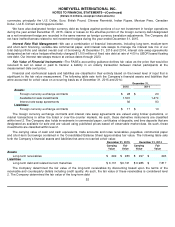

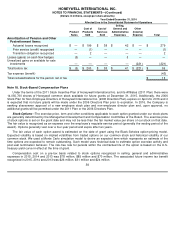

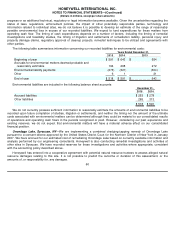

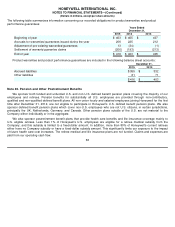

NARCO and Bendix asbestos related balances are included in the following balance sheet accounts:

NARCO Products—In connection with NARCO

’

s emergence from bankruptcy on April 30, 2013, a federally authorized

524(g) trust (NARCO Trust) was established for the evaluation and resolution of all existing and future NARCO asbestos

claims. Both Honeywell and NARCO are protected by a permanent channeling injunction barring all present and future

individual actions in state or federal courts and requiring all asbestos related claims based on exposure to NARCO

asbestos-containing products to be made against the NARCO Trust. The NARCO Trust reviews submitted claims and

determines award amounts in accordance with established Trust Distribution Procedures approved by the Bankruptcy Court

which set forth the criteria claimants must meet to qualify for compensation including, among other things, exposure and

medical criteria that determine the award amount. In addition, Honeywell provided, and continues to provide, input to the

design of control procedures for processing NARCO claims, and has on-going audit rights to review and monitor the claims

processors

’

adherence to the established requirements of the Trust Distribution Procedures.

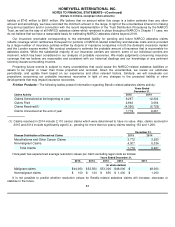

Honeywell is obligated to fund NARCO asbestos claims submitted to the NARCO Trust which qualify for payment under

the Trust Distribution Procedures (Annual Contribution Claims), subject to annual caps of $140 million in the years 2016

through 2018 and $145 million for each year thereafter. However, the initial $100 million of claims processed through the

NARCO Trust (the Initial Claims Amount) will not count against the annual cap and any unused portion of the Initial Claims

Amount will roll over to subsequent years until fully utilized. In 2015, Honeywell filed suit against the NARCO Trust in

Bankruptcy Court alleging breach of certain provisions of the Trust Agreement and Trust Distribution Procedures. The

proceeding is ongoing. As of December 31, 2015, Honeywell has not made any payments to the NARCO Trust for Annual

Contribution Claims.

Honeywell is also responsible for payments due to claimants pursuant to settlement agreements reached during the

pendency of the NARCO bankruptcy proceedings that provide for the right to submit claims to the NARCO Trust subject to

qualification under the terms of the settlement agreements and Trust Distribution Procedures criteria (Pre-established

Unliquidated Claims), which amounts are estimated at $150 million and are expected to be paid during the initial years of

trust operations ($5 million of which has been paid since the effective date of the NARCO Trust). Such payments are not

subject to the annual cap described above.

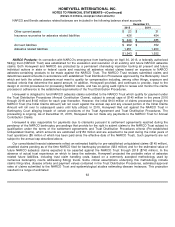

Our consolidated financial statements reflect an estimated liability for pre-established unliquidated claims ($145 million),

unsettled claims pending as of the time NARCO filed for bankruptcy protection ($33 million) and for the estimated value of

future NARCO asbestos claims expected to be asserted against the NARCO Trust through 2018 ($743 million). In the

absence of actual trust experience on which to base the estimate, Honeywell projected the probable value of asbestos

related future liabilities, including trust claim handling costs, based on a commonly accepted methodology used by

numerous bankruptcy courts addressing 524(g) trusts. Some critical assumptions underlying this methodology include

claims filing rates, disease criteria and payment values contained in the Trust Distribution Procedures, estimated approval

rates of claims submitted to the NARCO Trust and epidemiological studies estimating disease instances. This projection

resulted in a range of estimated

62

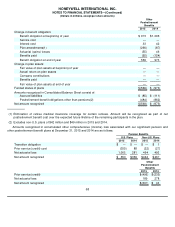

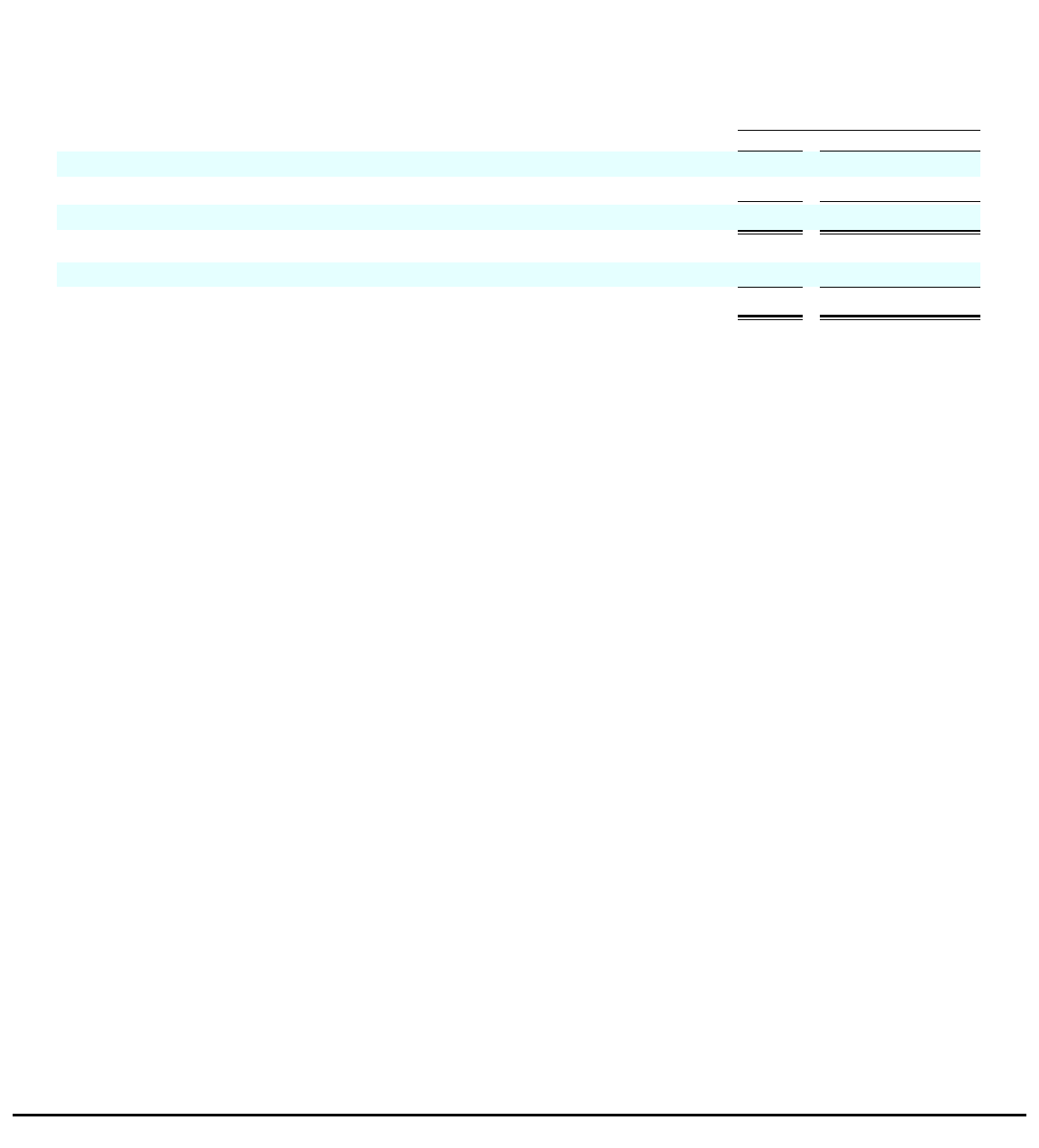

December 31,

2015

2014

Other current assets

$

23

$

31

Insurance recoveries for asbestos related liabilities

426

454

$

449

$

485

Accrued liabilities

$

292

$

352

Asbestos related liabilities

1,251

1,200

$

1,543

$

1,552