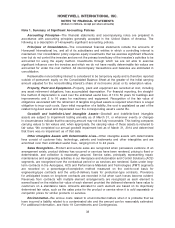

Honeywell 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

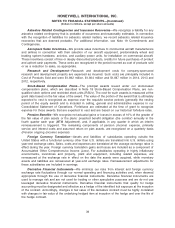

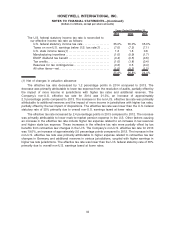

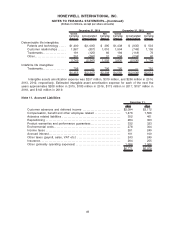

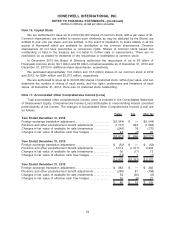

Deferred tax assets (liabilities)

The tax effects of temporary differences and tax carryforwards which give rise to future income tax

benefits and payables are as follows:

Deferred tax assets: 2014 2013

December 31,

Pension. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 573 $ 32

Postretirement benefits other than pensions . . . . . . . . . . . . . . . . . . . . . . 441 499

Asbestos and environmental . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 477 437

Employee compensation and benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . 387 382

Other accruals and reserves . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 672 702

Net operating and capital losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 639 838

Tax credit carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 199 266

Gross deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,388 3,156

Valuation allowance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (560) (614)

Total deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,828 $ 2,542

Deferred tax liabilities:

Property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (612) $ (654)

Intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,060) (1,126)

Other asset basis differences . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (286) (350)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7) (22)

Total deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,965) (2,152)

Net deferred taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 863 $ 390

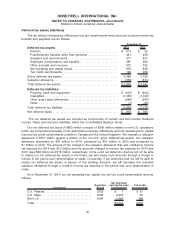

The net deferred tax assets are included as components of Current and Non-Current Deferred

Income Taxes and Accrued Liabilities within the Consolidated Balance Sheet.

Our net deferred tax asset of $863 million consists of $305 million related to non-U.S. operations

which are comprised principally of net deductible temporary differences and net operating loss, capital

loss and tax credit carryforwards (mainly in Canada and the United Kingdom). We maintain a valuation

allowance of $557 million against a portion of the non-U.S. gross deferred tax assets. Our valuation

allowance decreased by $54 million in 2014, increased by $16 million in 2013 and increased by

$7 million in 2012. The amount of the change in the valuation allowance that was credited to income

tax expense for 2014 was $10 million and the amounts charged to income tax expense for 2013 and

2012 were $49 million and $18 million, respectively. In the event we determine that we will not be able

to realize our net deferred tax assets in the future, we will reduce such amounts through a charge to

income in the period such determination is made. Conversely, if we determine that we will be able to

realize net deferred tax assets in excess of the carrying amounts, we will decrease the recorded

valuation allowance through a credit to income tax expense in the period that such determination is

made.

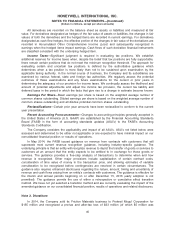

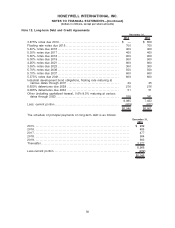

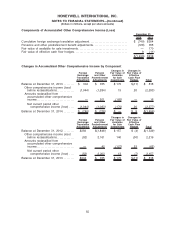

As of December 31, 2014, our net operating loss, capital loss and tax credit carryforwards were as

follows:

Jurisdiction

Expiration

Period

Net Operating

and Capital Loss

Carryforwards

Tax Credit

Carryforwards

U.S. Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2032 $ 1 $ 51

U.S. State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2034 2,200 35

Non-U.S. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2034 2,463 148

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $4,664 $234

45

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)