Honeywell 2014 Annual Report Download - page 34

Download and view the complete annual report

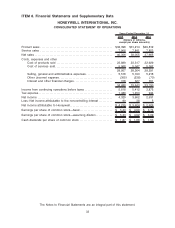

Please find page 34 of the 2014 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash used for investing activities increased by $531 million primarily due to an increase in cash

paid for acquisitions of $695 million (most significantly Intermec and RAE Systems Inc.), partially offset

by an increase of approximately $190 million in settlement receipts of foreign currency exchange

contracts used as economic hedges on certain non-functional currency denominated monetary assets

and liabilities.

Cash used for financing activities decreased by $773 million primarily due to an increase in the net

proceeds from debt issuances of $1,462 million, partially offset by an increase in net repurchases of

common stock of $651 million and an increase in cash dividends paid of $142 million.

Liquidity

Each of our businesses is focused on implementing strategies to increase operating cash flows

through revenue growth, margin expansion and improved working capital turnover. Considering the

current economic environment in which each of the businesses operate and their business plans and

strategies, including the focus on growth, cost reduction and productivity initiatives, we believe that

cash balances and operating cash flow will continue to be our principal source of liquidity. In addition to

the available cash and operating cash flows, additional sources of liquidity include committed credit

lines, short-term debt from the commercial paper markets, long-term borrowings, and access to the

public debt and equity markets. At December 31, 2014, a substantial portion of the Company’s cash

and cash equivalents were held by foreign subsidiaries. If the amounts held outside of the U.S. were to

be repatriated, under current law, they would be subject to U.S. federal income taxes, less applicable

foreign tax credits. However, our intent is to permanently reinvest the vast majority of these funds

outside of the U.S. It is not practicable to estimate the amount of tax that might be payable if some or

all of such earnings were to be repatriated, and the amount of foreign tax credits that would be

available to reduce or eliminate the resulting U.S. income tax liability.

We monitor the third-party depository institutions that hold our cash and cash equivalents on a

daily basis. Our emphasis is primarily on safety of principal and secondarily on maximizing yield on

those funds. We diversify our cash and cash equivalents among counterparties to minimize exposure

to any one of these entities.

A source of liquidity is our ability to issue short-term debt in the commercial paper market.

Commercial paper notes are sold at a discount and have a maturity of not more than 365 days from

date of issuance. Borrowings under the commercial paper program are available for general corporate

purposes as well as for financing acquisitions. The weighted average interest rate on short-term

borrowings and commercial paper outstanding at December 31, 2014 and 2013 was 0.60% and 0.79%,

respectively.

Our ability to access the commercial paper market, and the related cost of these borrowings, is

affected by the strength of our credit rating and market conditions. Our credit ratings are periodically

reviewed by the major independent debt-rating agencies. As of December 31, 2014, Standard and

Poor’s (S&P), Fitch, and Moody’s have ratings on our long-term debt of A, A and A2 respectively, and

short-term debt of A-1, F1 and P1 respectively. S&P, Fitch and Moody’s have Honeywell’s rating

outlook as “stable”. To date, the Company has not experienced any limitations in our ability to access

these sources of liquidity.

We also have a current shelf registration statement filed with the Securities and Exchange

Commission under which we may issue additional debt securities, common stock and preferred stock

that may be offered in one or more offerings on terms to be determined at the time of the offering. Net

proceeds of any offering would be used for general corporate purposes, including repayment of

existing indebtedness, capital expenditures and acquisitions.

On December 10, 2013, the Company entered into a $4 billion Amended and Restated Five Year

Credit Agreement (“Credit Agreement”) with a syndicate of banks. Commitments under the Credit

Agreement can be increased pursuant to the terms of the Credit Agreement to an aggregate amount

not to exceed $4.5 billion. The Credit Agreement is maintained for general corporate purposes. There

have been no borrowings under the Credit Agreement.

25