Honeywell 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

organizational realignments of businesses in our ACS and PMT segments. Also, $38 million of

previously established accruals, primarily for severance, mainly in our Aerospace and ACS segment

were returned to income in 2014 due principally to the change in scope of a previously announced

repositioning action and to fewer employee severance actions caused by higher attrition than originally

planned associated with prior severance programs.

In 2013, we recognized repositioning charges totaling $231 million including severance costs of

$186 million related to workforce reductions of 3,081 manufacturing and administrative positions across

all of our segments. The workforce reductions were primarily related to cost savings actions taken in

connection with our productivity and ongoing functional transformation initiatives, achieving acquisition-

related synergies in our ACS segment, outsourcing of non-core components in our Aerospace

segment, the shutdown of a manufacturing facility in our PMT segment, and factory transitions in our

ACS segment to more cost-effective locations. Also, $30 million of previously established accruals,

primarily for severance, in our ACS and PMT segments were returned to income in 2013 due to

changes in the scope of previously announced repositioning actions, lower than expected costs in

completing the exit of a product line and fewer employee severance actions caused by higher attrition

than originally planned associated with prior severance programs.

In 2012, we recognized repositioning charges totaling $119 million including severance costs of

$91 million related to workforce reductions of 2,204 manufacturing and administrative positions across

all of our segments. The workforce reductions were primarily related to the planned shutdown of a

manufacturing facility in our Aerospace segment, the exit from a product line in our PMT segment, and

cost savings actions taken in connection with our productivity and ongoing functional transformation

initiatives. Also, $66 million of previously established accruals, primarily for severance, in our ACS,

Aerospace and PMT segments were returned to income in 2012 due primarily to fewer employee

severance actions caused by higher attrition than originally planned associated with prior severance

programs and changes in the scope of previously announced repositioning actions.

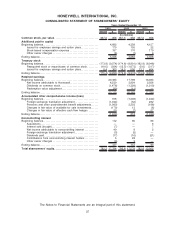

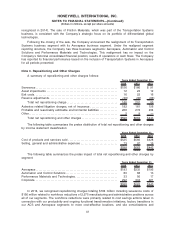

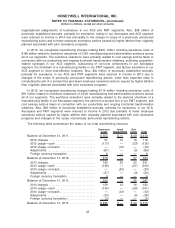

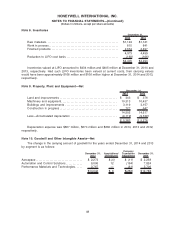

The following table summarizes the status of our total repositioning reserves:

Severance

Costs

Asset

Impairments

Exit

Costs Total

Balance at December 31, 2011 . . . . . . . . . . . . . . . . . . . $ 353 $ — $ 59 $ 412

2012 charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91 12 16 119

2012 usage—cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (113) — (23) (136)

2012 usage—noncash . . . . . . . . . . . . . . . . . . . . . . . . . . — (12) — (12)

Adjustments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (61) — (5) (66)

Foreign currency translation. . . . . . . . . . . . . . . . . . . . . 6 — — 6

Balance at December 31, 2012 . . . . . . . . . . . . . . . . . . . 276 — 47 323

2013 charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 186 23 22 231

2013 usage—cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (139) — (21) (160)

2013 usage—noncash . . . . . . . . . . . . . . . . . . . . . . . . . . — (23) — (23)

Adjustments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (27) — (3) (30)

Foreign currency translation. . . . . . . . . . . . . . . . . . . . . 6 — — 6

Balance at December 31, 2013 . . . . . . . . . . . . . . . . . . . 302 — 45 347

2014 charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 156 12 16 184

2014 usage—cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (135) — (26) (161)

2014 usage—noncash . . . . . . . . . . . . . . . . . . . . . . . . . . — (12) — (12)

Adjustments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (33) — (5) (38)

Foreign currency translation. . . . . . . . . . . . . . . . . . . . . (5) — — (5)

Balance at December 31, 2014 . . . . . . . . . . . . . . . . . . . $ 285 $ — $ 30 $ 315

42

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)