Honeywell 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

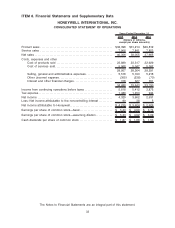

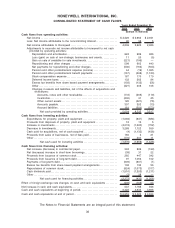

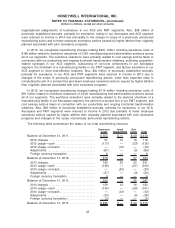

HONEYWELL INTERNATIONAL INC.

CONSOLIDATED STATEMENT OF CASH FLOWS

2014 2013 2012

Years Ended December 31,

(Dollars in millions)

Cash flows from operating activities:

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,329 $ 3,962 $ 2,931

Less: Net income attributable to the noncontrolling interest . . . . . . . . . . . . . . . . . 90 38 5

Net income attributable to Honeywell . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,239 3,924 2,926

Adjustments to reconcile net income attributable to Honeywell to net cash

provided by operating activities:

Depreciation and amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 924 989 926

Loss (gain) on sale of non-strategic businesses and assets . . . . . . . . . . . . 11 20 (5)

Gain on sale of available for sale investments . . . . . . . . . . . . . . . . . . . . . . . . . (221) (195) —

Repositioning and other charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 598 663 443

Net payments for repositioning and other charges . . . . . . . . . . . . . . . . . . . . . (530) (763) (503)

Pension and other postretirement expense (income) . . . . . . . . . . . . . . . . . . . 44 (19) 1,065

Pension and other postretirement benefit payments . . . . . . . . . . . . . . . . . . . . (167) (298) (1,183)

Stock compensation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 187 170 170

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 132 262 84

Excess tax benefits from share based payment arrangements. . . . . . . . . . (102) (132) (56)

Other................................................................ (327) 308 108

Changes in assets and liabilities, net of the effects of acquisitions and

divestitures:

Accounts, notes and other receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . (172) (365) (119)

Inventories. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (200) 41 25

Other current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 120 (421) (78)

Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 307 352 (13)

Accrued liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 181 (201) (273)

Net cash provided by operating activities. . . . . . . . . . . . . . . . . . . . . . . . 5,024 4,335 3,517

Cash flows from investing activities:

Expenditures for property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,094) (947) (884)

Proceeds from disposals of property, plant and equipment . . . . . . . . . . . . . . . . . 18 15 5

Increase in investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,074) (1,220) (702)

Decrease in investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,288 1,122 559

Cash paid for acquisitions, net of cash acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . (4) (1,133) (438)

Proceeds from sales of businesses, net of fees paid . . . . . . . . . . . . . . . . . . . . . . . 160 3 21

Other.................................................................... (170) 201 11

Net cash used for investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,876) (1,959) (1,428)

Cash flows from financing activities:

Net increase (decrease) in commercial paper . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 348 899 (199)

Net (decrease) increase in short-term borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . (39) 31 22

Proceeds from issuance of common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 265 447 342

Proceeds from issuance of long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 97 1,063 102

Payments of long-term debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (609) (607) (1)

Excess tax benefits from share based payment arrangements . . . . . . . . . . . . . . 102 132 56

Repurchases of common stock. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (924) (1,073) (317)

Cash dividends paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,510) (1,353) (1,211)

Other.................................................................... (2) 28 —

Net cash used for financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,272) (433) (1,206)

Effect of foreign exchange rate changes on cash and cash equivalents . . . . . . . . . (339) (155) 53

Net increase in cash and cash equivalents. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 537 1,788 936

Cash and cash equivalents at beginning of period. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,422 4,634 3,698

Cash and cash equivalents at end of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,959 $ 6,422 $ 4,634

The Notes to Financial Statements are an integral part of this statement.

36