Honda 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

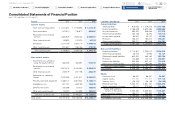

Unaudited Consolidated Statements of Cash Flows

Divided into Non-financial Services Businesses and Finance Subsidiaries

Fiscal years ended March 31, 2014 and 2015 Yen (millions)

2014 2015

Non-financial

Services

Businesses

Finance

Subsidiaries

Reconciling

Items Consolidated

Non-financial

Services

Businesses

Finance

Subsidiaries

Reconciling

Items Consolidated

Cash flows from operating activities:

Profit before income taxes ¥ 752,581 ¥ 181,322 ¥ — ¥ 933,903 ¥ 592,086 ¥ 214,151 ¥ —¥ 806,237

Depreciation, amortization and impairment losses excluding equipment

on operating leases 585,826 2,306 —588,132 622,238 2,991 —625,229

Share of profit of investments accounted for using the equity method (130,916) — — (130,916) (96,097) — — (96,097)

Decrease (increase) in trade receivables (51,301) (5,581) 9,798 (47,084) (55,694) 1,383 8,472 (45,839)

Decrease (increase) in inventories (66,233) (758) —(66,991) (55,882) (403) —(56,285)

Increase (decrease) in trade payables 91,845 (269) (7,056) 84,520 20,132 352 1,762 22,246

Decrease (increase) in receivables from financial services —(424,838) 1,732 (423,106) —317,033 (71) 316,962

Decrease (increase) in equipment on operating leases —(248,604) —(248,604) —(535,165) —(535,165)

Dividends received 107,627 2 — 107,629 114,499 2 — 114,501

Other, net (266,521) (79,408) (2,446) (348,375) (72,899) (48,238) (10,248) (131,385)

Net cash provided by (used in) operating activities 1,022,908 (575,828) 2,028 449,108 1,068,383 (47,894) (85) 1,020,404

Cash flows from investing activities:

Payments for additions to property, plant and equipment (717,958) (473) —(718,431) (647,773) (432) —(648,205)

Payments for additions to and internally developed intangible assets (205,286) (3,466) —(208,752) (231,280) (3,635) —(234,915)

Decrease (increase) in other financial assets* (32,541) (4,867) 4,327 (33,081) 145,452 (948) (133,480) 11,024

Other, net 35,654 3,587 —39,241 26,970 4,630 —31,600

Net cash provided by (used in) investing activities (920,131) (5,219) 4,327 (921,023) (706,631) (385) (133,480) (840,496)

Cash flows from financing activities:

Proceeds from (repayment of) short-term financing liabilities* (88,668) 73,965 7,756 (6,947) 54,692 (58,331) 133,358 129,719

Proceeds from long-term financing liabilities* 128,567 1,485,291 (16,328) 1,597,530 53,375 1,452,391 (34) 1,505,732

Repayments of long-term financing liabilities* (79,959) (981,493) 2,217 (1,059,235) (106,769) (1,282,593) 241 (1,389,121)

Dividends paid to owners of the parent (142,381) — — (142,381) (158,601) — — (158,601)

Other, net (33,509) — — (33,509) (75,241) — — (75,241)

Net cash provided by (used in) financing activities (215,950) 577,763 (6,355) 355,458 (232,544) 111,467 133,565 12,488

Effect of exchange rate changes on cash and cash equivalents 38,200 1,229 —39,429 77,335 8,415 —85,750

Net change in cash and cash equivalents (74,973) (2,055) —(77,028) 206,543 71,603 —278,146

Cash and cash equivalents at beginning of period 1,246,964 23,648 —1,270,612 1,171,991 21,593 —1,193,584

Cash and cash equivalents at end of period ¥1,171,991 ¥ 21,593 ¥ — ¥ 1,193,584 ¥1,378,534 ¥ 93,196 ¥ —¥ 1,471,730

Note: Non-financial services businesses provide loans to finance subsidiaries. These cash flows are included in the decrease (increase) in other financial assets, proceeds from (repayment of) short-term financing liabilities,

proceeds from and repayment of long-term financing liabilities (marked by *). The amount of the loans to finance subsidiaries is a ¥4,327 million increase for the fiscal year ended March 31, 2014, and a ¥133,480 million

decrease for the fiscal year ended March 31, 2015, respectively.

Honda Motor Co., Ltd. Annual Report 2015 41

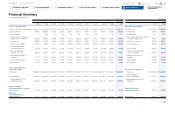

6 Financial Section

1 The Power of Dreams

2 Financial Highlights

3 To Our Shareholders

4 Review of Operations

5 Corporate Governance

7

Investor Relations

Information

Return to last

page opened

Go to

contents page