Honda 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

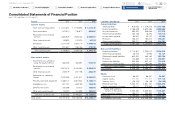

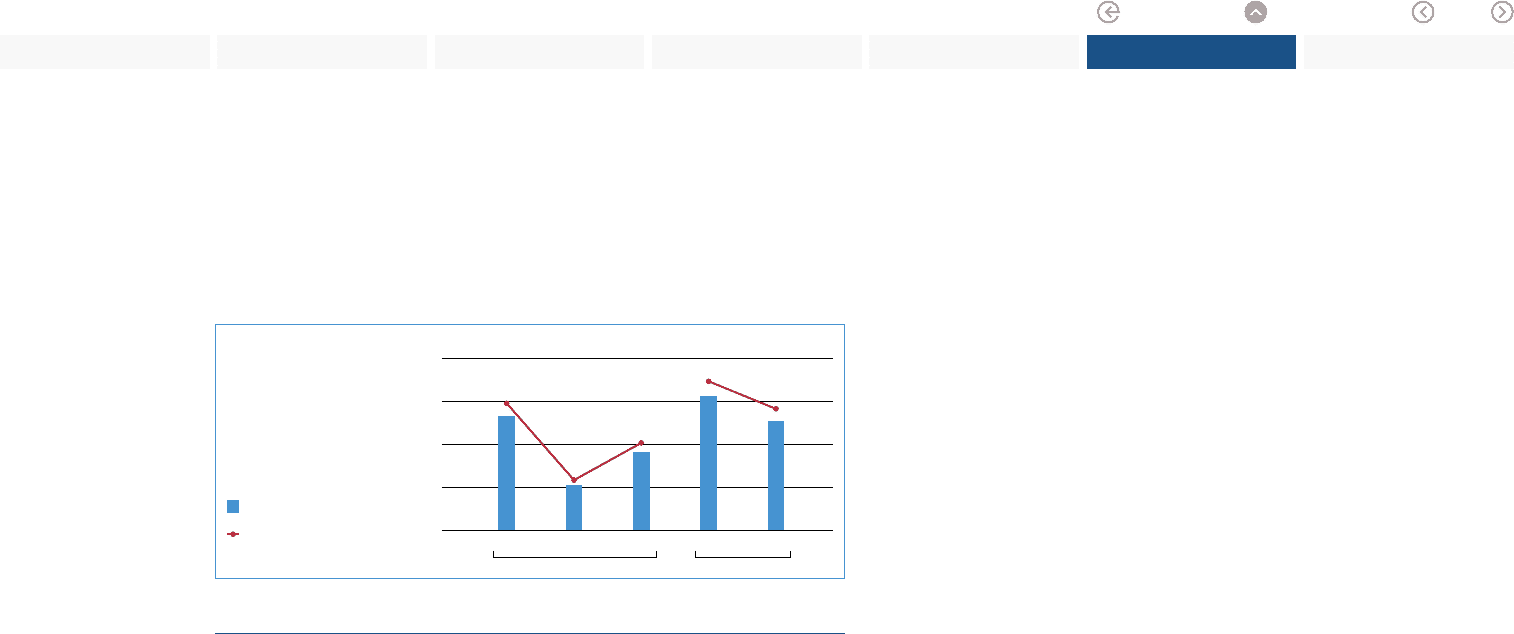

Profit for the Year Attributable to Owners of the Parent

Profit for the year attributable to owners of the parent decreased by ¥115.2 billion,

or 18.5%, to ¥509.4 billion from the previous fiscal year.

Profit for the Year Attributable to Non-controlling Interests

Profit for the year attributable to non-controlling interests increased by ¥10.4

billion, or 25.4%, to ¥51.6 billion from the previous fiscal year, due mainly to an

increase in profit for the year of the subsidiaries in Asia which have non-

controlling interests.

Business Segments

Motorcycle Business

Honda’s consolidated unit sales of motorcycles and all-terrain vehicles (ATVs)

totaled 10,725 thousand units, an increase of 3.8% from the previous fiscal year,

due mainly to an increase in consolidated unit sales in Asia.

Sales revenue from external customers increased by ¥157.4 billion, or 9.3%, to

¥1,846.6 billion from the previous fiscal year, due mainly to increased consolidated

unit sales and positive foreign currency translation effects. The impact of price

changes was immaterial. Honda estimates that by applying Japanese yen

exchange rates of the previous fiscal year to the current fiscal year, sales revenue

for the year would have increased by approximately ¥70.8 billion, or 4.2%, com-

pared to the increase as reported of ¥157.4 billion, which includes positive foreign

currency translation effects.

Operating costs and expenses increased by ¥142.1 billion, or 9.4%, to

¥1,654.5 billion from the previous fiscal year. Cost of sales increased by ¥114.4

billion, or 9.3%, to ¥1,342.8 billion, due mainly to an increase in costs attributable

to increased consolidated unit sales and negative foreign currency effects. Selling,

general and administrative expenses increased by ¥20.3 billion, or 9.5%, to

¥233.8 billion, due mainly to an increase in selling expenses attributable to

increased consolidated unit sales and negative foreign currency effects. Research

and development expenses increased by ¥7.3 billion, or 10.5%, to ¥77.7 billion.

Operating profit increased by ¥15.2 billion, or 8.6%, to ¥192.1 billion from the

previous fiscal year, due mainly to an increase in profit attributable to increased

sales revenue and positive foreign currency effects, which was partially offset by

increased selling, general and administrative expenses.

Automobile Business

Honda’s consolidated unit sales of automobiles totaled 3,513 thousand units, a

decrease of 0.5% from the previous fiscal year, due mainly to a decrease in con-

solidated unit sales in Japan, which was partially offset by an increase in Asia.

Sales revenue from external customers increased by ¥424.5 billion, or 4.6%,

to ¥9,603.3 billion from the previous fiscal year, due mainly to positive foreign

currency translation effects. The impact of price changes was immaterial. Honda

estimates that by applying Japanese yen exchange rates of the previous fiscal

year to the current fiscal year, sales revenue for the year would have decreased by

approximately ¥107.9 billion, or 1.2%, compared to the increase as reported of

¥424.5 billion, which includes positive foreign currency translation effects. Sales

revenue including intersegment sales increased by ¥508.5 billion, or 5.5%, to

¥9,757.8 billion from the previous fiscal year.

Operating costs and expenses increased by ¥689.9 billion, or 7.9%, to

¥9,478.1 billion from the previous fiscal year. Cost of sales increased by ¥491.9

billion, or 6.9%, to ¥7,641.8 billion, due mainly to negative foreign currency

effects. Selling, general and administrative expenses increased by ¥197.4 billion,

or 17.3%, to ¥1,337.7 billion, due mainly to increased product warranty expenses

and negative foreign currency effects. Product warranty expenses include

expenses related to airbag inflators. Research and development expenses totaled

¥498.4 billion, basically unchanged from the previous fiscal year.

Operating profit decreased by ¥181.4 billion, or 39.3%, to ¥279.7 billion from

the previous fiscal year, due mainly to increased selling, general and administrative

expenses including product warranty expenses, which was partially offset by

continuing cost reduction and positive foreign currency effect.

Financial Services Business

To support the sale of its products, Honda provides retail lending and leasing to

customers and wholesale financing to dealers through its finance subsidiaries in

Japan, the United States, Canada, the United Kingdom, Germany, Brazil, Thailand

and other countries.

Total amount of receivables from financial services and equipment on operating

leases of finance subsidiaries on March 31, 2015 increased by ¥1,240.3 billion, or

15.9%, to ¥9,018.9 billion from the March 31, 2014. Honda estimates that by apply-

ing Japanese yen exchange rates of the previous fiscal year to the current fiscal

year, total amount of receivables from financial services and equipment on operating

leases of finance subsidiaries as of March 31, 2015 would have increased by

Yen (billions) (Yen)

Profit for the Year

Attributable to Owners of

the Parent/Basic Earnings

per Share Attributable to

Owners of the Parent

* From fiscal 2011 to 2013, the above were named

“Net Income Attributable to Honda Motor Co.,

Ltd.” and “Basic Net Income Attributable to

Honda Motor Co., Ltd. per Common Share,”

and stated in accordance with U.S. GAAP.

Fiscal years ended March 31

Profit for the Year Attributable to

Owners of the Parent (left scale)

Basic Earnings per Share

Attributable to Owners of

the Parent (right scale)

400

200

600

800

0

100

200

300

400

0

11 12 13 14 15

U.S. GAAP IFRS

Honda Motor Co., Ltd. Annual Report 2015 25

6 Financial Section

1 The Power of Dreams

2 Financial Highlights

3 To Our Shareholders

4 Review of Operations

5 Corporate Governance

7

Investor Relations

Information

Return to last

page opened

Go to

contents page