Honda 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Japan

Total demand for automobiles in Japan*1 decreased around

7% from the previous fiscal year to approximately 5,290

thousand units in fiscal year 2015. This was greatly influ-

enced by the impact of an increase in Japan’s consumption

tax rate in April 2014 and a fall-back from a spike in

demand prior to the increase.

Honda’s consolidated unit sales in Japan decreased

11.7% from the previous fiscal year to 696 thousand units*2

in fiscal year 2015. The main reasons for the decline were

weak demand due to Japan’s consumption tax rate

increase and the fall-back from a spike in demand prior to

the increase, along with intensified competition in the mini-

vehicle segment. This was despite the introduction of new

automobile models such as GRACE and solid sales of the

VEZEL and N-WGN models.

Honda’s unit production of automobiles in fiscal year

2015 decreased 7.4% from the previous fiscal year to 868

thousand units. This was mainly due to the negative effects

of a decline in unit sales.

*1 Source: JAMA (Japan Automobile Manufacturers Association), as measured by

the number of regular vehicle registrations (661cc or higher) and mini vehicles

(660cc or lower)

*2 Certain sales of automobiles that are financed with residual value type auto loans

by our Japanese finance subsidiaries and sold through our consolidated subsid-

iaries are accounted for as operating leases in conformity with IFRS and are not

included in consolidated sales revenue to external customers in the Automobile

business. Accordingly, they are not included in consolidated unit sales.

North America

Total industry demand for automobiles in the United

States*, the principal market within North America, rose

around 6% from the previous year to approximately 16,520

thousand units in calendar year 2014. This was mainly

attributable to stable economic conditions including the

positive effects of an improvement in employment condi-

tions and a continued increase in personal consumption, as

well as an increase in light truck sales as a result of lower

gasoline prices.

Under these conditions, Honda’s consolidated unit sales

in North America decreased 0.2% from the previous fiscal

year to 1,750 thousand units in fiscal year 2015. This

decline was mainly caused by the negative effects of inten-

sified competition in the passenger car segment and the

U.S. West Coast port strikes, which more than offset the

positive impact of the Acura TLX launch and a full model

change of the Fit model.

Honda manufactured 1,810 thousand units in fiscal year

2015, up 1.8% from the previous fiscal year. This increase

mainly reflected an increase in unit production at Honda’s

new Celaya plant in Mexico, despite the negative effect

from the U.S. West Coast port strikes.

* Source: Autodata

Europe

Total demand for automobiles in Europe* increased about

5% from the previous year to approximately 13,000 thou-

sand units in calendar year 2014. Expansion in the market

as a whole was driven by an upturn in economic conditions.

Honda’s consolidated unit sales in Europe decreased

5.8% from the previous fiscal year to 161 thousand units in

fiscal year 2015. This was mainly due to a decline in unit

sales of the JAZZ.

Unit output at Honda’s U.K. plant in fiscal year 2015

declined 14.2% from the previous fiscal year to 115 thou-

sand units.

* Source: ACEA (Association des Constructeurs Europeens d’Automobiles (the

European Automobile Manufacturer’s Association)) New passenger car registra-

tions cover 28 EU countries and three EFTA countries, excluding Russia.

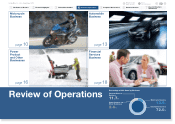

FIT

(North America)

Honda Motor Co., Ltd. Annual Report 2015 14

4 Review of Operations

1 The Power of Dreams

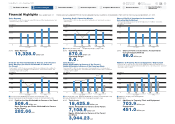

2 Financial Highlights

3 To Our Shareholders

5 Corporate Governance

6 Financial Section

7

Investor Relations

Information

Return to last

page opened

Go to

contents page