Harris Teeter 2012 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2012 Harris Teeter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

for fiscal 2012 (excluding stores acquired from Lowes Foods), as compared to $7.0 million (0.16% of sales) for fiscal 2011

and $8.4 million (0.20% of sales) in fiscal 2010. Pre-opening costs fluctuate between reporting periods depending on the new

store opening schedule and market location.

The Lowes Foods Transaction incremental costs of $29.8 million consist of $3.9 million in non-cash impairment charges

related to the write-off of a portion of the goodwill that related to stores not integrated into the operations. The costs also include

an increase in the Company’s closed store reserves of $15.5 million, incremental pre-opening costs associated with the stores

acquired and other fair market adjustments to fixed assets and intangibles.

Corporate SG&A expenses include a portion of compensation and benefits of holding company employees and certain other

costs that have not historically been fully allocated to the Company’s operating subsidiaries. Corporate SG&A expenses for fiscal

2012 were offset by $3.1 million of gains recorded in connection with proceeds received on company-owned life insurance

policies. Corporate SG&A expenses in fiscal 2010 were reduced by $3.9 million as a result of gains realized in connection with

the exchange of the Company’s corporate aircraft.

Net interest expense (interest expense less interest income) for fiscal 2012 decreased by $2.6 million from the prior year

period. Net interest expense for fiscal 2012 included a reversal of accrued interest amounting to $1.3 million that was associated

with a reduction of the Company’s unrecognized tax positions and approximately $0.3 million of additional interest income

associated with income tax refunds. Net interest expense has also been reduced as a result of lower interest on debt borrowings

due to lower average outstanding borrowings.

Net investment gains for fiscal 2011 include a pre-tax gain of $19.5 million the Company realized upon the sale of the

Company’s foreign investment.

The effective consolidated income tax rate on continuing operations for fiscal 2012 was 35.4% as compared to 38.5% for

fiscal 2011 and 37.4% for fiscal 2010. Income tax expense for fiscal 2012 was favorably impacted by the non-taxable gains

on insurance proceeds received in the third quarter of fiscal 2012 and income tax expense for fiscal 2011 included additional

foreign taxes paid in connection with the gain realized on the sale of the Company’s foreign investment.

Continuing Operations

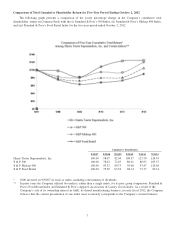

As a result of the items discussed above, earnings from continuing operations after tax were $99.9 million, or $2.04 per

diluted share, in fiscal 2012, as compared to $111.5 million, or $2.28 per diluted share, in fiscal 2011 and $98.7 million, or

$2.03 per diluted share, in fiscal 2010 (a 53-week year). In fiscal 2012, the Lowes Foods Transaction incremental costs reduced

earnings from continuing operations after tax by $18.1 million, or $0.37 per diluted share, the life insurance gains increased

earnings from continuing operations after tax by $3.1 million, or $0.06 per diluted share, and the interest expense reversal

increased earnings from continuing operations after tax by $0.8 million, or $0.02 per diluted share. The after-tax gain on the

sale of the Company’s foreign investment company increased fiscal 2011 earnings from continuing operations by $10.3 million,

or $0.21 per diluted share.

Discontinued Operations

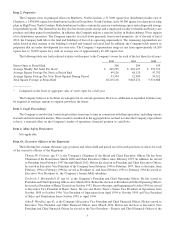

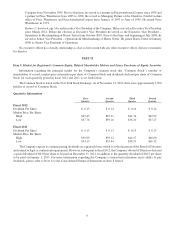

The following table sets forth the components of discontinued operations for the 52 weeks ended October 2, 2012 (fiscal

2012) and October 2, 2011 (fiscal 2011) and the 53 weeks ended October 3, 2010 (fiscal 2010), respectively (in thousands):

Fiscal 2012 Fiscal 2011 Fiscal 2010

Net Sales $ 30,313 $320,876 $301,097

Cost of Sales 23,205 241,539 228,685

Gross Profit 7,108 79,337 72,412

SG&A Expenses 22,824 52,351 51,297

Operating Profit (Loss) (15,716) 26,986 21,115

Interest Expense 19 380 421

Interest Income (17) (170) (66)

Less Net Earnings Attributable to Noncontrolling Interest 37 698 1,067

Loss on Disposition of Discontinued Operations 3,717 48,750 -

(Loss) Earnings on Discontinued Operations (19,472) (22,672) 19,693

Income Tax (benefit) Expense (2,057) (2.461) 6,304

(Loss) Earnings From Discontinued Operations, Net of Taxes $(17,415) $ (20,211) $ 13,389

12