Harris Teeter 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Harris Teeter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company has responded to its customers’ changing buying habits with increased promotional activity designed to

increase the overall value to the customers. During fiscal 2012, on a comparable basis, customer visits, average basket size and

the average number of items sold increased. In addition, Harris Teeter experienced average increases in active households per

comparable store (based on VIC data) of 1.61%, evidencing a continued growing customer base in those stores. Store brand

penetration has also increased on a year over year basis. Store brand penetration based on units sold increased 31 basis points

to 24.26% in fiscal 2012 from 23.95% in fiscal 2011. Store brand penetration based on sales dollars increased by 58 basis points

to 25.15% in fiscal 2012 from 24.57% in fiscal 2011.

The Company considers its reporting of comparable store sales growth to be effective in determining core sales growth

during periods of fluctuation in the number of stores in operation, their locations and their sizes. While there is no standard

industry definition of “comparable store sales,” the Company has been consistently applying the following definition.

Comparable store sales are computed using corresponding calendar weeks to account for the occasional extra week included

in a fiscal year. A new store must be in operation for 14 months before it enters into the calculation of comparable store sales.

A closed store is removed from the calculation in the month in which its closure is announced. A new store opening within an

approximate two-mile radius of an existing store that is to be closed as a result of the new store opening is included as a

replacement store in the comparable store sales measurement as if it were the same store. Sales increases resulting from existing

comparable stores that are expanded in size are included in the calculations of comparable store sales, if the store remains open

during the construction period. If the location is closed during the construction period, the sales during the reporting period

are removed from the calculation. If the location is completely rebuilt, it is reported as a replacement store and included in the

same store sales calculation for the weeks actually open. Comparable store sales for fiscal 2011 was computed on a 52-week

basis by reducing fiscal 2010 sales for the first week of the annual period.

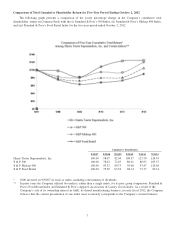

Gross Profit

Gross profit as a percent to sales increased 31 basis points from fiscal 2011 to fiscal 2012 and declined 30 basis points

from fiscal 2010 to fiscal 2011. The increase in the gross profit margin from fiscal 2011 to fiscal 2012 was driven by a decrease

in the annual LIFO charge between the respective years and an improvement of 10 basis points in the retail gross profit margin

resulting from our effective promotional activity. The decrease in the gross profit margin from fiscal 2010 to fiscal 2011 was

driven by an increase in the annual LIFO charge between the respective years and the Company’s efforts to drive sales through

its promotional activity, which includes lowering the sales price on selected items (price investment) that resulted in a reduction

in the retail gross profit margin by 2 basis points during fiscal 2011. The annual LIFO adjustment reduced gross profit by $3.0

million (0.07% to sales) in fiscal 2012, reduced gross profit by $11.1 million (0.26% to sales) in fiscal 2011 and increased gross

profit by $1.6 million (0.04% to sales) in fiscal 2010.

Expenses

Selling, general & administrative (“SG&A”) expenses for fiscal 2012 and its percent to sales increased from fiscal 2011

by $98.2 million and 76 basis points, respectively. The increase was driven by incremental store growth and its impact on

associated operational costs such as labor, credit and debit card fees, rent and other occupancy costs, and $29.8 million (or 66

basis points on a percent to sales basis) of Lowes Foods Transaction incremental costs (as described below). The increase in

SG&A expenses (excluding advertising and support department costs) from fiscal 2011 to fiscal 2012 for stores opened during

fiscal 2011 and fiscal 2012 accounted for $42.4 million of the $98.2 million increase in total SG&A expenses. Store labor and

benefit costs increased from fiscal 2011 to fiscal 2012 by $33.2 million and represented a 6 basis point increase on a percent

to sales basis. Increased costs of $12.0 million in advertising and support departments between fiscal 2011 and fiscal 2012

represented a 13 basis point increase on a percent to sales basis.

SG&A expenses for fiscal 2011 increased from fiscal 2010 by $38.8 million as a result of incremental store growth.

However, SG&A expenses as a percent to sales decreased 21 basis points from fiscal 2010 to 2011, as a result of the leverage

created through sales gains that apply against fixed costs, along with improved labor management and other cost control

initiatives. The increase in SG&A expenses (excluding advertising and support department costs) over the previous year for

stores opened in fiscal 2010 and fiscal 2011 amounted to $40.2 million, exceeding the $38.8 million increase in total SG&A

expenses from fiscal 2010 to fiscal 2011. Even though store labor and associated benefit costs increased between fiscal 2010

and fiscal 2011, as a result of Harris Teeter’s new store growth, there was a 29 basis point reduction in these costs as a percent

to sales. Advertising and support department costs as a percent to sales also declined between fiscal 2010 and fiscal 2011,

representing a 5 basis point reduction.

The Company continues to focus on its cost control programs in an effort to offset increased fringe benefit costs associated

with incentive bonus plans and pension expense, as well as increased remodeling expenses resulting from the Company’s store

remodeling program. Pre-opening costs are included with SG&A expenses and consist of rent, labor and associated fringe

benefits, and recruiting and relocation costs incurred prior to a new store opening and amounted to $5.8 million (0.13% of sales)

11