Harris Teeter 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Harris Teeter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

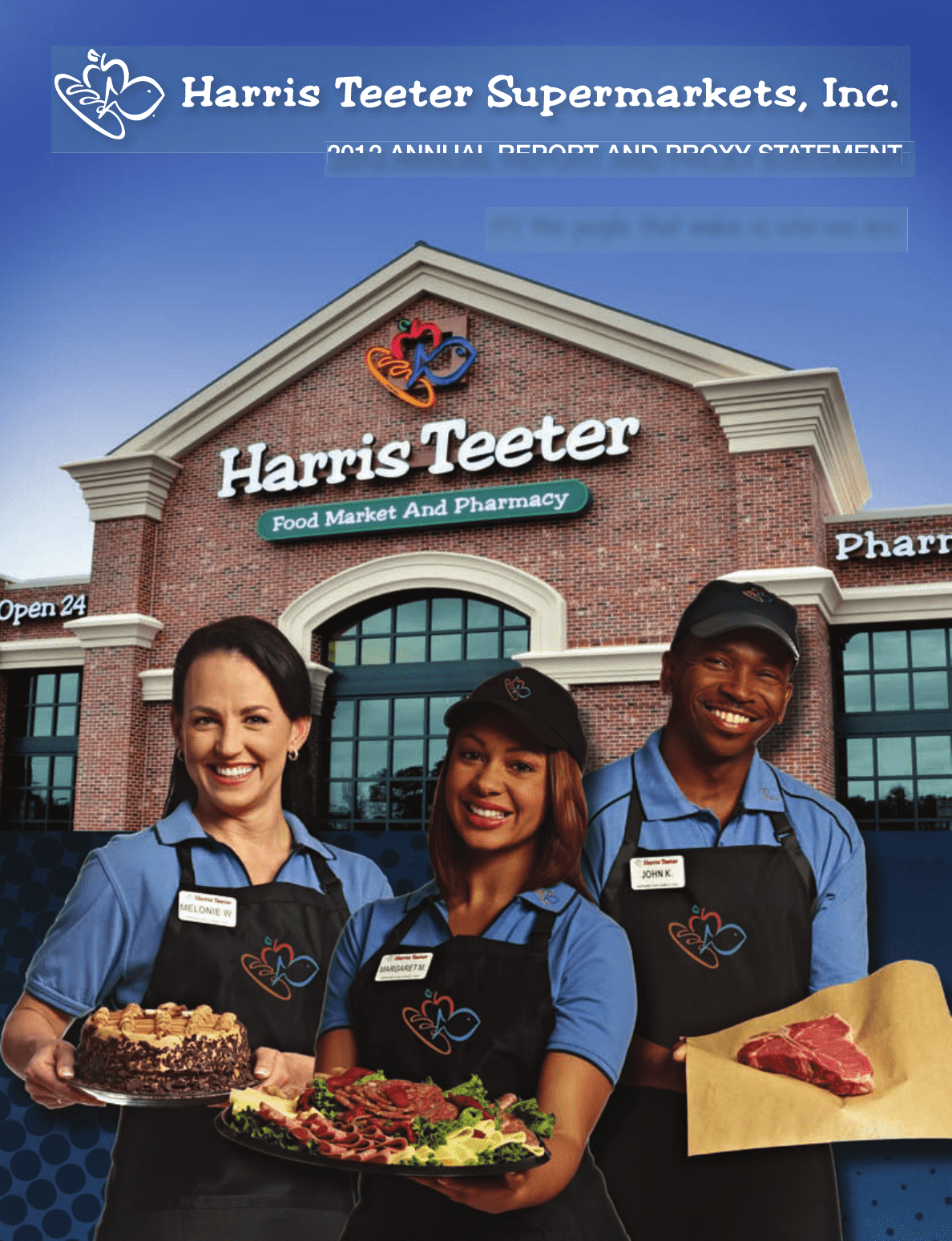

2012 ANNUAL REPORT AND PROXY STATEMENT

It’s the people that make us who we are.

2012 ANNUAL REPORT AND PROXY STATEMENT

Table of contents

-

Page 1

2012 ANNUAL REPORT AND PROXY STATEMENT It's the people that make us who we are. -

Page 2

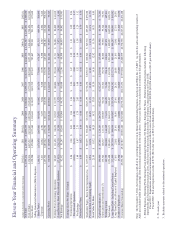

...135,542 Working Capital 182,755 total assets 1,952,488 long-term debt - Including Current portion $ 212,490 long-term debt as a percent of Capital employed 17.0% Number of employees 25,300 Common shares outstanding 49,292,585 Note: On November 7, 2011, the Company sold all of its ownership interest... -

Page 3

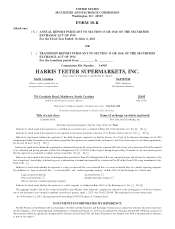

...Road, Matthews, North Carolina (Address of principal executive ofï¬ces) Registrant's telephone number, including area code: (704) 844-3100 Securities registered pursuant to Section 12(b) of the Act: 28105 (Zip Code) Title of each class: Common Stock Name of exchange on which registered: New York... -

Page 4

... and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneï¬cial Owners and Management and Related Shareholder Matters ...Certain Relationships and Related Transactions, and Director Independence ...Principal Accountant Fees and Services ...51 51 51 51 51 Market for... -

Page 5

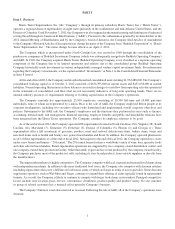

...nancial reporting, employee beneï¬ts and public and shareholder relations have been integrated into the Harris Teeter operations. The Company considers its employee relations to be good. As of the end of ï¬scal 2012, the Company operated 208 supermarkets located in North Carolina (136), Virginia... -

Page 6

... operators to continue to achieve comparable store sales gains. Because sales growth has been difï¬cult to attain, the Company's competitors have attempted to maintain market share through increased levels of promotional activities and discount pricing, creating a more difï¬cult environment in... -

Page 7

... and management resources on the development and implementation of expansion and renovation plans. The Company's new store opening program can vary depending on the economic conditions of the markets, including the Washington, D.C. metro market area which incorporates northern Virginia, the District... -

Page 8

... a material change for our self-insurance liability obligations and could adversely impact earnings. The Company may Incur Increased Pension Expenses. The Company maintains retirement beneï¬t plans for substantially all full-time employees and a supplemental retirement beneï¬t plan for certain... -

Page 9

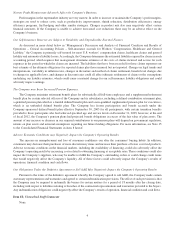

... with respect to the Company's stores for each of the last three ï¬scal years: 2012 2011 2010 Stores Open at Period End Average Weekly Net Sales Per Store* Average Square Footage Per Store at Period End Average Square Footage Per New Store Opened During Period Total Square Footage at Period... -

Page 10

... Company's common stock (the "Common Stock"), number of shareholders of record, market price information per share of Common Stock and dividends declared per share of Common Stock for each quarterly period in ï¬scal 2012 and 2011 is set forth below. The Common Stock is listed on the New York Stock... -

Page 11

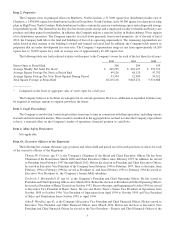

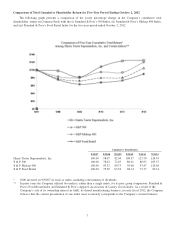

...Poor's Midcap 400 Index, and (iii) Standard & Poor's Food Retail Index for the ï¬ve-year period ended October 2, 2012. Cumulative Total Return 9/30/07 9/30/08 9/30/09 9/30/10 9/30/11 9/30/12 Harris Teeter Supermarkets, Inc. S & P 500 S & P Midcap 400 S & P Food Retail 100.00 100.00 100.00 100.00... -

Page 12

... Purchases of Equity Securities The following table summarizes the Company's purchases of its common stock during the quarter ended October 2, 2012. Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1) Maximum Number of Shares that May Yet Be Purchased Under the Plans... -

Page 13

... Carolinas region and Lowes Foods acquired six Harris Teeter store locations in western North Carolina. The majority of the stores acquired were temporarily closed for remodeling, stocking and training of employees. Six of the acquired stores were re-opened during the fourth quarter of ï¬scal 2012... -

Page 14

... to existing stores. Management believes that the Company's strategy of opening additional stores within close proximity to existing stores, and any similar new additions in the foreseeable future, have a strategic beneï¬t of enabling the Company to capture sales and expand market share as the... -

Page 15

...to ï¬scal 2011. Even though store labor and associated beneï¬t costs increased between ï¬scal 2010 and ï¬scal 2011, as a result of Harris Teeter's new store growth, there was a 29 basis point reduction in these costs as a percent to sales. Advertising and support department costs as a percent to... -

Page 16

...million (0.20% of sales) in ï¬scal 2010. Pre-opening costs ï¬,uctuate between reporting periods depending on the new store opening schedule and market location. The Lowes Foods Transaction incremental costs of $29.8 million consist of $3.9 million in non-cash impairment charges related to the write... -

Page 17

...ï¬scal 2012. The Company routinely evaluates its existing store operations in regards to its overall business strategy and from time to time will close or divest older or underperforming stores. The new store program anticipates the continued expansion of Harris Teeter's existing markets, including... -

Page 18

... of its operations and ï¬nancing activities. Financial obligations are considered to represent known future cash payments that the Company is required to make under existing contractual arrangements, such as debt and lease agreements. Management expects that cash provided by operations and other... -

Page 19

... Supplemental Executive Retirement Plan (the "SERP") and payments pursuant to the Company's ï¬,exible deferred compensation and survivor beneï¬t plans. The Company's funding policy in regards to the Pension Plan is to contribute annually the amount required by regulatory authorities to meet minimum... -

Page 20

... assurance of realizability. Vendor rebates, credits and other promotional allowances that relate to Harris Teeter's buying and merchandising activities, including lump-sum payments associated with long-term contracts, are recorded as a component of cost of sales as they are earned, the recognition... -

Page 21

...of inventories, management reviews its judgments, assumptions and other relevant, signiï¬cant factors on a routine basis and makes adjustments where the facts and circumstances dictate. Self-insurance Accruals for Workers' Compensation, Healthcare and General Liability The Company is primarily self... -

Page 22

... speciï¬c real estate markets, inï¬,ation rates and general economic conditions and may differ signiï¬cantly from those assumed and estimated. Store closings generally are completed within one year after the decision to close. Adjustments to closed store liabilities primarily relate to changes in... -

Page 23

... for retirees whose sum of age and years of service equal at least 75 at retirement. The plan continues coverage from early retirement date until the earlier date of eligibility for Medicare or any other employer's medical plan. The Company requires that the retiree pay the estimated full cost of... -

Page 24

...Company's exposure to market risks results primarily from changes in interest rates. Generally, the fair value of debt with a ï¬xed interest rate will increase as interest rates fall, and the fair value will decrease as interest rates rise. The table below presents principal cash ï¬,ows and related... -

Page 25

...Financial Statements and Supplementary Data HARRIS TEETER SUPERMARKETS, INC. AND CONSOLIDATED SUBSIDIARIES INDEX TO CONSOLIDATED FINANCIAL STATEMENTS AND SCHEDULE Page Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets, October 2, 2012 and October 2, 2011 Statements... -

Page 26

... of Directors and Shareholders Harris Teeter Supermarkets, Inc.: We have audited the accompanying consolidated balance sheets of Harris Teeter Supermarkets, Inc. and subsidiaries, formerly Ruddick Corporation and subsidiaries, (the Company) as of October 2, 2012 and October 2, 2011, and the related... -

Page 27

...Accounting Firm The Board of Directors and Shareholders Harris Teeter Supermarkets, Inc.: We have audited Harris Teeter Supermarkets, Inc. and subsidiaries, formerly Ruddick Corporation and subsidiaries (the Company) internal control over ï¬nancial reporting as of October 2, 2012, based on criteria... -

Page 28

... Accrued Compensation Other Current Liabilities Liabilities of Discontinued Operations Total Current Liabilities Long-Term Debt and Capital Lease Obligations Deferred Income Taxes Pension Liabilities Other Long-Term Liabilities Commitments and Contingencies Equity Common Stock, no par value - Shares... -

Page 29

STATEMENTS OF CONSOLIDATED OPERATIONS HARRIS TEETER SUPERMARKETS, INC. AND SUBSIDIARIES (dollars in thousands, except per share data) 52 Weeks Ended October 2, 2012 52 Weeks Ended October 2, 2011 53 Weeks Ended October 3, 2010 Net Sales Cost of Sales Selling, General and Administrative Expenses ... -

Page 30

... translation adjustment, net of $333 for taxes Total Comprehensive Income Dividends ($0.48 a share) Exercise of stock options, including tax beneï¬ts of $1,366 Share-based compensation Shares effectively purchased and retired for withholding taxes Shares purchased and retired Directors stock plan... -

Page 31

... Deferred Income Taxes Net Gain on Sale of Property and Investments Share-Based Compensation Other, Net Changes in Operating Accounts Providing (Utilizing) Cash: Accounts Receivable Inventories Prepaid Expenses and Other Current Assets Accounts Payable Other Current Liabilities Other Long-Term... -

Page 32

... The Company operates one primary business segment, retail grocery (including related real estate and store development activities) through its wholly-owned subsidiary Harris Teeter. Harris Teeter is a regional supermarket chain operating primarily in the southeastern and mid-Atlantic United States... -

Page 33

... in the form of a reduction of the purchase price of the merchandise reduce the cost of sales when the related merchandise is sold. Generally, volume rebates under a structured purchase program with allowances awarded based on the level of purchases are recognized, when realization is assured, as... -

Page 34

HARRIS TEETER SUPERMARKETS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) The value of property and equipment associated with closed stores and facilities is adjusted to reï¬,ect recoverable values based on the Company's prior history of disposing of similar assets ... -

Page 35

... its market position with each counterparty. The Company's derivative instruments do not contain any credit-risk related contingent features. Fair Value of Financial Instruments Fair value is deï¬ned as the price that would be received to sell an asset or paid to transfer a liability in an orderly... -

Page 36

... at the point of sale to the customers, net of returns and sales taxes. Cost of Sales The major components of cost of sales are (a) the cost of products sold determined under the Retail Inventory Method (see "Inventories" above) reduced by purchase cash discounts and vendor purchase allowances and... -

Page 37

HARRIS TEETER SUPERMARKETS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Stock Options and Stock Awards The Company uses fair-value accounting for all share-based payments to employees. Compensation expense for stock awards are based on the grant date fair value ... -

Page 38

...'s life insurance policies were $58,390,000 as of October 2, 2012 and $64,374,000 as of October 2, 2011, and no policy loans were outstanding at either date. 5. GOODWILL In June 2012, the Company completed a purchase and sale agreement between Harris Teeter and Lowe's Food Stores, Inc. ("Lowes Foods... -

Page 39

... with the closing of certain store locations, the Company has assigned leases to several sub-tenants with recourse. These leases expire over the next 9 years and the future minimum lease payments totaling $32,880,000 over this period have been assumed by these sub-tenants. 8. LONG-TERM DEBT... -

Page 40

... the Company's ability to meet future liquidity requirements through borrowings available under the Company's amended credit facility, including any liquidity requirements expected in connection with the Company's expansion plans for the foreseeable future. Long-term debt as of October 2, 2012 and... -

Page 41

HARRIS TEETER SUPERMARKETS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) In order to limit the price variability in fuel purchases associated with its distribution operations, the Company has entered into a series of purchased call options and written put options. ... -

Page 42

... Incentive Compensation Plan, which was approved by the Company's shareholders in February 2011. After such time, no awards were granted under the Company's prior equity incentive plans, including without limitation the Harris Teeter Supermarkets, Inc. 2002 Comprehensive Stock Option and Award Plan... -

Page 43

... to $35.24. The total cash received from stock options exercised for the exercise price and related tax deductions are included in the Consolidated Statements of Shareholders' Equity and Comprehensive Income. The Company has historically issued new shares to satisfy the stock options exercised. The... -

Page 44

...payment of cash to the tax authority to an earlier period. 15. EMPLOYEE BENEFIT PLANS The Company maintains various retirement beneï¬t plans for substantially all full-time employees of the Company and its subsidiaries. These plans include the Harris Teeter Supermarkets, Inc. Retirement and Savings... -

Page 45

... of both the years of service and compensation for a speciï¬ed period of time before retirement. The Company's current funding policy for the Pension Plan is to contribute annually the amount required by regulatory authorities to meet minimum funding requirements and an amount to increase the... -

Page 46

... utilized: 2012 2011 2010 Weighted Average Discount Rate - Pension Plan Weighted Average Discount Rate - SERP Rate of Increase in Future Payroll Costs: Pension Plan SERP Assumed Long-Term Rate of Return on Assets (Pension Plan only) * Rate varies by age, with higher rates associated with lower aged... -

Page 47

HARRIS TEETER SUPERMARKETS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) The SERP is unfunded, with beneï¬t payments being made from the Company's general assets. Assets of the Pension Plan are invested in a directed trust. The following table sets forth by level,... -

Page 48

...ï¬cers of the Company and directors. The Company has developed an Investment Policy Statement based on the need to satisfy the long-term liabilities of the Pension Plan. The Company seeks to maximize return with reasonable and prudent levels of risk. Risk management is accomplished through diversi... -

Page 49

...ed periods of time. These arrangements include (1) a directors' compensation deferral plan, funded in a rabbi trust, the beneï¬t and payment under such plan being made in the Company's common stock that has historically been purchased on the open market, (2) a key management deferral plan, unfunded... -

Page 50

... of KPS Capital Partners, LP. The purchase price was $180 million in cash consideration, adjusted for working capital and certain liabilities, including under-funded pension liabilities and foreign debt. In connection with the sale, the Company recorded pre-tax losses on disposition of discontinued... -

Page 51

HARRIS TEETER SUPERMARKETS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) The major classes of assets and liabilities of the discontinued operations that are included in the Company's Consolidated Balance Sheets as of October 2, 2011 were as follows (in thousands): ... -

Page 52

... and contingencies. 19. QUARTERLY INFORMATION (UNAUDITED) The Company's stock is listed and traded on the New York Stock Exchange. The following table sets forth certain ï¬nancial information, the high and low sales prices and dividends declared per share of common stock for the periods indicated... -

Page 53

HARRIS TEETER SUPERMARKETS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) First Quarter Second Quarter Third Quarter Fourth Quarter Fiscal Year 2011 Operating Results Net Sales Gross Proï¬t Earnings From Continuing Operations Earnings (Loss) From Discontinued ... -

Page 54

... and communicated to the Company's management, including its Chief Executive Ofï¬cer and Chief Financial Ofï¬cer, as appropriate to allow timely decisions regarding required disclosure. (b) Management's annual report on internal control over ï¬nancial reporting. Management of the Company is... -

Page 55

...of the Board of Directors," "Corporate Governance Matters - Audit Committee Financial Expert," and "Section 16(a) Beneï¬cial Ownership Reporting Compliance" in the Company's Proxy Statement to be ï¬led with the Securities and Exchange Commission with respect to the Company's 2013 Annual Meeting of... -

Page 56

...B Senior Notes due April 15, 2017 under the Note Purchase and Private Shelf Agreement dated April 15, 1997 between the Registrant and The Prudential Insurance Company of America, incorporated herein by reference to Exhibit 4.3 of the Registrant's Annual Report on Form 10-K for the ï¬scal year ended... -

Page 57

... 10-Q for the quarterly period ended March 30, 2003 (Commission File No. 1-6905).** Addendum to the Harris Teeter Supermarkets, Inc. 2002 Comprehensive Stock Option and Award Plan, incorporated herein by reference to Exhibit 10.2 of the Registrant's Current Report on Form 8-K dated February 15, 2007... -

Page 58

... herein by reference to Exhibit 10.5 of the Registrant's Quarterly Report on Form 10-Q for the quarterly period ended April 1, 2012.** Description of the Harris Teeter Supermarkets, Inc. Long Term Key Management Incentive Program, incorporated herein by reference to Exhibit 10.7 of the Registrant... -

Page 59

... Harris Teeter Supermarkets, Inc. Executive Bonus Insurance Plan, effective as of May 17, 2012, incorporated herein by reference to Exhibit 10.1 of the Registrant's Quarterly Report on Form 10-Q for the quarterly period ended July 1, 2012.** Change-in-Control and Severance Agreement dated September... -

Page 60

... of the Registrant's Quarterly Report on Form 10-Q for the quarterly period ended January 1, 2012.** Summary of Non-Employee Director Compensation. List of Subsidiaries of the Registrant. Consent of Independent Registered Public Accounting Firm. Certiï¬cation of Chief Executive Ofï¬cer pursuant to... -

Page 61

...Harris Teeter Supermarkets, Inc.'s Annual Report on Form 10-K for the ï¬scal year ended October 2, 2012, formatted in extensible Business Reporting Language (XBRL): (i) the Consolidated Balance Sheets, (ii) the Statements of Consolidated Operations, (iii) the Statements of Consolidated Shareholders... -

Page 62

... duly authorized. HARRIS TEETER SUPERMARKETS, INC. (Registrant) Dated: November 21, 2012 By: /s/ THOMAS W. DICKSON Thomas W. Dickson, Chairman of the Board and Chief Executive Ofï¬cer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the... -

Page 63

SCHEDULE I HARRIS TEETER SUPERMARKETS, INC. AND SUBSIDIARIES VALUATION AND QUALIFYING ACCOUNTS AND RESERVES For the Fiscal Years Ended October 2, 2012, October 2, 2011 and October 3, 2010 (in thousands) COLUMN A COLUMN B BALANCE AT BEGINNING OF FISCAL YEAR COLUMN C ADDITIONS CHARGED TO COSTS AND ... -

Page 64

This page intentionally left blank. -

Page 65

... Annual Meeting of the Shareholders of Harris Teeter Supermarkets, Inc. (the "Company") will be held at the Company's headquarters located at 701 Crestdale Road, Matthews, North Carolina 28105, on Thursday, February 21, 2013 at 10:00 A.M., local time. Pursuant to rules promulgated by the Securities... -

Page 66

This page intentionally left blank. -

Page 67

... and qualiï¬ed; To approve the Harris Teeter Supermarkets, Inc. 2013 Cash Incentive Plan; To consider and provide an advisory (non-binding) "Say on Pay" vote to approve the compensation of the Company's named executive ofï¬cers as described in the Proxy Statement; To ratify the appointment of KPMG... -

Page 68

This page intentionally left blank. -

Page 69

... the Company (the "Annual Meeting") to be held on Thursday, February 21, 2013, at 10:00 A.M., local time, at the Company's headquarters located at 701 Crestdale Road, Matthews, North Carolina 28105, and at any adjournment or adjournments thereof (the "Proxy Statement"). In accordance with rules and... -

Page 70

... of determining a quorum. Under the rules of the New York Stock Exchange Inc. (the "NYSE"), a bank, broker or other nominee holding the Company's shares in "street name" for a beneï¬cial owner has discretion (but is not required) to vote the client's shares with respect to "routine" matters if... -

Page 71

... Address of Beneï¬cial Owner Number of Shares Beneï¬cially Owned (1) Percent of Class T. Rowe Price Trust Company (2) Trustee of the Harris Teeter Supermarkets, Inc. Retirement and Savings Plan Post Ofï¬ce Box 89000 Baltimore, Maryland 21289 ...Neuberger Berman Group LLC (3) 605 Third Avenue New... -

Page 72

... will hold a special meeting to consider the matter. Thereafter, the Board of Directors will promptly disclose the explanation of its decision in a Current Report on Form 8-K ï¬led with the Securities and Exchange Commission. A director who is the subject of a Majority Withheld Vote will not... -

Page 73

...executive decision making skills, operating and management experience, and broad supermarket and real estate experience to the Board of Directors from his 30 years of experience with the Company and its subsidiaries. These experiences and Mr. Dickson's ongoing interaction with real estate developers... -

Page 74

... The Mills Corporation ("Mills"), a publicly traded developer, owner and manager of a diversiï¬ed portfolio of regional shopping malls and retail entertainment centers. Prior to that, Mr. Ordan held senior executive positions at a number of companies in the real estate, food service and supermarket... -

Page 75

... the high and low sale price ("Average Price") of a share of Common Stock on the Valuation Date. Directors' accounts are equitably adjusted for the amount of any dividends, stock splits or applicable changes in the capitalization of the Company. The Company uses a nonqualiï¬ed trust to purchase and... -

Page 76

... the Board and Chief Executive Ofï¬cer, is not included in this table because he is an employee of the Company and thus receives no compensation for his service as a director. The compensation received by Mr. Dickson as an employee of the Company is shown in the Summary Compensation Table for 2012... -

Page 77

...independent director, in accordance with the independence requirements of the New York Stock Exchange. The Compensation Committee met one (1) time during Fiscal 2012. For more information see the "Report of the Compensation Committee" appearing elsewhere in this Proxy Statement. Corporate Governance... -

Page 78

Beneï¬cial Ownership of Company Stock The following table presents information regarding the beneï¬cial ownership of the Common Stock, within the meaning of applicable securities regulations, of all current directors and all nominees for director of the Company and the executive ofï¬cers named in... -

Page 79

...of stock options that are currently exercisable, as to which she would have sole voting and investment power upon acquisition; and 12,000 shares owned by a corporation with respect to which she has shared voting and investment power and is deemed the beneï¬cial owner. (9) Includes 3,040 shares bene... -

Page 80

... stock options that are currently exercisable, as to which he would have sole voting and investment power upon acquisition. (13) Includes 29,268 shares beneï¬cially owned by Mr. Woodlief, as to which he has sole voting and investment power; 1,875 shares allocated to his Retirement and Savings Plan... -

Page 81

... Corporate Governance & Nominating Committee are also included on the Company's Website. Director Independence For a director to be considered independent under the listing standards of the New York Stock Exchange, the Board of Directors must afï¬rmatively determine that the director has no direct... -

Page 82

...-management directors, as a group, or any other group of directors by writing to: Harris Teeter Supermarkets, Inc. Board of Directors, c/o Secretary of the Corporation, 701 Crestdale Road, Matthews, North Carolina 28105. Each such communication should specify the applicable addressee(s). The Company... -

Page 83

... upon request to: Harris Teeter Supermarkets, Inc., 701 Crestdale Road, Matthews, Charlotte, North Carolina 28105, Attention: Secretary of the Corporation. Pursuant to its Charter, the Corporate Governance & Nominating Committee (i) periodically reviews the Company's corporate governance principles... -

Page 84

... to the Company's shareholders, employees, customers and suppliers. The Board of Directors also believes that its Lead Independent Director position effectively balances any risk of concentration of authority that may exist with a combined Chairman of the Board and Chief Executive Ofï¬cer... -

Page 85

...this review and discussion, the Compensation Committee has recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement and incorporated by reference into the Company's Annual Report on Form 10-K for the year ended October 2, 2012. SUBMITTED... -

Page 86

...change in pension value and non-qualiï¬ed deferred compensation earnings), reï¬,ecting strong Company and individual performance in Fiscal 2012. Mr. Dickson's total compensation reï¬,ects the role he plays in establishing the Company's strategic agenda and long-range plan, overseeing the management... -

Page 87

... by tying corporate and individual performance to compensation levels. The Company's executive compensation program consists generally of annual base salary, annual cash incentive bonuses, long-term equity incentive compensation, such as stock options, restricted stock and performance share grants... -

Page 88

..., shareholders will again have the opportunity to indicate their views on NEO compensation. For additional information, see "Proposal 3: Advisory (Non-Binding) "Say On Pay" Vote Approving Executive Compensation" in this Proxy Statement. Elements of Compensation Annual Cash Compensation. The Company... -

Page 89

... market share in A&E's foreign markets. During Fiscal 2011, the Company achieved most of Mr. Dickson's performance objectives, including: Harris Teeter achieved positive same store sales of 3.27%, opened 7 new stores and completed 8 major remodels, and made progress on a number of productivity... -

Page 90

... be required to meet in order to earn an Incentive Bonus under the plan. At its meeting in November 2012, the Board of Directors adopted the 2013 Cash Incentive Plan being presented to shareholders for approval at this Annual Meeting (see "Proposal 2: Approval of the Harris Teeter Supermarkets, Inc... -

Page 91

... and that excluding the Lowes Foods Transaction Expenses is in the best interests of the Company's shareholders because it is consistent with the Company's philosophy to align executive compensation with long-term shareholder value. After excluding these expenses and reviewing the performance of the... -

Page 92

... opening of stores in connection with the Lowes Foods transactions described above. For Fiscal 2013, the Compensation Committee will use NOPAT Return for annual incentive compensation for all named executive ofï¬cers and operating proï¬t margin for certain other employees of the Company. Long... -

Page 93

..., these shares of restricted stock vest 25% per year on each of the ï¬rst four anniversaries of the date of the issuance. Pension Plan and Supplemental Executive Retirement Plan. NEOs participate in the Harris Teeter Supermarkets, Inc. Employees' Pension Plan (the "Pension Plan"), a tax-qualiï¬ed... -

Page 94

...upon age and service points, eligible participants will receive an annual automatic retirement contribution equal to between 2% and 5% of covered pay, subject to certain limitations. Disability Beneï¬ts and Excess Liability Insurance. The Company generally provides income protection in the event of... -

Page 95

...provides the Company's executives with a whole life insurance policy as to which the Company makes the premium payments while the participant is employed by the Company. The premiums paid with respect to the Executive Bonus Insurance Plan were grossed up for tax purposes. The EBIP generally requires... -

Page 96

... Summary Compensation Table for 2012 Change in Pension Value and Non-Qualiï¬ed Non-Equity Deferred Option Incentive Plan Compensation All Other Awards Compensation Earnings Compensation ($) ($)(3) ($)(4) ($)(5) Name and Principal Position Year Salary ($) Bonus ($)(1) Stock Awards ($)(2) Total... -

Page 97

...note to the table entitled "Pension Beneï¬ts for 2012". The Company's non-qualiï¬ed deferred compensation plan does not provide above-market or preferential earnings on deferred compensation, and therefore, in accordance with Securities and Exchange Commission rules, there were no changes of value... -

Page 98

... of Plan-Based Awards for 2012 Estimated Future Estimated Future All Other Stock Grant Date Payouts Under Payouts Under Awards: Number Fair Value of Non-Equity Incentive Equity Incentive of Shares of Stock Stock and Plan Awards (1) Plan Awards (2) or Units Option Awards Name Grant Date Threshold... -

Page 99

... of restricted stock by $37.88, the closing market price of the Company's Common Stock on October 2, 2012, the last day in Fiscal 2012 (the "Closing Market Price"). (3) Amounts shown are target number of shares of performance shares granted in Fiscal 2012, assuming the Company meets or exceeds its... -

Page 100

... Payments Upon Termination of Employment or Change in Control" for additional information. Pension Beneï¬ts for 2012 (1) Payments Number of Years Present Value of During Credited Service Accumulated Beneï¬t Last Fiscal Year (#) ($)(2) ($) Name Plan Name Thomas W. Dickson ...Pension Plan... -

Page 101

... such contributions. All NEOs had 45 points or more as of December 31, 2005. A participant's normal annual retirement beneï¬t under the Pension Plan at age 65 is an amount equal to 0.8% (and through the Company's sale of A&E in November 2011, 0.6% for employees of A&E including Mr. Jackson) of the... -

Page 102

...the Flexible Deferral Plan are general creditors of the Company in the event the Company becomes insolvent. Potential Payments Upon Termination of Employment or Change in Control After reviewing market trends, including information prepared by a consultant, the Company entered into Change-in-Control... -

Page 103

... the event a NEO's employment is terminated by the Company either before or after a "change in control" other than for "cause", or by the NEO for "good reason", such NEO is also entitled to a payment of a bonus under an equity incentive plan based upon the Company's actual performance up to the date... -

Page 104

...in the Company's Cash Incentive Plan, calculated utilizing the Company's annualized NOPAT return on the Company's invested capital for the ï¬scal period-to-date as of the most recent ï¬scal quarter ending on or before either: (1) the date of such NEO's termination or (2) the date of the "change in... -

Page 105

...or other person or entity in a business relation with the Company during the same period. Furthermore, under the terms of the Harris Teeter Supermarkets, Inc. 2002 Comprehensive Stock Option and Award Plan (the "2002 Plan"), in the event of a change in control of the Company, as deï¬ned in the 2002... -

Page 106

... the restricted stock awards and performance share awards is calculated by multiplying the number of accelerated shares by the average of the high and low trading price on the last business day prior to the assumed termination of service date in accordance with plan administration rules. (2) Messrs... -

Page 107

... stock and performance share awards is calculated by multiplying the number of accelerated shares by the average of the high and low trading price on the last business day prior to the assumed termination of service date in accordance with plan administration rules. (5) The value of the health... -

Page 108

... compensation is awarded in the form of equity awards that vest over a multi-year period, subject to continued service by the recipient. This further aligns the interests of the NEOs to long-term shareholder value and helps retain management. Payouts under the Company's annual incentive compensation... -

Page 109

... do not represent potential dilution. For more information on the Company's restricted stock and performance share grants, see the note entitled "Stock Options and Stock Awards" in the Notes to Consolidated Financial Statements included within the Company's Annual Report on Form 10-K for the ï¬scal... -

Page 110

... to the New York Stock Exchange that the Board of Directors has determined that all members of the Audit Committee are "independent" as deï¬ned in the New York Stock Exchange Listed Company Manual. Management is responsible for the Company's internal controls and the ï¬nancial reporting process... -

Page 111

... the requirements to qualify the amounts paid pursuant to the Plan for a United States federal income tax deduction. The Board believes that it is in the best interests of the Company and its shareholders to provide for a shareholder-approved plan under which bonuses paid to its executive ofï¬cers... -

Page 112

... the Plan requires that the executive ofï¬cer be an active employee on the payroll of the Company or an afï¬liate on the last day of the performance period and at the time the payment is made, unless the executive ofï¬cer's employment was earlier terminated due to early, normal or late retirement... -

Page 113

... shareholder approval requirement under Section 162(m) of the Code ceases to be met or (iii) the date that is ï¬ve years after the Annual Meeting. The Compensation Committee may amend, suspend or terminate the Plan at any time as it may deem proper and in the best interests of the Company; provided... -

Page 114

... the Plan. As stated previously, the Plan is being submitted for shareholder approval at the Annual Meeting so that payments under the Plan can qualify for deductibility by the Company under Section 162(m) of the Code. However, shareholder approval of the Plan is only one of several requirements... -

Page 115

...shareholders approve the compensation of the Company's named executive ofï¬cers for the ï¬scal year ended October 2, 2012, as disclosed in Company's Proxy Statement for Fiscal 2012 pursuant to the compensation disclosure rules of the Securities and Exchange Commission." The above "Say on Pay" vote... -

Page 116

... LLP as the Company's independent registered public accounting ï¬rm requires the afï¬rmative vote of the shareholders holding a majority of the votes cast with respect to this matter at the Annual Meeting in person or by proxy. The Board of Directors recommends that the shareholders vote FOR the... -

Page 117

... his designee, that decision is required to be presented at the next meeting of the Audit Committee. Prior to approving any services, the Audit Committee considers whether the provision of such services is consistent with the Securities and Exchange Commission's rules on auditor independence and is... -

Page 118

...lease for the Harris Teeter store located at 820 South College Road in Wilmington, North Carolina. The amendment was entered into in connection with the Wilmington Landlord's purchase of the real estate from an unrelated party that had listed the property for sale on the open market. Under the terms... -

Page 119

...with the previously disclosed transactions with Lowes Foods, Harris Teeter assumed from Lowes Foods a lease for property located at 10828 Providence Road in Charlotte, North Carolina. In Fiscal 2012, pursuant to the lease, Harris Teeter paid to Promenade Shopping Center, LLC (the "Promenade Landlord... -

Page 120

... in the Company's proxy statement) will not be considered timely unless the notice required by the Bylaws is delivered to the Secretary of the Company not later than Wednesday, November 20, 2013. HOUSEHOLDING OF ANNUAL MEETING MATERIALS The Securities and Exchange Commission rules permit registrants... -

Page 121

charge, upon request to: Harris Teeter Supermarkets, Inc., 701 Crestdale Road, Matthews, North Carolina 28105, Attention: Secretary of the Corporation. OTHER MATTERS The Board of Directors knows of no other business that will be presented for consideration at the Annual Meeting. However, if other ... -

Page 122

This page intentionally left blank. -

Page 123

... of this Plan is to provide executive ofï¬cers of Harris Teeter Supermarkets, Inc. (f/k/a Ruddick Corporation) and its Afï¬liates with incentive compensation based upon the level of achievement of ï¬nancial, business and other performance criteria. This Plan is intended to permit the payment of... -

Page 124

... shareholders' meeting following the date that the Board adopts this Plan. Once approved by the Harris Teeter Supermarkets, Inc.'s shareholders, this Plan shall continue until the earlier of (i) a termination under Section 9 of this Plan, (ii) the date any shareholder approval requirement under Code... -

Page 125

... a speciï¬c Performance Period requires that the employee be an active employee on the payroll of Harris Teeter Supermarkets, Inc.'s or an Afï¬liate on the last day of each applicable Performance Period and at the time the payment is made, unless the Participant's employment was earlier terminated... -

Page 126

... this Plan, with respect to awards granted hereunder, shall be binding on any successor to Harris Teeter Supermarkets, Inc., whether the existence of such successor is the result of a direct or indirect purchase, merger, consolidation, or otherwise, of all or substantially all of the business or... -

Page 127

... and Chief Financial Officer Rodney C. Antolock executive vice president shareholder Information Corporate address 701 Crestdale road Matthews, NC 28105 704-844-3100 NeW YorK stoCK exChaNGe (NYse) listing Common stock symbol: htsI ClosING stoCK prICe fIsCal Year eNd (In Dollars) GeNeral CouNsel... -

Page 128

701 Crestdale Road, Matthews, NC 28105 • 704-844-3100 • www.harristeeter.com