Electronic Arts 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy Statement

Annual Equity Awards

In fiscal 2013, the Committee approved annual equity awards to certain NEOs based on eligibility criteria at the

time of grant. The Board approved all equity awards granted to our former CEO. These awards were targeted as

50% performance-based RSUs and 50% time-based RSUs with a three-year pro rata vesting schedule. We

granted a mix of performance-based RSUs and RSUs to our NEOs to balance pay-for-performance equity

incentives with the retentive value of time-based awards. The number of performance-based RSUs and RSUs

awarded to each NEO was determined by a variety of factors including: role within the Company, individual

performance, the value of unvested equity, the grant date value of the award, actual compensation realized,

market practices, and internal alignment with other executive officers.

Performance-Based RSUs

For the past two fiscal years, we have granted performance-based RSUs as a component of the annual equity

awards to executive officers at the level of Executive Vice President and above, excluding new hires. The vesting

of these performance-based RSUs is based on the Company’s TSR relative to the performance of each of the

companies in the NASDAQ-100 over one-year, two-year and three-year measurement periods. These

measurement periods are intended to incent and reward NEOs for Company performance in both the short- and

long-term. Up to one-third of the total number of performance-based RSUs granted may vest following each of

the three measurement periods. For each measurement period, if the Company’s TSR is at the 60th percentile of

the companies in the NASDAQ-100, 100% of the target number of shares will vest. If the Company’s TSR is

above the 60th percentile, the number of shares that vest will increase by 3% for each percentile above the 60th

(up to a maximum of 200% of target shares vesting). If the Company’s TSR is below the 60th percentile, for each

percentile below the 60th, the number of shares that vest will decrease by 2%. This vesting methodology is

referred to as the “performance-based RSU vesting scale” throughout this Compensation Discussion and

Analysis.

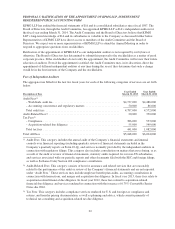

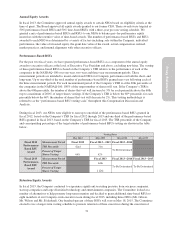

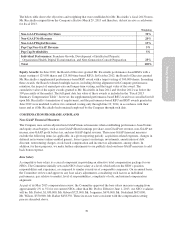

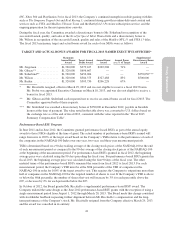

During fiscal 2013, our NEOs were eligible to earn up to one-third of the performance-based RSUs granted in

fiscal 2012, based on the Company’s TSR for fiscal 2012 through 2013 and one-third of the performance-based

RSUs granted in fiscal 2013, based on the Company’s TSR for fiscal 2013. The TSR percentile of the Company

and corresponding percentage of the target number of performance-based RSUs vesting are shown in the table

below.

Vesting Dates

May 2012 May 2013 May 2014 May 2015

Fiscal 2012

Performance-

Based RSU

Award

Measurement Period Fiscal 2012 Fiscal 2012 – 2013 Fiscal 2012 –2014

TSR Percentile 42nd 31st

To Be Determined

Percent of Target

Shares Vesting 64% 42%

Fiscal 2013

Performance-

Based RSU

Award

Measurement Period Fiscal 2013 Fiscal 2013 –2014 Fiscal 2013 –2015

TSR Percentile 64th

To Be Determined To Be Determined

Percent of Target

Shares Vesting 112%

Retention Equity Awards

In fiscal 2013, the Company continued to experience significant recruiting pressure from our peer companies,

start-up companies and large diversified technology and entertainment companies. The Committee looked at a

number of alternatives to help promote long-term retention and decided to grant additional time-based RSUs to

eight members of our Company-wide executive team during fiscal 2013, including three NEOs (Mr. Gibeau,

Mr. Wilson and Mr. Söderlund). One hundred-percent of these RSUs will vest on May 18, 2015. The Committee

elected to use a longer-term vesting schedule to promote retention of these executives during the execution of

31