Electronic Arts 2013 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2013 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

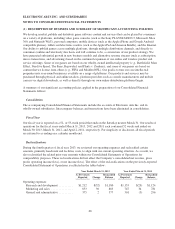

Advertising Costs

We generally expense advertising costs as incurred, except for production costs associated with media

campaigns, which are recognized as prepaid assets (to the extent paid in advance) and expensed at the first run of

the advertisement. Cooperative advertising costs are recognized when incurred and are included in marketing and

sales expense if there is a separate identifiable benefit for which we can reasonably estimate the fair value of the

benefit identified. Otherwise, they are recognized as a reduction of revenue and are generally accrued when

revenue is recognized. We then reimburse the channel partner when qualifying claims are submitted.

We are also reimbursed by our vendors for certain advertising costs incurred by us that benefit our vendors. Such

amounts are recognized as a reduction of marketing and sales expense if the advertising (1) is specific to the

vendor, (2) represents an identifiable benefit to us, and (3) represents an incremental cost to us. Otherwise,

vendor reimbursements are recognized as a reduction of cost of revenue as the related revenue is recognized.

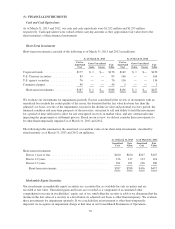

Vendor reimbursements of advertising costs of $45 million, $39 million, and $31 million reduced marketing and

sales expense for the fiscal years ended March 31, 2013, 2012 and 2011, respectively. For the fiscal years ended

March 31, 2013, 2012 and 2011, advertising expense, net of vendor reimbursements, totaled approximately

$240 million, $321 million, and $312 million, respectively.

Software Development Costs

Research and development costs, which consist primarily of software development costs, are expensed as

incurred. We are required to capitalize software development costs incurred for computer software to be sold,

leased or otherwise marketed after technological feasibility of the software is established or for development

costs that have alternative future uses. Under our current practice of developing new games, the technological

feasibility of the underlying software is not established until substantially all product development and testing is

complete, which generally includes the development of a working model. The software development costs that

have been capitalized to date have been insignificant.

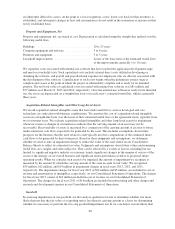

Stock-Based Compensation

We are required to estimate the fair value of share-based payment awards on the date of grant. We recognize

compensation costs for stock-based payment awards to employees based on the grant-date fair value using a

straight-line approach over the service period for which such awards are expected to vest.

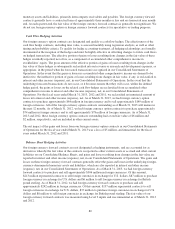

We determine the fair value of our share-based payment awards as follows:

•Restricted Stock Units, Restricted Stock, and Performance-Based Restricted Stock Units. The fair value of

restricted stock units, restricted stock, and performance-based restricted stock units (other than market-

based restricted stock units) is determined based on the quoted market price of our common stock on the

date of grant. Performance-based restricted stock units include grants made (1) to certain members of

executive management primarily granted in fiscal year 2009 and (2) in connection with certain

acquisitions.

•Market-Based Restricted Stock Units. Market-based restricted stock units consist of grants of

performance-based restricted stock units to certain members of executive management that vest

contingent upon the achievement of pre-determined market and service conditions (referred to herein as

“market-based restricted stock units”). The fair value of our market-based restricted stock units is

determined using a Monte-Carlo simulation model. Key assumptions for the Monte-Carlo simulation

model are the risk-free interest rate, expected volatility, expected dividends and correlation coefficient.

•Stock Options and Employee Stock Purchase Plan. The fair value of stock options and stock purchase

rights granted pursuant to our equity incentive plans and our 2000 Employee Stock Purchase Plan

(“ESPP”), respectively, is determined using the Black-Scholes valuation model based on the multiple-

award valuation method. Key assumptions of the Black-Scholes valuation model are the risk-free interest

rate, expected volatility, expected term and expected dividends.

73