Electronic Arts 2013 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2013 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

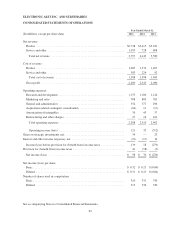

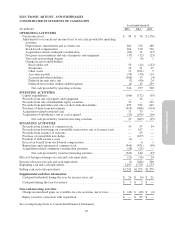

ELECTRONIC ARTS INC. AND SUBSIDIARIES

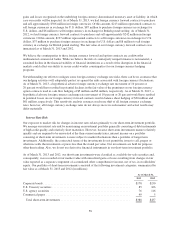

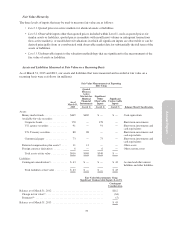

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year Ended March 31,

(In millions) 2013 2012 2011

OPERATING ACTIVITIES

Net income (loss) .................................................. $ 98 $ 76 $ (276)

Adjustments to reconcile net income (loss) to net cash provided by operating

activities:

Depreciation, amortization and accretion, net .......................... 264 216 180

Stock-based compensation ......................................... 164 170 176

Acquisition-related contingent consideration .......................... (64) 11 (17)

Net gains on investments and sale of property and equipment ............. (37) (12) (25)

Non-cash restructuring charges ..................................... 7 (6) 1

Change in assets and liabilities:

Receivables, net ............................................... 56 (14) (122)

Inventories ................................................... 16 21 25

Other assets ................................................... 15 (101) 5

Accounts payable .............................................. (78) (50) 114

Accrued and other liabilities ...................................... (106) 13 (4)

Deferred income taxes, net ....................................... (7) (90) 24

Deferred net revenue (online-enabled games) ........................ (4) 43 239

Net cash provided by operating activities ......................... 324 277 320

INVESTING ACTIVITIES

Capital expenditures ................................................ (106) (172) (59)

Proceeds from sale of property and equipment ........................... — 26 —

Proceeds from sale of marketable equity securities ........................ 72 — 132

Proceeds from maturities and sales of short-term investments ............... 459 526 442

Purchase of short-term investments .................................... (414) (468) (514)

Acquisition-related restricted cash ..................................... 31 75 —

Acquisition of subsidiaries, net of cash acquired .......................... (10) (676) (16)

Net cash provided by (used in) investing activities .................. 32 (689) (15)

FINANCING ACTIVITIES

Proceeds from issuance of common stock ............................... 34 57 34

Proceeds from borrowings on convertible senior notes, net of issuance costs . . . — 617 —

Proceeds from issuance of warrants .................................... — 65 —

Purchase of convertible note hedge .................................... — (107) —

Payment of debt issuance costs ....................................... (2) — —

Excess tax benefit from stock-based compensation ........................ — 4 1

Repurchase and retirement of common stock ............................ (349) (471) (58)

Acquisition-related contingent consideration payment ..................... (28) (25) —

Net cash provided by (used in) financing activities .................. (345) 140 (23)

Effect of foreign exchange on cash and cash equivalents ..................... (12) (14) 24

Increase (decrease) in cash and cash equivalents ............................ (1) (286) 306

Beginning cash and cash equivalents ..................................... 1,293 1,579 1,273

Ending cash and cash equivalents ....................................... $1,292 $1,293 $1,579

Supplemental cash flow information:

Cash paid (refunded) during the year for income taxes, net ................. $ 26 $ (4) $ 21

Cash paid during the year for interest .................................. $ 5 $ 2 $ —

Non-cash investing activities:

Change in unrealized gains on available-for-sale securities, net of taxes ....... $ (46) $ (40) $ (4)

Equity issued in connection with acquisition ............................. $ — $ 87 $ —

See accompanying Notes to Consolidated Financial Statements.

65