Electronic Arts 2013 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2013 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

are generally expensed to cost of revenue generally at the greater of the contractual rate or an effective royalty

rate based on the total projected net revenue for contracts with guaranteed minimums. Prepayments made to

thinly capitalized independent software developers and co-publishing affiliates are generally made in connection

with the development of a particular product and, therefore, we are generally subject to development risk prior to

the release of the product. Accordingly, payments that are due prior to completion of a product are generally

expensed to research and development over the development period as the services are incurred. Payments due

after completion of the product (primarily royalty-based in nature) are generally expensed as cost of revenue.

Our contracts with some licensors include minimum guaranteed royalty payments, which are initially recorded as

an asset and as a liability at the contractual amount when no performance remains with the licensor. When

performance remains with the licensor, we record guarantee payments as an asset when actually paid and as a

liability when incurred, rather than recording the asset and liability upon execution of the contract. Royalty

liabilities are classified as current liabilities to the extent such royalty payments are contractually due within the

next 12 months.

Each quarter, we also evaluate the expected future realization of our royalty-based assets, as well as any

unrecognized minimum commitments not yet paid to determine amounts we deem unlikely to be realized through

product sales. Any impairments or losses determined before the launch of a product are charged to research and

development expense. Impairments or losses determined post-launch are charged to cost of revenue. We evaluate

long-lived royalty-based assets for impairment generally using undiscounted cash flows when impairment

indicators exist. Unrecognized minimum royalty-based commitments are accounted for as executory contracts

and, therefore, any losses on these commitments are recognized when the underlying intellectual property is

abandoned (i.e., cease use) or the contractual rights to use the intellectual property are terminated. During fiscal

year 2013, we recognized losses of $15 million on previously unrecognized royalty-based commitments,

inclusive of $9 million in license termination costs related to our fiscal 2013 restructuring. During fiscal year

2012, we recognized losses of $21 million, representing an adjustment to our fiscal 2011 restructuring. During

fiscal year 2011, we recognized losses of $85 million, inclusive of 75 million related to the fiscal 2011

restructuring, on previously unrecognized minimum royalty-based commitments. In addition, we recognized

impairment charges of $40 million, inclusive of $27 million related to the fiscal 2011 restructuring, on royalty-

based assets. The losses and impairment charges related to restructuring and other restructuring plan-related

activities are presented in Note 7 of the Notes to Consolidated Financial Statements.

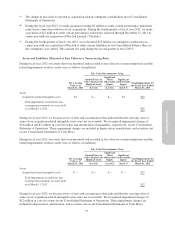

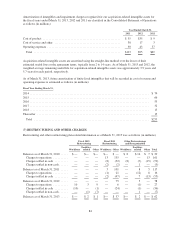

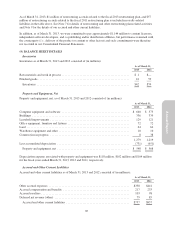

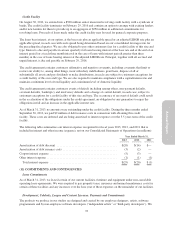

The current and long-term portions of prepaid royalties and minimum guaranteed royalty-related assets, included

in other current assets and other assets, consisted of (in millions):

As of March 31,

2013 2012

Other current assets .......................................................... $ 63 $ 85

Other assets ................................................................ 93 102

Royalty-related assets ...................................................... $156 $187

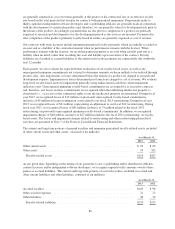

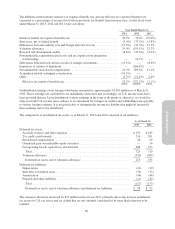

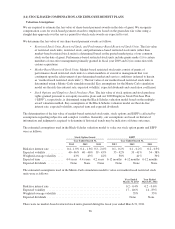

At any given time, depending on the timing of our payments to our co-publishing and/or distribution affiliates,

content licensors and/or independent software developers, we recognize unpaid royalty amounts owed to these

parties as accrued liabilities. The current and long-term portions of accrued royalties, included in accrued and

other current liabilities and other liabilities, consisted of (in millions):

As of March 31,

2013 2012

Accrued royalties ............................................................ $103 $ 98

Other accrued expenses ....................................................... 21 23

Other liabilities ............................................................. 46 52

Royalty-related liabilities ................................................... $170 $173

86