Electronic Arts 2013 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2013 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

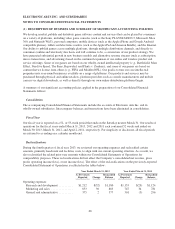

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted

in the United States (“U.S. GAAP”) requires us to make estimates and assumptions that affect the amounts

reported in our consolidated financial statements and the accompanying notes. Such estimates include sales

returns and allowances, provisions for doubtful accounts, accrued liabilities, offering periods for deferred net

revenue, income taxes, losses on royalty commitments, estimates regarding the recoverability of prepaid

royalties, inventories, long-lived assets, assets acquired and liabilities assumed in business combinations, certain

estimates related to the measurement and recognition of costs resulting from our share-based payment awards,

deferred income tax assets and associated valuation allowances as well as estimates used in our goodwill,

intangibles, short-term investments, and marketable equity securities impairment tests. These estimates generally

involve complex issues and require us to make judgments, involve analysis of historical and future trends, can

require extended periods of time to resolve, and are subject to change from period to period. In all cases, actual

results could differ materially from our estimates.

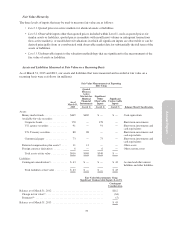

Cash, Cash Equivalents, Short-Term Investments and Marketable Equity Securities

Cash equivalents consist of highly liquid investments with insignificant interest rate risk and original or

remaining maturities of three months or less at the time of purchase.

Short-term investments consist of securities with original or remaining maturities of greater than three months at

the time of purchase, are accounted for as available-for-sale securities and are recorded at fair value. Short-term

investments are available for use in current operations or other activities such as capital expenditures and

business combinations.

Marketable equity securities consist of investments in common stock of publicly-traded companies, are

accounted for as available-for-sale securities and are recorded at fair value.

Unrealized gains and losses on our short-term investments and marketable equity securities are recorded as a

component of accumulated other comprehensive income in stockholders’ equity, net of tax, until either (1) the

security is sold, (2) the security has matured, or (3) we determine that the fair value of the security has declined

below its adjusted cost basis and the decline is other-than-temporary. Realized gains and losses on our short-term

investments and marketable equity securities are calculated based on the specific identification method and are

reclassified from accumulated other comprehensive income to interest and other income (expense), net, and gains

on strategic investments, net, respectively. Determining whether the decline in fair value is other-than-temporary

requires management judgment based on the specific facts and circumstances of each security. The ultimate

value realized on these securities is subject to market price volatility until they are sold.

Our short-term investments and marketable equity securities are evaluated for impairment quarterly. We consider

various factors in determining whether we should recognize an impairment charge, including the credit quality of

the issuer, the duration that the fair value has been less than the adjusted cost basis, severity of the impairment,

reason for the decline in value and potential recovery period, the financial condition and near-term prospects of

the investees, our intent to sell and ability to hold the investment for a period of time sufficient to allow for any

anticipated recovery in market value, and any contractual terms impacting the prepayment or settlement process.

If we conclude that an investment is other-than-temporarily impaired, we recognize an impairment charge at that

time in our Consolidated Statements of Operations.

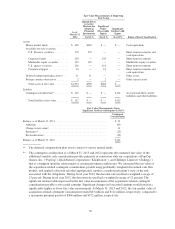

Inventories

Inventories consist of materials (including manufacturing royalties paid to console manufacturers), labor and

freight-in and are stated at the lower of cost (using the weighted average costing method) or market value. We

regularly review inventory quantities on-hand. We write down inventory based on excess or obsolete inventories

determined primarily by future anticipated demand for our products. Inventory write-downs are measured as the

difference between the cost of the inventory and market value, based upon assumptions about future demand that

67