Electronic Arts 2013 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2013 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

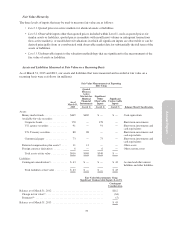

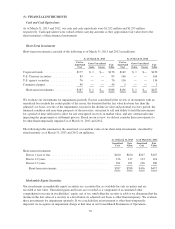

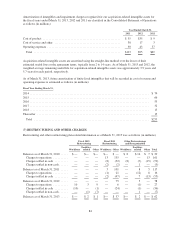

We had no marketable equity securities as of March 31, 2013. Marketable equity securities consisted of the

following as of March 31, 2012 (in millions):

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

As of March 31, 2012 .................................... $32 $87 $— $119

Our marketable equity securities as of March 31, 2012 consisted of common shares of Neowiz Corporation and

Neowiz Games, collectively referred to as “Neowiz.” During the fiscal year ended March 31, 2013, we sold our

investment in Neowiz and received proceeds of $72 million and realized a gain of $39 million, net of costs to

sell. The realized gain is included in gains on strategic investments, net, in our Consolidated Statements of

Operations. We did not recognize any impairment charges on our marketable equity securities during the fiscal

years 2013 and 2012.

During the fiscal year ended March 31, 2011, we sold our investments in Ubisoft Entertainment (“Ubisoft”) and

The9 Limited (“The9”) and received proceeds of $121 million and $11 million, respectively, and realized a gain

of $28 million and a loss of $3 million, respectively, net of costs to sell. The realized gain and loss are included

in gains on strategic investments, net, in our Consolidated Statements of Operations.

Due to various factors, including but not limited to, the extent and duration during which the market prices of

these securities had been below adjusted cost and our intent to hold certain securities, we recognized impairment

charges attributed to unrealized losses on our investment in The9 that we concluded were other-than-temporary

in the amount of $2 million during the fiscal year ended March 31, 2011. The impairment charges for the fiscal

year ended March 31, 2011 are included in gains on strategic investments, net, in our Consolidated Statements of

Operations.

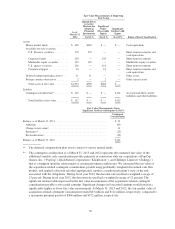

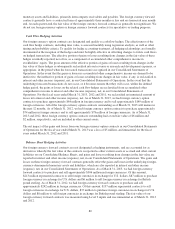

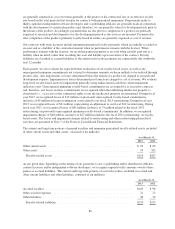

0.75% Convertible Senior Notes Due 2016

The following table summarizes the carrying value and fair value of our 0.75% Convertible Senior Notes due

2016 as of March 31, 2013 and 2012 (in millions):

As of March 31, 2013 As of March 31, 2012

Carrying

Value

Fair

Value

Carrying

Value

Fair

Value

0.75% Convertible Senior Notes due 2016 ........................ $559 $614 $539 $584

The carrying value of the 0.75% Convertible Senior Notes due 2016 excludes the fair value of the equity

conversion feature, which was classified as equity upon issuance, while the fair value is based on quoted market

prices for the 0.75% Convertible Senior Notes due 2016, which includes the equity conversion feature. The fair

value of the 0.75% Convertible Senior Notes due 2016 is classified as Level 2 within the fair value hierarchy. See

Note 11 for additional information related to our 0.75% Convertible Senior Notes due 2016.

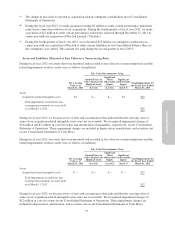

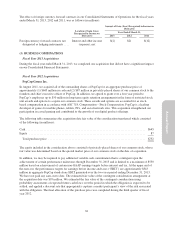

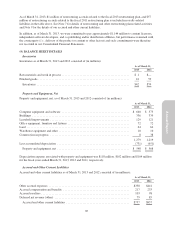

(4) DERIVATIVE FINANCIAL INSTRUMENTS

The assets or liabilities associated with our derivative instruments and hedging activities are recorded at fair

value in other current assets or accrued and other current liabilities, respectively, on our Consolidated Balance

Sheets. As discussed below, the accounting for gains and losses resulting from changes in fair value depends on

the use of the derivative instrument and whether it is designated and qualifies for hedge accounting.

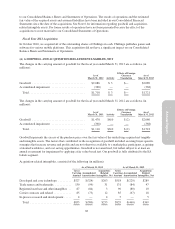

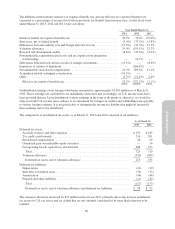

We transact business in various foreign currencies and have significant international sales and expenses

denominated in foreign currencies, subjecting us to foreign currency risk. We purchase foreign currency option

contracts, generally with maturities of 12 months or less, to reduce the volatility of cash flows primarily related

to forecasted revenue and expenses denominated in certain foreign currencies. Our cash flow risks are primarily

related to fluctuations in the Euro, British pound sterling and Canadian dollar. In addition, we utilize foreign

currency forward contracts to mitigate foreign exchange rate risk associated with foreign-currency-denominated

79