Electronic Arts 2013 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2013 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

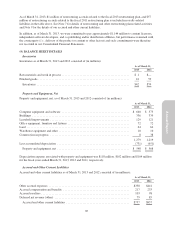

(3) FINANCIAL INSTRUMENTS

Cash and Cash Equivalents

As of March 31, 2013 and 2012, our cash and cash equivalents were $1,292 million and $1,293 million,

respectively. Cash equivalents were valued at their carrying amounts as they approximate fair value due to the

short maturities of these financial instruments.

Short-Term Investments

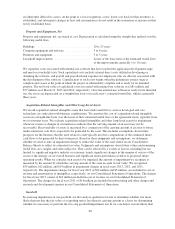

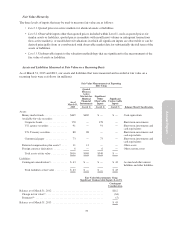

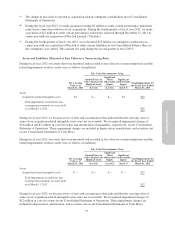

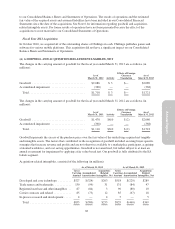

Short-term investments consisted of the following as of March 31, 2013 and 2012 (in millions):

As of March 31, 2013 As of March 31, 2012

Cost or

Amortized

Cost

Gross Unrealized Fair

Value

Cost or

Amortized

Cost

Gross Unrealized Fair

ValueGains Losses Gains Losses

Corporate bonds ................... $177 $ 1 $— $178 $149 $ 1 $— $150

U.S. Treasury securities ............. 85 — — 85 166 — — 166

U.S. agency securities ............... 76 — — 76 116 — — 116

Commercial paper .................. 49 — — 49 5 — — 5

Short-term investments ............ $387 $ 1 $— $388 $436 $ 1 $— $437

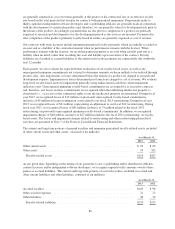

We evaluate our investments for impairment quarterly. Factors considered in the review of investments with an

unrealized loss include the credit quality of the issuer, the duration that the fair value has been less than the

adjusted cost basis, severity of the impairment, reason for the decline in value and potential recovery period, the

financial condition and near-term prospects of the investees, our intent to sell and ability to hold the investment

for a period of time sufficient to allow for any anticipated recovery in market value, and any contractual terms

impacting the prepayment or settlement process. Based on our review, we did not consider these investments to

be other-than-temporarily impaired as of March 31, 2013 and 2012.

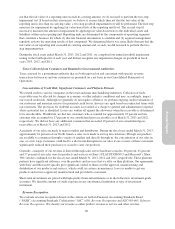

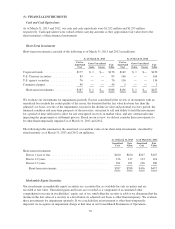

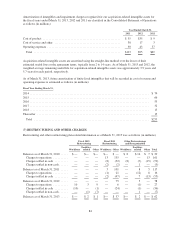

The following table summarizes the amortized cost and fair value of our short-term investments, classified by

stated maturity as of March 31, 2013 and 2012 (in millions):

As of March 31, 2013 As of March 31, 2012

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Short-term investments

Due in 1 year or less ....................................... $160 $160 $207 $207

Due in 1-2 years .......................................... 126 127 123 124

Due in 2-3 years .......................................... 101 101 106 106

Short-term investments ................................... $387 $388 $436 $437

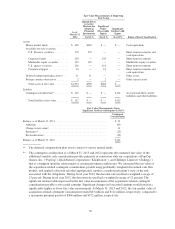

Marketable Equity Securities

Our investments in marketable equity securities are accounted for as available-for-sale securities and are

recorded at fair value. Unrealized gains and losses are recorded as a component of accumulated other

comprehensive income in stockholders’ equity, net of tax, until either the security is sold or we determine that the

decline in the fair value of a security to a level below its adjusted cost basis is other-than-temporary. We evaluate

these investments for impairment quarterly. If we conclude that an investment is other-than-temporarily

impaired, we recognize an impairment charge at that time in our Consolidated Statements of Operations.

78