Dish Network 2001 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2001 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–26

which EchoStar is unable to amend, or 3) present to Hughes a plan, taking into account prevailing market conditions

for the relevant notes, designed so that at and after the effective time of the Hughes merger, the surviving corporation

and its subsidiaries would not be in breach of their obligations under those indentures.

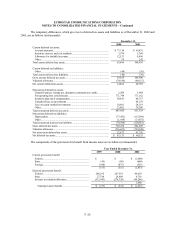

Mortgages and Other Notes Payable

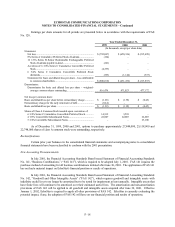

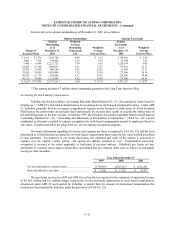

Mortgages and other notes payable consists of the following (in thousands):

December 31,

2000 2001

8.25% note payable for satellite vendor financing for EchoStar I due in equal monthly

installments of $722, including interest, through February 2001............................. $ 2,137 $ –

8.25% note payable for satellite vendor financing for EchoStar II due in equal monthly

installments of $562, including interest, through November 2001............................ 5,930 –

8.25% note payable for satellite vendor financing for EchoStar III due in equal

monthly installments of $294, including interest, through October 2002.................. 5,978 2,829

8.25% note payable for satellite vendor financing for EchoStar IV due upon resolution

of satellite insurance claim (Note 3) ....................................................................... 11,327 11,327

Mortgages and other unsecured notes payable due in installments through August

2020 with interest rates ranging from 2% to 10%.................................................... 10,572 7,106

Total ........................................................................................................................ 35,944 21,262

Less current portion .................................................................................................. (21,132) (14,782)

Mortgages and other notes payable, net of current portion .......................................... $ 14,812 $ 6,480

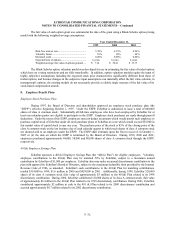

Future maturities of EchoStar’s outstanding long-term debt are summarized as follows (in thousands):

December 31,

2002 2003 2004 2005 2006 Thereafter Total

9 1/4% Seven Year Notes .... $ – $ – $ – $ – $ 375,000 $ – $ 375,000

9 3/8% Ten Year Notes........ – – – – – 1,625,000 1,625,000

10 3/8% Seven Year Notes .. – – – – – 1,000,000 1,000,000

9 1/8% Seven Year Notes .... – – – – – 700,000 700,000

4 7/8% Convertible Notes .... – – – – – 1,000,000 1,000,000

5 3/4% Convertible Notes .... – – – – – 1,000,000 1,000,000

Mortgages and Other Notes

Payable ............................ 14,782 1,992 723 753 798 2,214 21,262

Total.................................... $ 14,782 $ 1,992 $ 723 $ 753 $ 375,798 $ 5,327,214 $ 5,721,262

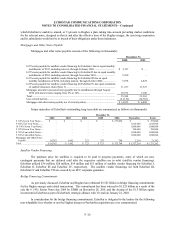

Satellite Vendor Financing

The purchase price for satellites is required to be paid in progress payments, some of which are non-

contingent payments that are deferred until after the respective satellites are in orbit (satellite vendor financing).

EchoStar utilized $36 million, $28 million, $14 million and $13 million of satellite vendor financing for EchoStar I,

EchoStar II, EchoStar III and EchoStar IV, respectively. The satellite vendor financings for both EchoStar III,

EchoStar IV and EchoStar VII are secured by an ECC corporate guarantee.

Bridge Financing Commitments

As previously discussed, EchoStar and Hughes have obtained $5.525 billion in bridge financing commitments

for the Hughes merger and related transactions. This commitment has been reduced to $3.325 billion as a result of the

sale the 9 1/8% Senior Notes due 2009 by EDBS on December 28, 2001 and the closing of the $1.5 billion equity

investment in EchoStar as part of EchoStar’s strategic alliance with Vivendi on January 22, 2002.

In consideration for the bridge financing commitments, EchoStar is obligated to the lenders for the following

non-refundable fees whether or not the Hughes merger or PanAmSat acquisition are ever consummated: