Dish Network 2001 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2001 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–18

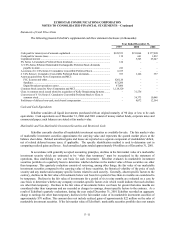

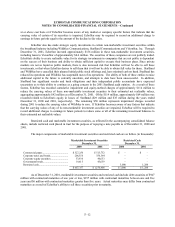

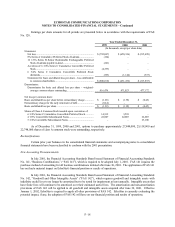

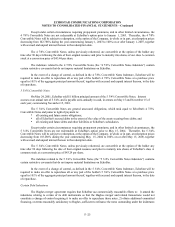

Earnings per share amounts for all periods are presented below in accordance with the requirements of FAS

No. 128.

Year Ended December 31,

1999 2000 2001

(In thousands, except per share data)

Numerator:

Net loss.................................................................................... $ (792,847) $ (650,326) $ (215,498)

8% Series A Cumulative Preferred Stock dividends..................... (124) – –

12 1/8% Series B Senior Redeemable Exchangeable Preferred

Stock dividends payable in-kind............................................. (241) – –

Accretion of 6 3/4% Series C Cumulative Convertible Preferred

Stock.................................................................................... (6,335) – –

6 3/4% Series C Cumulative Convertible Preferred Stock

dividends.............................................................................. (553) (1,146) (337)

Numerator for basic and diluted loss per share – loss attributable

to common shareholders ........................................................ $ (800,100) $ (651,472) $ (215,835)

Denominator:

Denominator for basic and diluted loss per share – weighted-

average common shares outstanding ....................................... 416,476 471,023 477,172

Net loss per common share:

Basic and diluted loss per share before extraordinary charge............. $ (1.28) $ (1.38) $ (0.45)

Extraordinary charge for the early retirement of debt........................ (0.64) – –

Basic and diluted loss per share ...................................................... $ (1.92) $ (1.38) $ (0.45)

Shares of Class A Common Stock issuable upon conversion of:

6 3/4% Series C Cumulative Convertible Preferred Stock ............ 14,912 3,593 –

4 7/8% Convertible Subordinated Notes.................................... 22,007 22,007 22,007

5 3/4% Convertible Subordinated Notes ..................................... – – 23,100

As of December 31, 1999, 2000 and 2001, options to purchase approximately 27,844,000, 25,118,000 and

22,748,000 shares of class A common stock were outstanding, respectively.

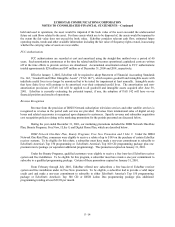

Reclassifications

Certain prior year balances in the consolidated financial statements and accompanying notes to consolidated

financial statements have been reclassified to conform with the 2001 presentation.

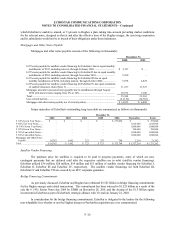

New Accounting Pronouncements

In July 2001, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards

No. 141, “Business Combinations,” (“FAS 141”), which is required to be adopted July 1, 2001. FAS 141 requires the

purchase method of accounting for all business combinations initiated after June 30, 2001. The application of FAS 141

has not had a material impact on EchoStar’s financial position or results of operations.

In July 2001, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards

No. 142, “Goodwill and Other Intangible Assets” (“FAS 142”), which requires goodwill and intangible assets with

indefinite useful lives to no longer be amortized but to be tested for impairment at least annually. Intangible assets that

have finite lives will continue to be amortized over their estimated useful lives. The amortization and non-amortization

provisions of FAS 142 will be applied to all goodwill and intangible assets acquired after June 30, 2001. Effective

January 1, 2002, EchoStar is required to apply all other provisions of FAS 142. EchoStar is currently evaluating the

potential impact, if any, the adoption of FAS 142 will have on our financial position and results of operations.