Dish Network 2001 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2001 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–9

rather than undertaking the merger or the tender offer, EchoStar must make offers for all PanAmSat shares that

remain outstanding. EchoStar expects that its acquisition of Hughes’ interest in PanAmSat, which is at a price of

$22.47 per share, together with its assumed purchase of the remaining outstanding PanAmSat shares and payment of

the termination fee to Hughes would require at least $3.4 billion of cash and approximately $600 million of

EchoStar’s class A common stock. EchoStar expects that it would meet this cash requirement by utilizing a portion

of cash on hand.

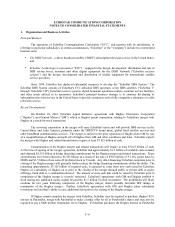

Organization and Legal Structure

In December 1995, ECC merged Dish, Ltd. with another wholly-owned subsidiary of ECC. During 1999,

EchoStar placed ownership of all of its direct broadcast satellites and related FCC licenses into subsidiaries of

EchoStar DBS Corporation. Dish, Ltd. and EchoStar Satellite Broadcasting Company were merged into EchoStar

DBS Corporation. EchoStar IV and the related FCC licenses were transferred to ESC. During September 2000,

EchoStar Broadband Corporation was formed for the purposes of issuing new debt. Contracts for the construction

and launch of EchoStar VII, EchoStar VIII and EchoStar IX are held in EchoStar Orbital Corporation. Substantially

all of EchoStar’s operations are conducted by subsidiaries of EDBS.

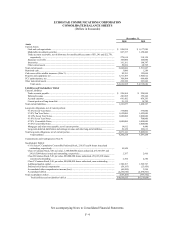

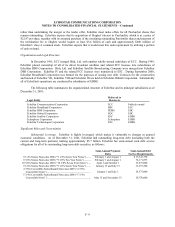

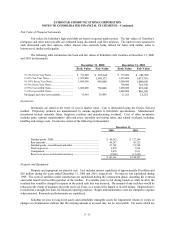

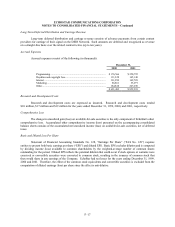

The following table summarizes the organizational structure of EchoStar and its principal subsidiaries as of

December 31, 2001:

Legal Entity

Referred to

Herein As

EchoStar Communications Corporation ECC Publicly owned

EchoStar Broadband Corporation EBC ECC

EchoStar DBS Corporation EDBS EBC

EchoStar Orbital Corporation EOC EBC

EchoStar Satellite Corporation ESC EDBS

Echosphere Corporation Echosphere EDBS

EchoStar Technologies Corporation ETC EDBS

Significant Risks and Uncertainties

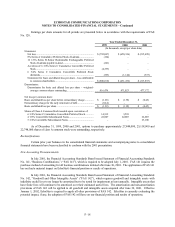

Substantial Leverage. EchoStar is highly leveraged, which makes it vulnerable to changes in general

economic conditions. As of December 31, 2001, EchoStar had outstanding long-term debt (including both the

current and long-term portions) totaling approximately $5.7 billion. EchoStar has semi-annual cash debt service

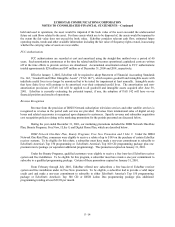

obligations for all of its outstanding long-term debt securities, as follows:

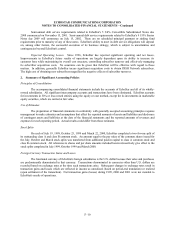

Semi-Annual Payment

Dates

Semi-Annual Debt

Service Requirements

9 1/4% Senior Notes due 2006 (“9 1/4% Seven Year Notes”)....... February 1 and August 1 $ 17,343,750

9 3/8% Senior Notes due 2009 (“9 3/8% Ten Year Notes”).......... February 1 and August 1 76,171,875

10 3/8% Senior Notes due 2007 (“10 3/8% Seven Year Notes”)..... April 1 and October 1 51,875,000

9 1/8% Senior Notes due 2009 (“9 1/8% Seven Year Notes”)....... January 15 and July 15 31,937,500

4 7/8% Convertible Subordinated Notes due 2007 (“4 7/8%

Convertible Notes”) ................................................................ January 1 and July 1 24,375,000

5 3/4% Convertible Subordinated Notes due 2008 (“5 3/4%

Convertible Notes”) ................................................................ May 15 and November 15 28,750,000