Dish Network 2001 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2001 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

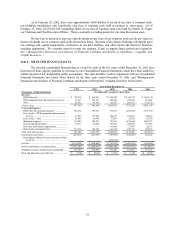

LIQUIDITY AND CAPITAL RESOURCES

Cash Sources

Since inception, we have financed the development of our EchoStar DBS system, and the related commercial

introduction of the DISH Network service, primarily through the sale of equity and debt securities and cash from

operations. From May 1994 through December 31, 2001, we have raised total gross cash proceeds of approximately

$249 million from the sale of our equity securities and as of December 31, 2001, we had approximately $5.7 billion of

outstanding long-term debt (including current portion).

As of December 31, 2001, our cash, cash equivalents and marketable investment securities totaled

$2.952 billion, including $122 million of cash reserved for satellite insurance and approximately $1 million of

restricted cash, compared to $1.550 billion, including $82 million of cash reserved for satellite insurance and $3 million

of restricted cash, as of December 31, 2000. For the year ended December 31, 2001 and 2000, we reported net cash

flows from operating activities of $489 million and negative $119 million, respectively. The $608 million increase in

net cash flow from operating activities reflects, among other things, an increase in the number of DISH Network

subscribers, increased penetration of our Digital Home Plan promotions, changes in working capital and higher average

revenue per subscriber, resulting in recurring revenue which is large enough to support the cost of new and existing

subscribers, though not yet adequate to fully support interest payments and other non-operating costs.

Except with respect to the Hughes merger, if completed, we expect that our future working capital, capital

expenditure and debt service requirements will be satisfied primarily from existing cash and investment balances and

cash generated from operations. We may, however, be required to raise additional capital in the future to meet these

requirements. However, there can be no assurance that additional financing will be available on acceptable terms, or at

all, if needed in the future. Our ability to generate positive future operating and net cash flows is dependent upon our

ability to continue to expand our DISH Network subscriber base, retain existing DISH Network subscribers, and our

ability to grow our ETC business. There can be no assurance that we will be successful in achieving our goals. The

amount of capital required to fund our 2002 working capital and capital expenditure needs will vary, depending, among

other things, on the rate at which we acquire new subscribers and the cost of subscriber acquisition, including

capitalized costs associated with our Digital Home Plan. Our working capital and capital expenditure requirements

could increase materially in the event of increased competition for subscription television customers, significant

satellite failures, or in the event of continued general economic downturn, among other factors. These factors could

require that we raise additional capital in the future.

From time to time we evaluate opportunities for strategic investments or acquisitions that would complement

our current services and products, enhance our technical capabilities or otherwise offer growth opportunities. As a

result, acquisition discussions and offers, and in some cases, negotiations may take place and future material

investments or acquisitions involving cash, debt or equity securities or a combination thereof may result.

Investment Securities

We currently classify all marketable investment securities as available-for-sale. In accordance with generally

accepted accounting principles, we adjust the carrying value of our available-for-sale marketable investment securities

to fair market value and report the related temporary unrealized gains and losses as a separate component of

stockholders’ deficit. Declines in the fair market value of a marketable investment security which are estimated to be

“other than temporary” must be recognized in the statement of operations, thus establishing a new cost basis for such

investment. We evaluate our marketable investment securities portfolio on a quarterly basis to determine whether

declines in the market value of these securities are other than temporary. This quarterly evaluation consists of

reviewing, among other things, the fair value of our marketable investment securities compared to the carrying value of

these securities, the historical volatility of the price of each security and any market and company specific factors

related to each security. Generally, absent specific factors to the contrary, declines in the fair value of investments

below cost basis for a period of less than six months are considered to be temporary. Declines in the fair value of

investments for a period of six to nine months are evaluated on a case by case basis to determine whether any company

or market-specific factors exist which would indicate that such declines are other than temporary. Declines in the fair

value of investments below cost basis for greater than nine months are considered other than temporary and are

recorded as charges to earnings, absent specific factors to the contrary.