Dish Network 2001 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2001 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

approximately $60 million if one or two satellites are so leased or transferred, and by an additional material amount

if a third satellite is leased or transferred. We believe we have in-orbit satellite capacity sufficient to expeditiously

recover transmission of most programming in the event one of our in-orbit satellites fails. However, the cash

reserved for satellite insurance is not adequate to fund the construction, launch and insurance for a replacement

satellite in the event of a complete loss of a satellite. Programming continuity cannot be assured in the event of

multiple satellite losses.

We may not be able to obtain commercial insurance covering the launch and/or in-orbit operation of

EchoStar VIII at rates acceptable to us and for the full amount necessary to construct, launch and insure a

replacement satellite. In that event, we will be forced to self-insure all or a portion of the launch and/or in-orbit

operation of EchoStar VIII. The manufacturer of EchoStar VIII is contractually obligated to use their reasonable best

efforts to obtain commercial insurance for the launch and in-orbit operation of EchoStar VIII for a period of in-orbit

operation to be determined and in an amount of up to $225 million. There is no guarantee that they or we will be

able to obtain commercial insurance for the launch and in-orbit operation of EchoStar VIII at reasonable rates and

for the full replacement cost of the satellite.

We utilized $91 million of satellite vendor financing for our first four satellites. As of December 31, 2001,

approximately $14 million of that satellite vendor financing remained outstanding. The satellite vendor financing

bears interest at 8 1/4% and is payable in equal monthly installments over five years following launch of the satellite

to which it relates. A portion of the contract price with respect to EchoStar VII is payable over a period of 13 years

following launch with interest at 8%, and a portion of the contract price with respect to EchoStar VIII and EchoStar

IX is payable following launch with interest at 8%. Those in orbit payments are contingent on the continued health

of the satellites. The satellite vendor financings for both EchoStar III, EchoStar IV and EchoStar VII are secured by

an ECC corporate guarantee.

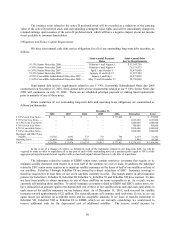

During 2002, we anticipate total capital expenditures of between $500-$750 million depending upon the

strength of the economy and other factors. We expect approximately 25% of that amount to be utilized for satellite

construction and approximately 75% for EchoStar receiver systems in connection with our Digital Home Plan and

for general corporate expansion. These percentages, as well as the overall expenditures, could change depending on

a variety of factors including Digital Home Plan penetration and the extent we contract for the construction of

additional satellites.

In addition to our DBS business plan, we have licenses, or applications pending with the FCC, for a two

satellite FSS Ku-band satellite system and a two satellite FSS Ka-band satellite system. We will need to raise

additional capital to complete construction of these satellites. We are currently funding the construction phase for

two satellites. One of these satellites, EchoStar VIII, will be an advanced, high-powered DBS satellites. The second

satellite, EchoStar IX, will be a hybrid Ku/Ka-band satellite.

During November 2000, one of our wholly owned subsidiaries purchased a 49.9% interest in VisionStar,

Inc. VisionStar holds an FCC license, and is constructing a Ka-band satellite, to launch into the 113 degree orbital

location. In February 2002, we increased our ownership of VisionStar to 90%, for a total purchase price of

approximately $2.8 million. In addition, we have made loans to VisionStar totaling approximately $4.6 million as of

December 31, 2001. Pegasus Development Corporation filed a petition for reconsideration of the FCC's approval of

that transaction. There can be no assurance that the FCC will not reconsider its approval or otherwise revoke

VisionStar’s license, rendering our investment worthless. Furthermore, VisionStar’s FCC license currently requires

construction of the satellite to be completed by April 30, 2002 and the satellite to be operational by May 31, 2002.

We will not complete construction or launch of the satellite by those dates and will have to ask for an extension.

Failure to meet the milestones or receive an extension, of which there can be no assurance, will make the license

invalid unless the milestones are extended by the FCC. In May 2001, the FCC already denied an earlier request by

VisionStar to extend its milestones. In October 2001, upon granting the acquisition of VisionStar by us, the FCC

conditioned the license transfer on our completion of construction of the satellite by April 2002, launching the

satellite by May 2002, and reporting any change in the status of the spacecraft contract. In the future we may fund

construction, launch and insurance of the satellite through cash from operations, public or private debt or equity

financing, joint ventures with others, or from other sources, although there is no assurance that such funding will be

available.