Dish Network 2001 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2001 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–12

at or above cost basis or if EchoStar becomes aware of any market or company specific factors that indicate that the

carrying value of certain of its securities is impaired, EchoStar may be required to record an additional charge to

earnings in future periods equal to the amount of the decline in fair value.

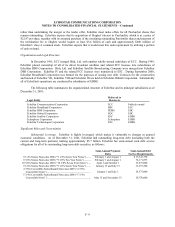

EchoStar also has made strategic equity investments in certain non-marketable investment securities within

the broadband industry including Wildblue Communications, StarBand Communications and VisionStar, Inc. Through

December 31, 2001, EchoStar invested approximately $156 million in these non-marketable investment securities,

including loans to VisionStar of approximately $4.6 million. The securities of these companies are not publicly traded.

EchoStar’s ability to create realizable value for its strategic investments in companies that are not public is dependent

on the success of their business and ability to obtain sufficient capital to execute their business plans. Since private

markets are not as liquid as public markets, there is also increased risk that EchoStar will not be able to sell these

investments, or that when EchoStar desires to sell them that it will not be able to obtain full value for them. StarBand

and Wildblue have cancelled their planned initial public stock offerings and, have minimal cash on hand. StarBand has

reduced its operations and Wildblue has suspended most of its operations. The ability of both of these entities to raise

additional capital in the future is currently uncertain, and attempts to date have been unsuccessful. In addition,

StarBand has significant vendor and bank obligations and their independent public accountants have expressed

uncertainty as to their ability to continue as a going concern in the 2001 StarBand audit opinion. As a result of these

factors, EchoStar has recorded cumulative impairment and equity-method charges of approximately $114 million to

reduce the carrying values of these non-marketable investment securities to their estimated net realizable values,

aggregating approximately $42 million as of December 31, 2001. Of the $114 million, approximately $64 million was

recorded related to EchoStar’s equity in losses of StarBand ($29 million and $35 million during the years ended

December 31, 2000 and 2001, respectively). The remaining $50 million represents impairment charges recorded

during 2001 to reduce the carrying value of Wildblue to zero. If EchoStar becomes aware of any factors that indicate

that the carrying values of any of its non-marketable investment securities are impaired, EchoStar will be required to

record additional charges to earnings in future periods to reduce some or all of the remaining investment balances to

their estimated net realizable values.

Restricted cash and marketable investment securities, as reflected in the accompanying consolidated balance

sheets, include restricted cash placed in trust for the purpose of repaying a note payable as of December 31, 2000 and

2001.

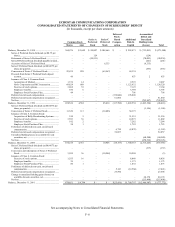

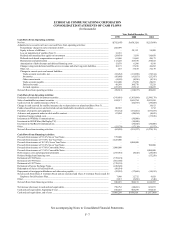

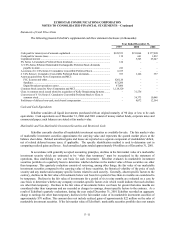

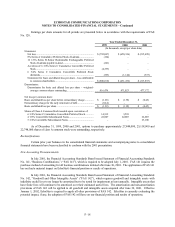

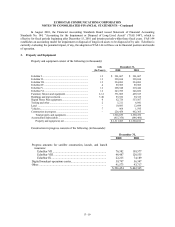

The major components of marketable investment securities and restricted cash are as follow (in thousands):

Marketable Investment Securities Restricted Cash

December 31, December 31,

2000 2001 2000 2001

Commercial paper...................................... $ 327,250 $ 515,752 $ – $ –

Corporate notes and bonds.......................... 206,556 550,364 – –

Corporate equity securities.......................... 53,936 40,633 – –

Government bonds..................................... 19,615 43,659 – –

Restricted cash........................................... – – 3,000 1,288

$ 607,357 $ 1,150,408 $ 3,000 $ 1,288

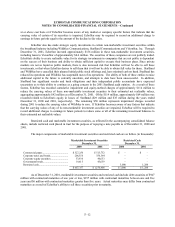

As of December 31, 2001, marketable investment securities and restricted cash include debt securities of $947

million with contractual maturities of one year or less, $157 million with contractual maturities between one and five

years and $6 million with contractual maturities greater than five years. Actual maturities may differ from contractual

maturities as a result of EchoStar’s ability to sell these securities prior to maturity.