Dish Network 1997 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 1997 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

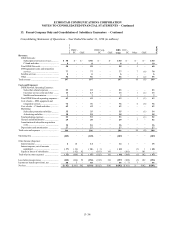

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

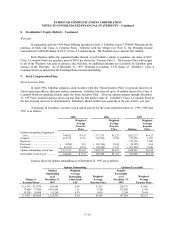

9. Stock Compensation Plans – Continued

F–27

On July 1, 1997, the Board of Directors approved a repricing of substantially all outstanding options with an

exercise price greater than $17.00 per share of Class A Common Stock to $17.00 per share. The Board of Directors

would not typically consider reducing the exercise price of previously granted options. However, these options were

repriced due to the occurrence of certain events beyond the reasonable control of the employees of EchoStar which

significantly reduced the incentive these options were intended to create. The fair market value of the Class A

Common Stock was $15.25 on the date of the repricing. Options to purchase approximately 256,000 shares of Class A

Common Stock were affected by this repricing.

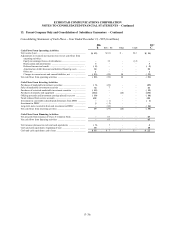

Accounting for Stock-Based Compensation

EchoStar has elected to follow Accounting Principles Board Opinion No. 25, “ Accounting for Stock Issued to

Employees,” (“ APB 25” ) and related interpretations in accounting for its stock-based compensation plans. Under APB

25, because the exercise price of EchoStar’s employee stock options is equal to the market price of the underlying stock

on the date of the grant, no compensation expense is recognized. In October 1995, the FASB issued FAS No. 123,

“ Accounting and Disclosure of Stock-Based Compensation,” (“ FAS No. 123” ) which established an alternative method

of expense recognition for stock-based compensation awards to employees based on fair values. EchoStar elected to

not adopt FAS No. 123 for expense recognition purposes.

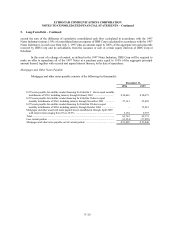

Pro forma information regarding net income and earnings per share is required by FAS No. 123 and has been

determined as if EchoStar had accounted for its stock-based compensation plans using the fair value method prescribed

by that statement. For purposes of pro forma disclosures, the estimated fair value of the options is amortized to

expense over the options’ vesting period. All options are initially assumed to vest. Compensation previously

recognized is reversed to the extent applicable to forfeitures of unvested options. EchoStar’s pro forma net loss

attributable to common shares and pro forma basic and diluted loss per common share were as follows ( in thousands,

except per share amounts):

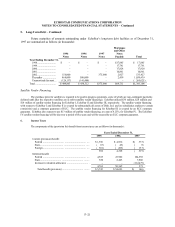

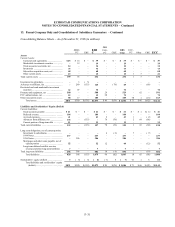

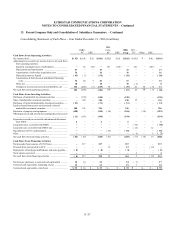

Years Ended December 31,

1995 1996 1997

Net loss attributable to common shares ......................... $(13,079) $(103,120) $(323,371)

Basic and diluted loss per share ................................ .... $( 0.37) $( 2.54) $( 7.71)

The fair value of each option grant was estimated at the date of the grant using a Black-Scholes option pricing

model with the following weighted-average assumptions:

Years Ended December 31,

1995 1996 1997

Risk-free interest rate ................................ ......... 6.12% 6.80% 6.09%

Volatility factor ................................ ................. 62% 62% 68%

Dividend yield ................................ ................... 0.00% 0.00% 0.00%

Expected term of options ................................ ..... 6 years 6 years 6 years

Weighted-average fair value of options granted .... $ 9.86 $ 16.96 $ 10.38