Dish Network 1997 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 1997 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

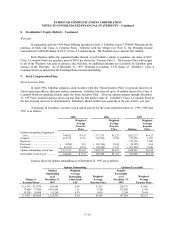

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

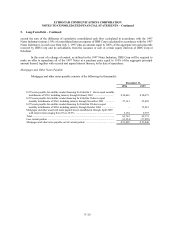

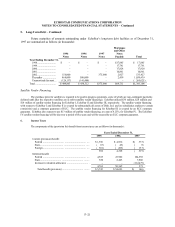

5. Long-Term Debt – Continued

F–18

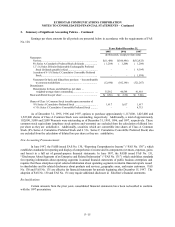

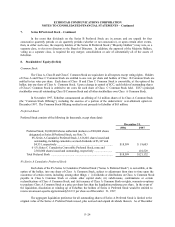

Except under certain circumstances requiring prepayment premiums, and in other limited circumstances, the

1994 Notes are not redeemable at Dish, Ltd.’s option prior to June 1, 1999. Thereafter, the 1994 Notes will be subject

to redemption, at the option of Dish, Ltd., in whole or in part, at redemption prices ranging from 104.828% during the

year commencing June 1, 1999, to 100% of principal value at stated maturity on or after June 1, 2002, together with

accrued and unpaid interest thereon to the redemption date. On each of June 1, 2002, and June 1, 2003, Dish, Ltd. will

be required to redeem 25% of the original aggregate principal amount of 1994 Notes at a redemption price equal to

100% of principal value at stated maturity thereof, together with accrued and unpaid interest thereon to the redemption

date. The remaining principal of the 1994 Notes matures on June 1, 2004.

In the event of a change of control and upon the occurrence of certain other events, as described in the indenture related to

the 1994 Notes (the “ 1994 Notes Indenture” ), Dish, Ltd. will be required to make an offer to each holder of 1994 Notes to repurchase

all or any part of such holder’s 1994 Notes at a purchase price equal to 101% of the accreted value thereof on the date of purchase, if

prior to June 1, 1999, or 101% of the aggregate principal amount thereof, together with accrued and unpaid interest thereon to the

date of purchase, if on or after June 1, 1999.

The 1994 Notes Indenture contains restrictive covenants that, among other things, impose limitations on Dish, Ltd. and its

subsidiaries with respect to their ability to: ( i) incur additional indebtedness; (ii) issue preferred stock; (iii) apply the proceeds of

certain asset sales; (iv) create, incur or assume liens; (v) create dividend and other payment restrictions with respect to Dish, Ltd.’s

subsidiaries; (vi) merge, consolidate or sell assets; (vii) incur subordinated or junior debt; and (viii) enter into transactions with

affiliates. In addition, Dish, Ltd., may pay dividends on its equity securities only if (1) no default is continuing under the 1994 Notes

Indenture; and (2) after giving effect to such dividend, Dish, Ltd.’s ratio of total indebtedness to cash flow (calculated in accordance

with the 1994 Notes Indenture) would not exceed 4.0 to 1.0. Moreover, the aggregate amount of such dividends generally may not

exceed the sum of 50% of Dish, Ltd.’s consolidated net income (calculated in accordance with the 1994 Notes Indenture) from April

1, 1994, plus 100% of the aggregate net proceeds to Dish, Ltd. from the issuance and sale of certain equity interests of Dish, Ltd.

(including common stock).

1996 Notes

In March 1996, ESBC, an indirect wholly-owned subsidiary of ECC, completed an offering (the “ 1996 Notes

Offering” ) of 13 1/8% Senior Secured Discount Notes due 2004 (the “ 1996 Notes” ). The 1996 Notes Offering resulted

in net proceeds to ESBC of approximately $337 million (after payment of underwriting discounts and other issuance

costs aggregating approximately $13 million). The 1996 Notes bear interest at a rate of 13 1/8%, computed on a semi-

annual bond equivalent basis. Interest on the 1996 Notes will not be payable in cash prior to March 15, 2000, with the

1996 Notes accreting to a principal amount at stated maturity of $580 million by that date. Commencing September

15, 2000, interest on the 1996 Notes will be payable in cash on September 15 and March 15 of each year. The 1996

Notes mature on March 15, 2004.

The 1996 Notes rank pari passu in right of payment with all senior indebtedness of ESBC. The 1996 Notes

are guaranteed on a subordinated basis by ECC, and are secured by liens on certain assets of ESBC, ECC and certain of

ECC’s subsidiaries, including all of the outstanding capital stock of Dish, Ltd., which currently owns substantially all

of ECC’s operating subsidiaries. Although the 1996 Notes are titled “ Senior:” (i) ESBC has not issued, and does not

have any current arrangements to issue, any significant indebtedness to which the 1996 Notes would be senior; and (ii)

the 1996 Notes are effectively subordinated to all liabilities of ECC (except liabilities to general creditors) and its other

subsidiaries (except liabilities of ESBC), including liabilities to general creditors. As of December 31, 1997,

EchoStar’s liabilities, exclusive of the 1996 Notes and the 1997 Notes, aggregated approximately $882 million.

Further, net cash flows generated by the assets and operations of ESBC’s subsidiaries will be available to satisfy the

obligations of the 1996 Notes only to the extent of allowable dividend payments by Dish, Ltd. under the 1994 Notes

Indenture.

Except under certain circumstances requiring prepayment premiums, and in other limited circumstances, the

1996 Notes are not redeemable at ESBC’s option prior to March 15, 2000. Thereafter, the 1996 Notes will be subject

to redemption, at the option of ESBC, in whole or in part, at redemption prices ranging from 106.5625% during the

year commencing March 15, 2000, to 100% on or after March 15 , 2003 of principal amount at stated maturity, together

with accrued and unpaid interest thereon to the redemption date. The entire principal balance of the 1996 Notes will

mature on March 15, 2004.